Cabinet Come Together – What Does It Mean

It’s been fun to watch the Trump Team make its nominations in the last few days and weeks. For some reason, I’ve found myself spending a lot of time looking at the nominees, and trying to determine what they will mean for the overall economy.

I was lucky enough to attend a Raymond James Investment Conference in Miami last week and spent some time with some strategist that I respect. I found it comforting to know that they have been studying these nominations as well for similar reasons. I won’t go into all the nominees, just to say that I think that there is real business experience here, with many being vocal critics of the Departments they may now lead. Regardless of whether the results are good or bad, I think it’s fair to say that there will be a definite challenge to the status quo. CNN has a good website that is updated as nominees are announced http://www.cnn.com/interactive/2016/11/politics/new-cabinet/

So, what does it mean?

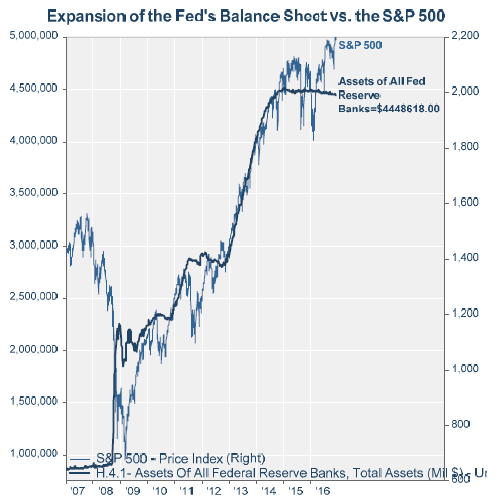

Well first despite the new administration, I feel we have made a move in the equity markets driven by monetary policy and now we can see this shift to fiscal policy. The graph below on the expansion of the Fed’s balance sheet and the move in the equity markets highlight this as well. Aside from expecting some better earnings in 2017 & 2018 that we are seeing priced in to the markets now, we are also raising the multiples. We are now comfortable paying 19 times earnings for 2017 & 2018 which will lift our year end estimates for 2016/17/18 on the S&P 500.

Source; Raymond James Research

Why lift the multiples?

We have made this move based on what we see as being a pro-growth environment moving forward. Historically you find that you pay a higher multiple for growth companies than value companies. The average forward P/E on the S&P 500 Value Index on November 30 was 16.25 compared to the S&P 500 Growth Index of 18.62 as per Standard & Poor’s. That number extenuates further as you move into smaller cap stocks. So, after a lot of discussion with analysts we feel that the market can sustain somewhere between 18-20 multiple without being expensive. Although most felt that not all of the Trump agenda will be achieved, most will be compromised. Thompson Reuters estimates that every 1 percentage point reduction in corporate taxes will bring $1.31 to S&P earnings. So even a compromise can push us forward.

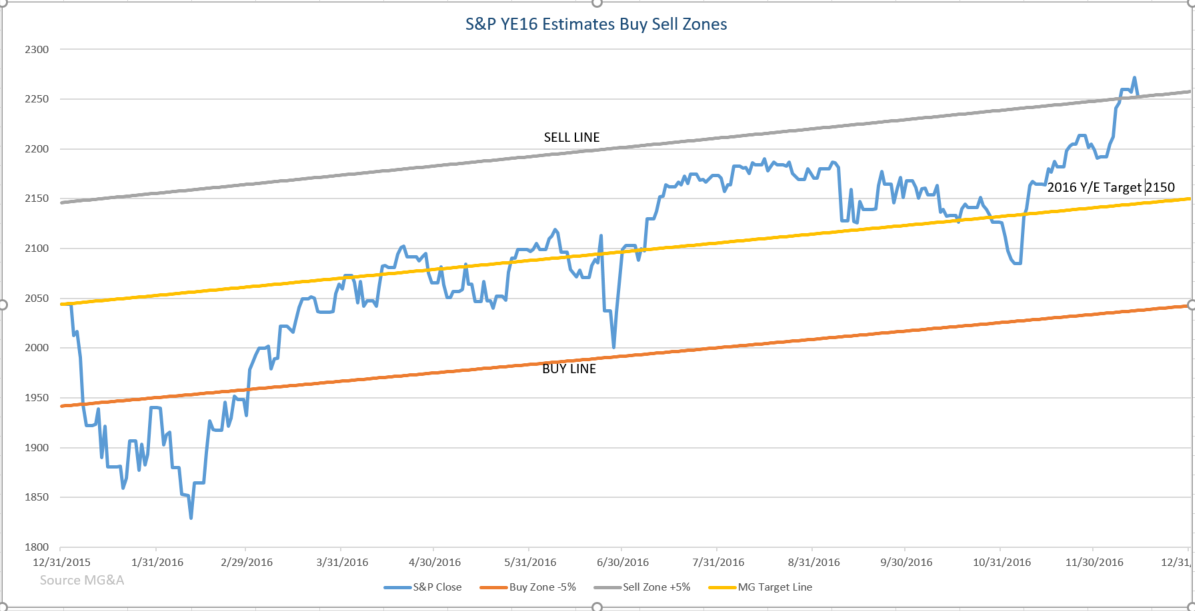

So, here’s our S&P 500-year end estimates

2016 - 2242

2017 - 2470

2018 - 2622

Source MG&A

Furthermore, what I found interesting was the real rotation that is taking place between the size & style (Large Cap v Small Cap/Growth v Value) as well as some of the sectors within them. The overriding theme was a reversion to the mean happens, its underway and still has a way to go. More about this next week.

As always should you have any questions, please don’t hesitate to call

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Links are provided for informational purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any websites users and/or members.