What’s Cheap in the Markets in all Cycles - Take Out Targets

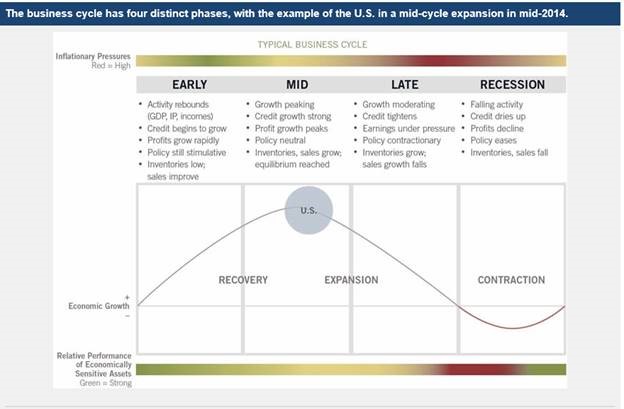

At each phase of the economic cycle different components of the markets perform better than the other. I would argue that we are in the latter phase of the recovery. Now that being said I still think this phase has many years to unfold, but it’s important to note that if I am correct, the markets will continue to benefit from several years of positive returns.

Source: Fidelity

As you know from our previous meetings, I’ve highlighted the fact that there is still, unprecedented amounts of cash on corporate balance sheets. I’ve also stated that one of three things will happen to this cash, when CEO’s get clarity on both the political future, and what the landscape will look like from a corporate tax perspective.

- Stock Buy Backs – Companies with excess cash will look to repurchase their own shares in excess of what is normally needed to run the company and incentivize employees.

Dividends – Special or Ordinary. I mean you could see one time special dividends or an increase in ordinary dividends. (Dividends are not guaranteed and must be authorized by the company’s board of directors)

- Mergers & Acquisitions. Companies looking to expand by purchasing companies up or down in the supply chain, or looking to expand customer base, or gain access to new markets.

Any of the three will ultimately be good for the markets.

What has grabbed my attention in this phase of the economic cycle are companies that are identified as “Take Out Targets”. Last year according to Thompson Reuters, M&A deals was $4.8 Trillion which was a new all-time high. 2016 has been much slower, however I feel that is due to an election year and the uncertainty that surrounds.

To first find companies that could be identified as “Take Out Targets”, you fist need to find companies that have excess cash to make these purchases. I look for companies that have a higher than normal level of cash compared to the market average. Once they are identified we need to look at areas they are trying to expand. Then find existing companies that already have a solid business in this sector. Historically the health care sector has nearly twice as much activity than any other sector. Mainly due to the R&D component of pharmaceuticals.

As you can imagine it’s a time consuming process. According to website “seeking Alpha” average premiums received (difference between what the stock price the day before the deal was announced, and what it eventually closed at) was 35% last year. It’s certainly a return that grabs attention, and one that deserves some time devoted to it. I see 2017 and beyond will see a lot more M&A activity and something I’d love all my clients to benefit from.

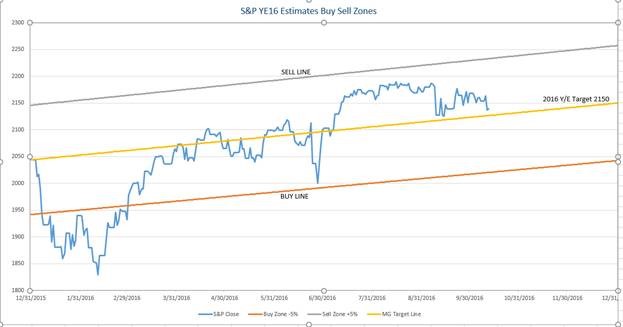

Source: MG&A. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.

As always should you have any questions or concerns, please feel free to give me a call.

Regards,

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete Raymond James is not affiliated with the website Seeking Alpha.