Tailored advice, delivered by a dedicated team

Our team of investment professionals provides for all aspects of investment consulting. Our proactive advice includes the creation and implementation of a well-defined process for making informed investment decisions based on prudent investment practices. Each investment strategy is developed in consideration of well-established fiduciary standards and is backed by our philosophy of conservative management.

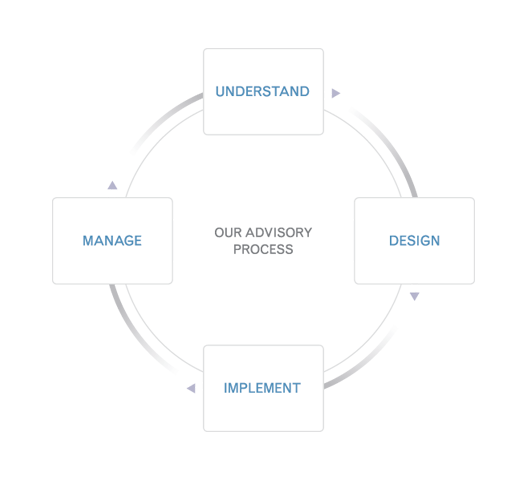

We believe in, and emphasize, getting ahead of your needs with hands-on, proactive communication as it is integral to a successful working relationship. In accordance with our fiduciary responsibilities, we can help simplify solutions by utilizing a defined four-step process to provide additional discipline and structure to the consulting services we deliver to each client.

First, we assist in creating a custom investment policy statement (IPS) that clearly outlines your organization’s specific investment criteria. With regards to retirement plans, we also monitor participant behavior and regulatory changes on an ongoing basis against the plan's objectives and refine as needed for alignment with their goals and mission.

As a dedicated partner to help handle your organization’s fiduciary responsibilities we will help create a plan specific to your organization so you can focus on your mission. Once your portfolio is constructed, we optimize the asset allocation and analyze against unconstrained, efficient portfolios designed to maximize returns at each level of risk.

By evaluating, researching and identifying investments and portfolios based on strict quantitative and qualitative criteria, we help you decide which investments are right for your organization. Along the way, we document investment manager research, portfolio construction methodologies and due-diligence data.

*Asset allocation does not guarantee a profit nor protect against loss. Past performance does not guarantee a profit nor protect against loss.

Once the investment process is established and investments are implemented, our work and communications continue. Performance is monitored and allocations are refined based on investment policy constraints and informed market judgment.