The Oracle of Omaha

I wanted to share a snippet of Warren Buffet interviews that CNBC posted on their site. CNBC put their Top 5 Buffet Investment Macro Theories listed below:

- Don’t buy or sell on headlines…. Warren Buffet mentioned he was 11 years old when bought his first stock. That was 1941. Although I can’t attest personally, I think there were probably a few headlines around that would have scared a few people away from the markets.

- Don’t try to profit from bubbles, but rather try to not go broke from them. The most recent story I can remember dates back to the tech bubble in 2000, where Warren Buffet was highly criticized for not participating in the run up of the tech sector. This time he was quoted explaining, “If I can’t understand how the company makes money now or will in the future then I can’t invest in it.”

- Put your Emotions Aside…. Warren Buffet highlights the “impossibility” that is market timing. In 1954 the country was in the midst of a recession and the stock market went up 50%. He still says this was his greatest year investing.

- A productive asset is a better asset than a non-productive one. He compared a producing farm to a gold bar. He said, “One asset you can look at and feel. However, if you want to do something with it you will need to get rid of some of it, while a producing farm creates cash flow and can enable you the opportunity to buy more farms”.

- Lastly…” Don’t bet against America” …. I know I read this in 2008 when markets were down 40. He stated that when we all come together, you better get out of the way.

I’m totally committed to the philosophy that Warren Buffet learned from Ben Graham. I’m investing today for your and my life expectancy. Not next week, month or year.

Here are a few of my favorite Warren Buffet “Zingers” …… Im sure you’ve heard a couple of them.

- In the market you don’t have to swing at everything…. You can wait for your pitch. The problem when you’re a money manager is that your fans keep yelling “Swing, you bum!”

- Calling someone who trades actively in the market an investor, is like calling someone who repeatedly engages in one-night stands a romantic.

- Successful investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time. You can’t produce a baby in one month by getting nine women pregnant.

- The best thing that happens to us is when a great company gets into temporary trouble…. We want to buy them when they’re on the operating table.

- Be fearful when others are greedy and greedy when others are fearful.

- I believe in giving my kids enough so they can do anything, but not so much they can do nothing…

- Wall Street is the only place people take a limo to get advice from someone who takes the train.

Now back to reality…….

The Fed meeting last week was disappointing. Another quarter of no action, with rates kept artificially low for longer. Were now are looking at the possibility of December. This get us through the election.

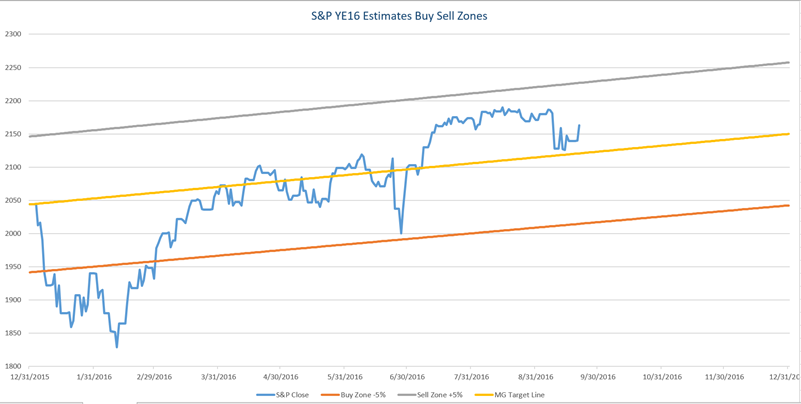

I still feel that sitting on some cash may prove to be the most valuable asset. I continue to think that we will see some volatility that will provide some good entry points. I refer to the successful investing quote above from the Oracle….

As always should you have any questions, please don’t hesitate to call.

Regards

Source: MG&A

Any opinions are those of Mick Graham and not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance.

Individual investor's results will vary. Past performance does not guarantee future results. Holding stocks for the long-term does not insure a profitable outcome. Investing in stocks always involves risk, including the possibility of losing one's entire investment. There is no guarantee that any statements, opinions or forecasts provided herein will prove to be correct. Warren Buffet is in no way affiliated with Raymond James Financial Services.