Summer 2019 Quarterly Commentary

Dear Clients and Friends,

We hope everyone had a wonderful summer! As the weather begins to cool, leaves begin to change, football kicks off, and market traders come back from vacation, we expect volatility to increase.

September has historically been a flat to slightly negative month for the S&P 500. Since 1950, the markets have fallen by ½% during the month. However, during the last 10 years, the S&P 500 has averaged gains around 1%. Many investors associate October with the market crashes of 1929 and 1987; however, since 1970 October has been the fourth best month of the year for investors. While some economic indicators have weakened in the last few months, our outlook is for slow growth, but not a recession. The Federal Reserve reduced interest rates by .25% in July and future reductions are expected. An accommodative Federal Reserve coupled with slower global growth has lowered interest rates and sparked a bond rally. Looser monetary policy is helping counter act the potential effects of the Chinese trade dispute/tariffs. No trade agreement is imminent, but a potential resolution could create a significant rally in global stock markets.

So far this year, the S&P 500 is up over 20%, the NYSE Composite over 13%, International stocks MSCI EAFA over 11%, and the Barclays Bond Aggregate is up over 8% (as of 9 -06-2019). A strong year so far for sure…

Real Estate, Communications, and Technology sectors are currently areas of outperformance. Laggards have been Energy, Healthcare, and Defensive sectors.

Market Outlook

From last quarter:

“We continue to focus on maintaining broadly diversified portfolios that can reduce risk while still achieving expected rates of return. Specifically, we are investing in high quality bonds and stocks, maintaining a balance between growth and dividend-oriented stocks, and maintaining modest holdings in international investments. Even when prices fluctuate, income is created within the portfolios for your income needs or to reinvest. We continue to be positive on the markets as we feel the current valuations are fair and economic and corporate health seems strong. We are rebalancing client portfolios to make sure the percentage of stocks does not exceed acceptable levels of risk. With strong moves forward, stock percentages can grow beyond those recommended; without prudent rebalancing risk can move beyond what is desired.”

While volatility has certainly increased and is expected through the fall, we would recommend accumulating investors add to stock positions in the event of a 5 – 7% pullback. With valuations in line with historical averages, an accommodative Federal Reserve, and an administration that seems to follow equity markets closely, we feel downside risk could be limited.

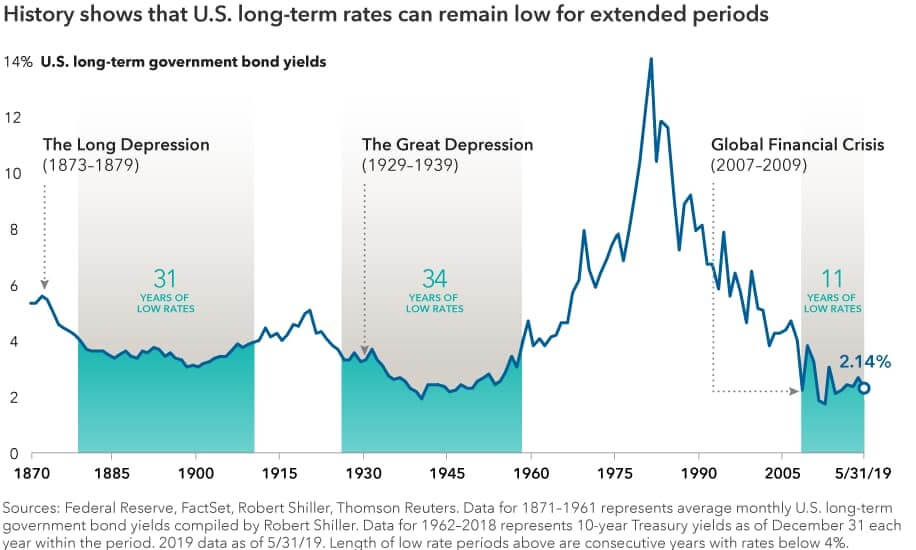

Many clients have asked us about interest rates and just how long they can stay low (The 10-year Treasury Bond rate is now 1.55%). We believe they can continue to stay low for an extended period of time. The chart below shows that rates move in cycles that can last over 30 years.

Research

Iris attended the invitation-only 2019 Annual Women’s Symposium in Orlando, Florida. The three-day conference is in its 25th year and is structured towards continuing education and industry trends.

Pictured: Iris with company CEO and Chairman, Paul Reilly

The Team

After 13 long months and 100’s of hours of study, George completed the certification of CERTIFIED FINANCIAL PLANNER ™ in July. Scott’s dog Bodie helped him celebrate!

Please see website bio for more information on Bodie: https://www.raymondjames.com/legacyfinancialgroup/about-us/bio?_=bodie.mowry 😊

Scott and Lynn sent their oldest, Clay, off to college…Bodie is wondering where he is?

September Trivia

The NFL celebrates its 100th year in 2020. The first season was in 1920 and included 14 teams such as Akron Pros, Canton Bulldogs, Dayton Triangles, Decatur Staleys, Detroit Heralds, Hammond Pros, Muncie Flyers, Rochester Jeffersons, Rock Island Independents and Chicago Cardinals.

And the first champion? The Akron Pros with the inaugural champs going 8-0-3.

Any original teams remaining? Yes! Chicago Cardinals (now Arizona Cardinals) and Decatur Staleys (now Chicago Bears)

We have listed a link to the most recent quarterly market data for your review. Raymond James’ Capital Markets Review reflects current market and economic conditions. You can access the report by clicking on the link http://www.raymondjames.com/pdfs/capital_markets_review.pdf.

Thank you for your interest and as always please do not hesitate to contact us if you have any questions or comments.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The Dow Jones Industrial Average (DJIA), commonly known as “The Dow” is an index representing 30 stock of companies maintained and reviewed by the editors of the Wall Street Journal. The MSCI is an index of stocks compiled by Morgan Stanley Capital International. The index consists of more than 1,000 companies in 22 developed markets. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar-denominated, fixed-rate taxable bond market. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. Investing involves risk and you may incur a profit or loss regardless of strategy selected.