Can you believe we are into the 4th Quarter

Can you believe we are into the 4th Quarter???

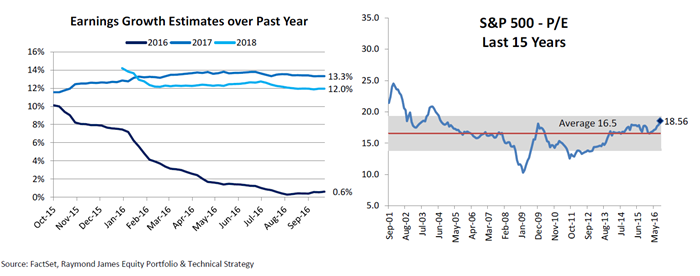

Last quarter of the year already. It feels like the year has just flown past. We now look to focus on the 3Q earnings to see if we can get any type of momentum into year end. As I’ve said previously, it all comes back to earnings in the end. Markets move based on many things but ultimately the true test is what multiple of a company’s earnings are you prepared to pay to own a stock.

So what’s our forecast for earnings on the S&P 500?

2016 - $119 (2150)

2017 - $128 (2300)

We are using an 18 multiple for the market based on our macro-economic outlook that gives the market a valuation of 2150 & 2300 for year end 16/17.

What can make me change my mind on this?

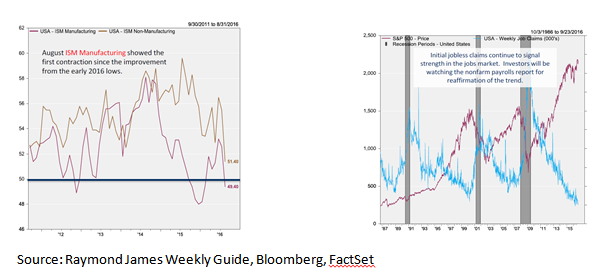

Im watching numbers like the ISM Manufacturing index. To me this is one of the leading indicators on what earnings will be like for the next few quarters. The ISM index is a survey of around 300 manufacturing firms, conducted by the Institute of Supply Management. It surveys employment, production, inventories and new orders. The index has been retracting since June. Augusts numbers were a little concerning, however one data point does not make a trend, so we will wait to see what Septembers number is when its released on October 3. We are looking for a number better than 50.2 to be bullish again. Anything below last month’s 49.4 will make us revisit our longer term forecasts.

Initial jobless claims have been signaling a bullish trend for some time, however this report holds less weight with me.

Source: Raymond James Weekly Guide, Bloomberg, FactSet

Here is our Buy/Sell graph through 9/29

As always should you have any questions or concerns, please don’t hesitate to give us a call

Regards

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct.