Election and Fundamentals

One day to go, thankfully!!! It’s been a long bloody road and regardless of which way this election goes life will go on and we will make recommendations accordingly. As you know I’ve been promoting holding some cash leading into this election, mainly since I’m more concerned about managing the downside than I am the upside. This might sound strange however I believe when the markets rally its generally wide spread, and I look to gain outperformance in the indexes we follow on the way down by being defensive in times of uncertainty and increased volatility.

Regardless however we remain focused on our longer-term objectives rather than the short-term news. Below are a few facts by RJ research that bring it back to fundamentals.

Economy

- While the election has generated some uncertainty for investors, the economic data point to a moderate pace of growth over the next several months.

- Internal pressure to raise short-term interest rates has been building at the Fed. In mid-September, nine of the 12 Federal Reserve district banks had requested that the Board of Governors increase the discount rate (the rate the Fed charges banks for short-term borrowing), but the governors denied that request.

- The Fed is generally expected to raise rates at the mid-December meeting. However, most Fed officials anticipate only two rate increases over the course of 2017.

- Job growth has slowed in 2016, reflecting tighter job market conditions. Labor force participation has been trending higher, helping to keep the unemployment rate roughly steady.

- The Consumer Price Index rose 1.5% over the 12 months ending in September. In January, Social Security beneficiaries will receive a 0.3% cost-of-living adjustment.

- Manufacturing activity has remained mixed, but generally soft, reflecting global demand and a weak pace of capital spending.

Equity markets

- With the expectation of an interest rate hike in December, yield-sensitive sectors have headed lower as rates inched higher, explained Chief Investment Strategist Jeff Saut.

- 68% of companies reporting earnings have beaten their estimates for the third quarter.

Fixed income

- There is a general sense that things will remain static in the fixed income markets until the election determines whether the markets remain “status quo” or whether fiscal policy changes will be put into play, according to Doug Drabik, senior fixed income analyst for Raymond James. Yields have recently inched up but are still lower than at the beginning of the year.

Global

- British Prime Minister Theresa May has announced that Brexit negotiations to start in earnest at the end of March.

- European economic data remains patchy and indices variable, albeit in a fairly narrow range, according to Chris Bailey, European strategist for Raymond James Euro Equities*. Currencies across Europe have fallen to new recent lows against the dollar as this uncertainty persists.

- The International Monetary Fund (IMF) revised its global growth outlook slightly lower for 2016 and 2017 to 3.1% and 3.5%, respectively.

*An affiliate of Raymond James & Associates and Raymond James Financial Services

Bottom line

- The U.S. economy is showing modest growth, but a soft global economy and election uncertainty continue to act as headwinds.

- The end of the year is a good time to revisit your tax-planning strategy and how to best position your portfolio for 2017 and beyond.

- During times of volatility, raise some cash to take advantage of new investment opportunities, suggests Saut.

Markets

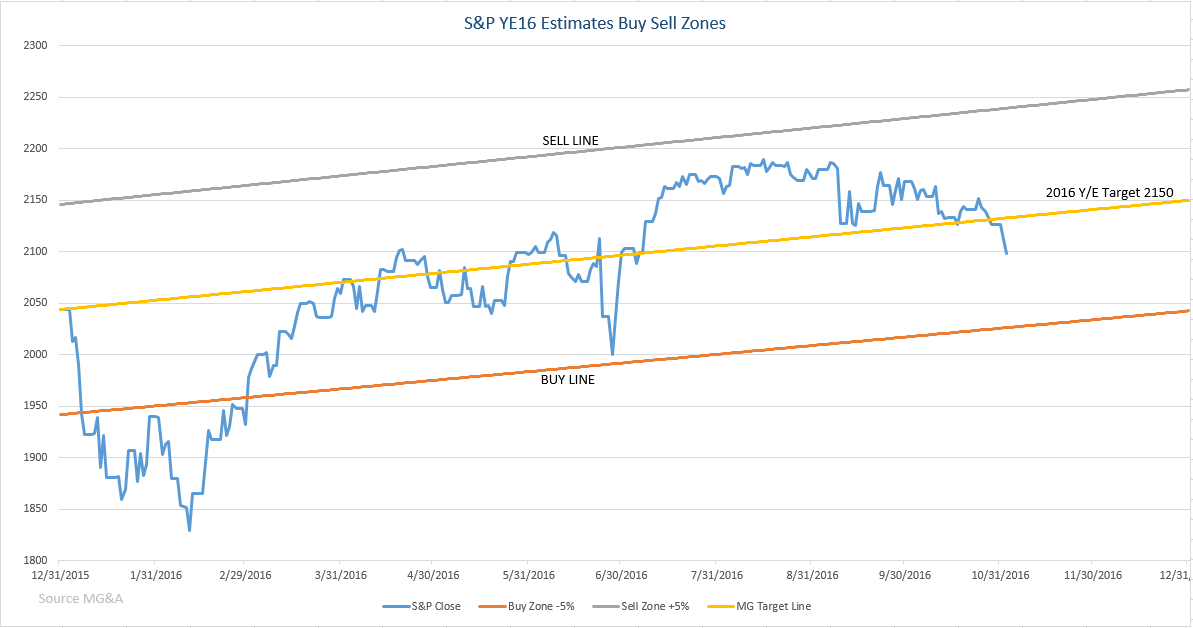

We’ve seen a bit of a pullback last week breaking the 2100 mark on the S&P500, breaking our mean line for the first time since mid-July.

As always should you have any questions or concerns, please feel free to give me a call.

Regards,

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete Raymond James is not affiliated with the website Seeking Alpha.