Happy New Year

In reflection, what a year in the markets. Politically we received the total opposite of every poll and pundit’s predictions, and the markets have rallied around the thought of something greater than 1% growth. Economically the bull run driven by monetary policy has come to an end and we will now rely on fiscal policy to drive future growth.

As I write this the S&P 500 has returned 10.76%, which not many predicted, including yours truly, and the 10-year treasury rate has moved a full point up to a recent high of 2.61%.

For my first email to you of 2017, I want to go back to fundamentals. It’s a good place to start. My number one goal in what we do each day, apart from managing your money, is to educate you on the process. Investing is not rocket science It’s a Process and a Discipline”. These emails each week are designed to educate you on the process and highlight the disciplines that are needed to help achieve your goals in investing.

The Process Overview

The Financial Plan…. We created and use the plan to highlight how aggressive you need to be invested to achieve your goals. It should highlight Total Current Net Worth, Risk and Insurance, Estate Planning, Current Income & Retirement Planning/Living, Tax Effectiveness and Budgeting. After these conversations have been had, and documented, we can determine strategies to assist you achieve your goals. From where we sit, our management of your assets touch on these areas and help us determine the next step, which is;

Asset Allocation…. I tell clients there are 6 basic asset classes that you can invest in. Stocks, Bonds, Cash, Currency, Commodities and Real Estate. In my opinion, an ideal asset allocation (which is designed to lower overall risk) would have exposure to all six, for no other reason than we are trying to create an environment where your assets do not always correlate with each other.

Diversification… Now we have the six asset classes, we now dig a little deeper to diversify through the different sectors. Stocks or equities range from large cap to small cap, and have 10 major sectors. Bonds or fixed income, has different issuances from treasuries, municipals, and corporates with varying durations and degrees of risk. Real Estate has residential and commercial, with many different uses, that all have separate cycles. Commodities are the lifeblood of the economy and the original need for markets, have many different sectors, and lastly currencies play a larger part than the average investor realizes. Although cash is cash and pays very little in this environment, it gives you buying power.

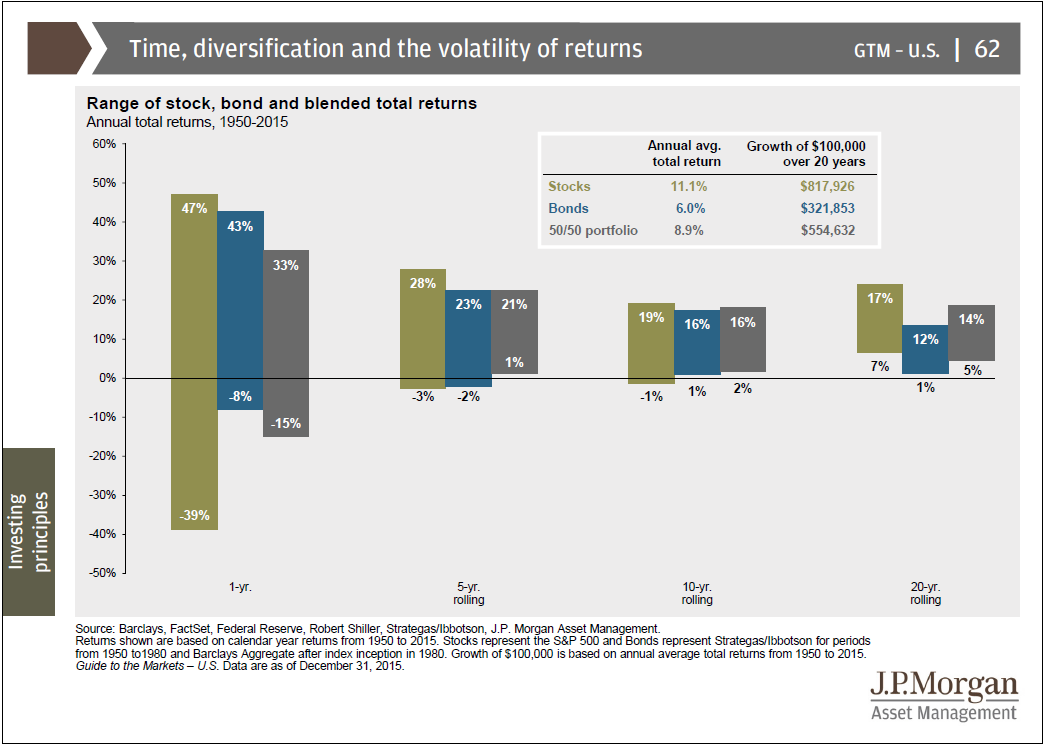

Risk Reduction Strategies… Beyond the Diversification strategies outlined above, we have a few tools in the chest designed to help reduce risk. Number one on that list is TIME. It’s been said that when an investor purchases a stock, and that stock goes down, they are not wrong, just early! Although that sounds nonsensical, it has been proved to be great advice over the history of the stock market, dating over 100 years. We invest for our client’s life expectancy, and in some cases the life expectancy of their beneficiaries. This gives us the ability to not think about the markets on the next earnings cycle, but in a much longer time horizon. Another risk reduction strategy is dollar cost averaging. If you started investing early, or you were fortunate enough to continually put money in a 401K or equivalent tax deferred vehicle, you would not have been concerned with the day to day movements of the market knowing that if/when the market goes down, you’re able to buy it cheaper. Although this strategy is not generally available for retirees, dividend re-investment is, as well as investing in companies that continually buy their own stock back. Each of these strategies assist you in growing your share of that company.

Research and Implementation… To determine the what and how goes into our portfolios, we use Fundamental Analysis. This means we read research on both the economy and markets to determine what we think is a fair price, and get deeper to sectors and individual securities to determine our ultimate selections. We make forecasts both on the S&P 500 and the 10-year treasury yield for year end, and create portfolios around these estimates.

The Discipline Overview

This will be short and sweet, because it’s the psychological side of investing. Your money is emotional. What you have is based on many years of sweat and a lifetime of productivity, and your ability to save. I understand that, however you must not make investment decisions emotionally. You should not be invested if you don’t have the time to reap the benefits. I get many calls that say I have X dollars to invest for the next 12 months, what should I do. I say “Stick it in the bank”. If there’s a time horizon less than 5 years, then I would not risk what the market can give you, however if you have longer, then take confidence in the following graph.

What I want you to take away from the graph is how the range of returns narrow the longer you go out.

I’ll be going into further detail throughout the year on each of the topics above, as well as highlighting why I believe that investing directly into individual stocks and bonds is a superior strategy. Believe it or not I’ve been restricted by FINRA rules (FINRA is the regulator of our industry) on commenting on registered securities, but thankfully these laws will be changing in mid-January, and I will go into further detail after that date.

Here is our tracking sheet on the S&P 500 going out to 2018

Source MG&A as of 12/28

Finally, best wishes for a Happy, Healthy and Prosperous 2017. Im excited to tick over the first year in our new business and continue our work with you. Im so appreciative for your continued support and your trust in us, it’s not now and will never be taken for granted.

HAPPY NEW YEAR!!!!!

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct.The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss. Dollar-cost averaging cannot guarantee a profit or protect against a loss, and you should consider your financial ability to continue purchases through periods of low price levels. Keep in mind that there is no assurance that any strategy will ultimately be successful or profitable nor protect against a loss. Dividends are not guaranteed and must be authorized by the company’s board of directors.