So, What from Here?

This is Volatility……. Let’s look forward and determine what from here.

President Elect Trump has promised pro-growth strategies and given the fact that the Republicans held both the house and senate, you would assume that he will be able to get a lot of his agenda accomplished. Highlighting a couple of economic items that he has promised;

- Large amount of spending on infrastructure

- Tax Reform

- Trade

- Health Care

- Federal Reserve & Rates

Infrastructure Spending…. The new administration has promised massive spending on transportation, roads, bridges, airports and tunnels. The figures quoted are $550 Billion. The discussion from here is how to both spend the money and how to pay for it. Most commentators believe this will be gained by increasing the budget and issuing another $1 Trillion of US Government Securities.

Tax Reform…. From what I’ve seen there are four components to the tax plan, with the focus of simplification

- Tax Rates…. The Republican plan will collapse the current 7 tax brackets to 3. For married filing jointly Under $75K (12%), $75K – $225K (25%) over $225K (33%)

- Deductions… Standard deductions will rise from $12,600 for married filing joint to $30,000. There will be a cap on individual deductions $200K for married couples and $100K for single payers

- Cap Gains…. Current structure will remain with the top bracket being 20%. The 3.8% Obama tax will be repealed.

- Estate Tax…. Estate or Death Tax will be repealed. Households with over $10million who have held gains till death will be subject to taxation

- Childcare… There will be an above the line deduction (based on state averages) for children under 13 and for eldercare for a dependent. There is more detail to this one.

Trade

One of the main points of the campaign was to reverse decades of trade policies to level the playing field and keep companies here and maintain jobs in the US. This is a double-edged sword as there will be benefit to some to the detriment of others. A lot of our current industrial companies who export to countries under current agreements could be affected by any cancelation of existing policies. This will be a wait and see issue.

Health Care (Affordable Care Act-Obama Care)

Repealing Obamacare was a focal point of the campaign. The proposal calls for patient central health care, with governance by the states. I see some the beneficiaries moving to drug manufacturers from hospitals under this instance.

Federal Reserve & Rates

During the campaign, Mr. Trump was very critical of the Fed Chairwoman and felt that rates were held artificially low to assist the current administration. You would think that the new President will be looking to nominate a new Fed Chair after the current term, although some have stated that he may ask for a resignation prior, or the desire for Janet Yellen to stay on. I feel regardless given where we are now and some of the proposals above there will be pressure on rates to rise, and we are already seeing that in the open market. Remember generally the market will force the Fed to raise rates not the other way around.

In Summary

Pro-Growth policies are generally good for the markets long term. With jobs close to “full employment”, successful pro-growth policies can assist with the next phase, wage growth. Remember consumer spending is 70% of our economy. Other policies not discussed above include the repatriation of funds held overseas, which most view as a positive for the overall economy

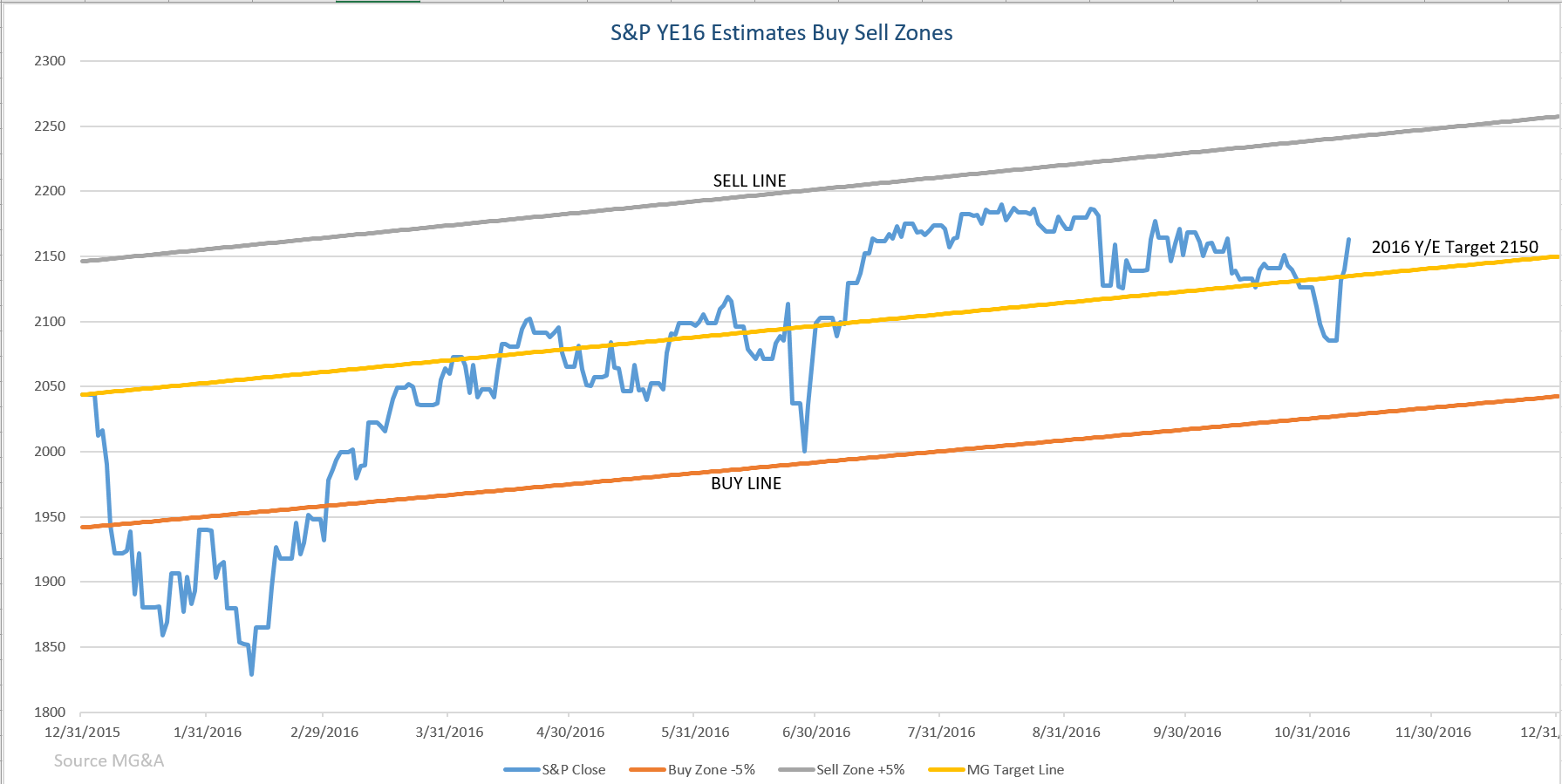

So, my view, maintain overweight to equities. I expect more volatility and I would recommend buying pullbacks below our mean line (see below). I will be looking at 2017-year end forecast over the next few weeks and will update the graph. I expect rates to rise due to both pro-growth policies and the issuance of future debt. Bonds will need to be managed, ensuring that we have a ladder that provides opportunity to buy into the longer end of the curve as rates rise. Again, I recommend owning individual bonds rather than funds.

Source MG&A

A lot of detail in this one, and I’m sure there will be lots more to come. I’m excited to dig through all the detail. As always should you have any questions please feel free to give me a call.

Regards,

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.