Independence Day

Happy 4th. It’s the 240th anniversary of America’s independence or as our 7-year-old calls it, Americas Birthday….

As I know your aware, it’s been a rollercoaster following the unexpected Brexit Vote. I thought we might see some volatility but I did not see it bouncing back so quickly. The Friday of the Brexit vote the market was down over 600 Dow Jones points, which is obviously a big swing, however to put it in perspective even after the drop we were within 1% of where we were a week earlier.

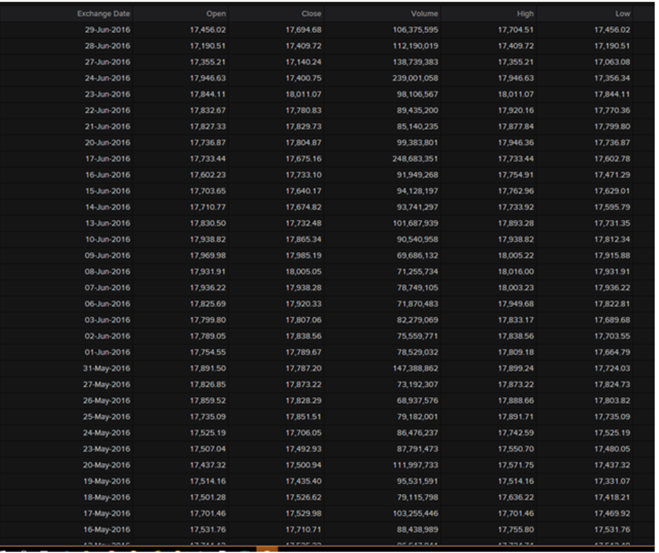

Source Thompson Reuters

Today as I write the Dow is flat for the quarter and up 1.8% for the year, and we are well within our range of returns for the year. A bunch of noise for what we predicted will be returns based on growth of corporate earnings to $119.00, this year and $130 for next year.

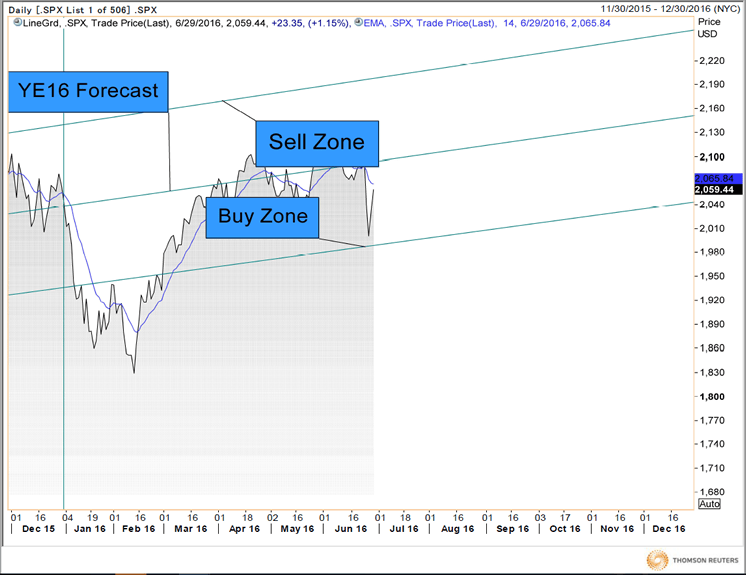

Here is a copy of the chart we create each week and as you can see we came close to our buy zone triggers without actually breaking it. Although simplistic, this graph has been a good barometer for us over the years.

l in all, a busy last 7 days with a lot to keep the media busy, but again nothing that changes our long term thesis on a sustained bull run that has years left.

As always, if you have any questions please feel free to give us a call

Regards,

Mick

Opinions expressed are not necessarily those of Raymond James Financial Services. Information contained was received from sources believed to be reliable, but accuracy is not guaranteed. Investing always involves risk and you may incur a profit or loss. No investment strategy can guarantee success. Past performance may not be indicative of future results. It is not possible to invest directly in an index. The S&P 500 is an unmanaged index of 500 widely held stocks. The Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the Nasdaq.