December Effect

I’m struggling to believe that we are in the last month of the year, it’s been one of the most eventful years I’ve had in the business (except 08 of course). We’ve seen volatility in equities and more recently bond markets. I’ve spent that last couple of weeks from the election, trying to determine what a Trump Administration will do for the both asset classes moving forward. I’ve always said, and still believe, that it doesn’t matter who is in office, that companies will figure out how to make money if we give them some clarity on the political landscape moving forward.

This is the first time I’ve seen a transitioning Administration’s plan laid out in such detail. Look at www.greatagain.gov to see the plan. A lot of detail provided in an easy to read format. I guess the question now is, how much will he be able to get through, and how much will be negotiated. Im hearing that corporate tax rates could be settled at 25% rather than 15% as promised in the campaign. We’ll just have to wait and see, however I feel that whatever is ultimately settled on its going to be great for earnings.

It all comes back to Earnings. I say it all the time. The market is priced today based on earnings expectations in the future. Based on current market conditions, investors seem confident that the environment for earnings should be better for the overall market under a Trump Administration, thus what we have seen in the last few weeks. Our thoughts on earnings is that we are coming out of an earnings trough and the earlier this year, and the second half of the secular bull market should be driven by earnings and not interest rates as it has in the past. Although many nay-sayers predicted the last quarter would be negative for earnings it looks as though we are seeing profits up this quarter.

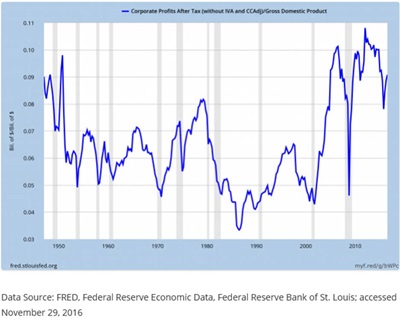

The Wall Street Journal showed a nice graph November 29, 2016 that highlights corporate profits as a percentage of GDP. The third quarter shows business profits represented 9.1%in the third quarter up from a recent low of 7.8%

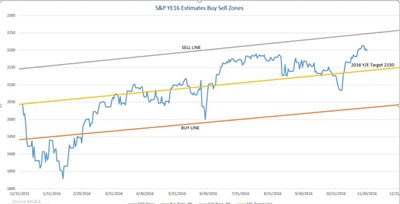

That said, I think we are starting to see how the components of the S&P 500 can get to $130 per share of earnings in 2017 to reach a yearend target of 2350 on the S&P 500, which could give the index a high single digit return from here.

Back to the Administration, it’s exciting to see how the rest of the cabinet room will come together; however, I’m encouraged in the ‘hands on’ experience of those selected so far…

Source MG&A. Graph is provided on the S&P 500 for informational purposes only and does not constitute a recommendation. It is not possible to invest directly in an index

We should have a new graph next week that will take us through the end of 2017.

All in all, I’m getting more comfortable getting to fully invested.

Have a great week

Any opinions are those of Mick Graham, Branch Manager and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Links are provided for informational purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any websites users and/or members.