Rigorously evidenced services tailored to your individual objectives

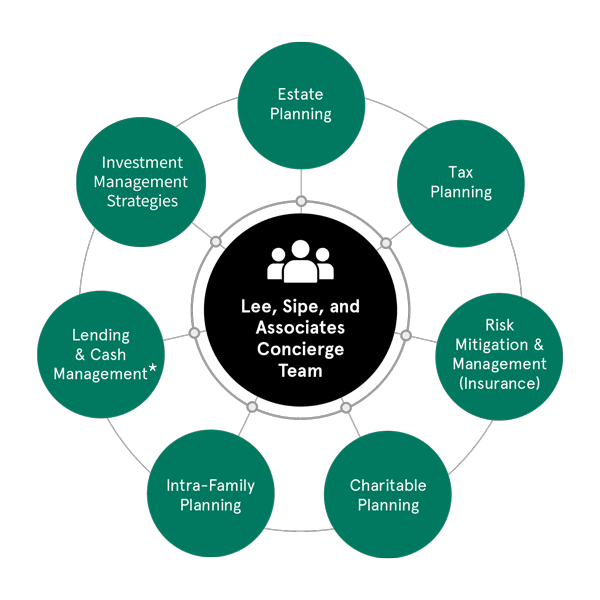

Whether addressing the objectives and aspirations of individuals or those entrusted with their organization’s financial stewardship, our commitment is to offer a full complement of financial and investment planning services.

We have designed our services to transcend rudimentary financial stewardship, instead oriented towards effecting transformative change and fostering enduring legacies.

Each of our services involves close collaboration with you and, when applicable, the other professionals and consultants whom you have enlisted for support. We strive to identify the most suitable service offerings that are fully congruent with your needs.

Partial list of services:

- Comprehensive financial planning

- Milestone management, including important dates

- Custom portfolios

- Custom indexing

- ESG investing

- Asset allocation and asset location strategies

- Alternative investment consultation

- Concentrated portfolio risk mitigation

- Tax loss harvesting

- Roth conversion window

- Roth estate planning strategies

- Mega and backdoor Roth

- Charitable planning strategies

- Business exit strategies

- Unmarketable asset strategies

- Cash management

- Lending strategies

- Advanced estate planning

- Intra-family planning

- Special needs planning

- LTC consultation

- "Four-letter" trusts

- Advanced retirement planning, including define benefit and uni-401(k) plans

- Executive compensation strategies

- Concierge email

- Real estate strategies, including DST, 1031 exchange, etc.

- Investment Banking Trust Services

*Lending Services provided by Raymond James Bank, member FDIC, affiliated with Raymond James Financial Services and Raymond James & Associates, Inc. Neither Raymond James Financial Services nor any Raymond James Financial Advisor renders advice on tax issues, these matters should be discussed with the appropriate professional. Not all services listed are suitable for all investors.