Yield Trap - Watch our for Utilities and Telecom

Beware of the Yield Trap (Watch Out for Utilities)

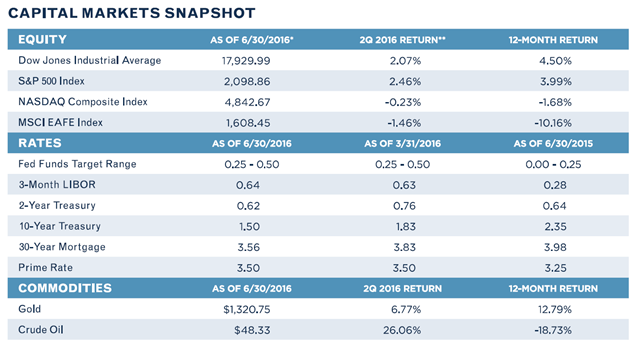

I just finished completing the reviews of all of our portfolios for the 2nd quarter. It was amazing to see the second quarter finish in positive territory for all of the major indexes considering all the negative news like Brexit causing an 800-point drop in the Dow in two days.

What I did find amazing was the return of both the Utility Sector and the Telecom Sector.

What this tells me is in desperation in the search for yield, investors have rushed into these historically higher yielding sector of the market. I call these Yield Substitutes. Trouble is that when you try to substitute the yields from bonds, you can get killed and often do.

Valuations on these sectors is the highest level it’s been in 20 years, according to a recent Wall Street Journal article. This is a perfect storm for these companies, low in interest rates that boost profits, and with energy costs low, utilities actually benefit due to the fact they simply pass along costs. When consumer energy prices are lower, regulators are more likely to allow rate increases which the industry is constantly looking for.

Last summer the utility sector fell 11% in two weeks, as investors sold around $4 billion from utility mutual funds, showing that when this turns, it turns quickly and it will take years to get that loss back in the yields they pay.

I know I’ve been saying this for some time, however if rates ever do rise this sector can have the burden of higher costs of borrowing and could possibly see a mass exodus as investors look for yield in other areas.

This in my mind is a classic case when you should show discipline in your investing and be diversified, meaning if you have Utilities and/or Telecom it may be time to rebalance.

As always should you have any questions or concerns please don’t hesitate to give me a call.

Regards

Mick

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of Mick Graham and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. This information is not intended as a solicitation or an offer to buy or sell any security referred to herein. Investments mentioned may not be suitable for all investors. Every investor's situation is unique and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation.