Spring 2019 Quarterly Commentary

Dear Clients and Friends,

We would like to wish everyone a wonderful spring! As the pollen subsides and the weather warms, it’s a great time to get outside and enjoy the mild weather.

Speaking of warming, after a 20% correction in the S&P 500 at the end of 2018, the markets have been performing quite well. The S&P 500 has regained all of its losses from 2018 and is now close to an all-time high. Many factors contributed to the market bounce back including the lower valuation from the correction, the Federal Reserve pausing interest rate increases, and potential agreement to resolve tariffs and other trade issues.

Most all economic indicators are positive with most improving from already strong readings. Recent economic growth above 3% is a positive sign for economic expansion.

So far this year, the S&P 500 is up 18%, NYSE Composite 14.21%, International stocks MSCI EAFA 14.94%, and the Barclays Bond Aggregate is up 2.97% (as of 4-26-2019).

Industrials, Consumer Cyclical, and Technology sectors are currently areas of outperformance. We are overweight in all of these sectors. Laggards have been Utilities, Healthcare, and Defensive sectors. We are underweight Utilities and Defensive sectors. We feel the Healthcare sector is still an attractive area and recent weakness could be an opportunity as demographic trends still favor this area of the markets. International stocks are contributing this year to strong performance.

Market Outlook

From last quarter:

We believe this is a correction and not a downward move into a bear market. As such, further weakness in stocks should be viewed as a long-term investment opportunity.”

While no one can be right 100% of the time, looking back from the December lows to today this call turned out to be the correct one.

We continue to focus on maintaining broadly diversified portfolios that can reduce risk while still achieving expected rates of return. Specifically, we are investing in high quality bonds and stocks, maintaining a balance between growth and dividend-oriented stocks, and maintaining modest holdings in international investments. Even when prices fluctuate, income is created within the portfolios for your income needs or to reinvest. We continue to be positive on the markets as we feel the current valuations are fair and economic and corporate health seems strong. We are rebalancing client portfolios to make sure the percentage of stocks does not exceed acceptable levels of risk. With strong moves forward, stock percentages can grow beyond those recommended; without prudent rebalancing risk can move beyond what is desired.

Legacy Financial Group Website

We have recently redone our website. The new site includes updated information about us and the firm, market commentary, links to client access, and the services we provide. We are very excited about the new site and hope you will take a look and provide us with your thoughts.

www.legacyfingroup.com

Research

Scott attended the Winter Symposium conference located at the Raymond James Headquarters in Tampa, Florida. The two-day conference is structured towards continuing education and industry trends. While attending, Scott and his wife, Lynn, had the opportunity to visit the recently opened James Museum of Western & Wildlife Art and chat with Tom James, the retired chairman of Raymond James.

Best in State – Forbes

We made the list! #14 in Virginia... Thank you to our wonderful clients for making this possible.

The Team

The team added a new member this quarter. Shelby Holt joined the administrative team. Shelby recently returned to the area after supporting her husband’s deployment to South Korea. You might find her at the front reception or reaching out to you regarding a review, paperwork, or answering a question.

Lynn, Shannon, Iris, and Scott attended the Kiwanis Club of Williamsburg’s Shamrock the Burg! Legacy was a sponsor and proceeds from the event will help support Grove Christian Outreach Center, Latisha’s House Foundation, Literacy for Life, One Child Center for Autism, and Kiwanis Youth leadership programs.

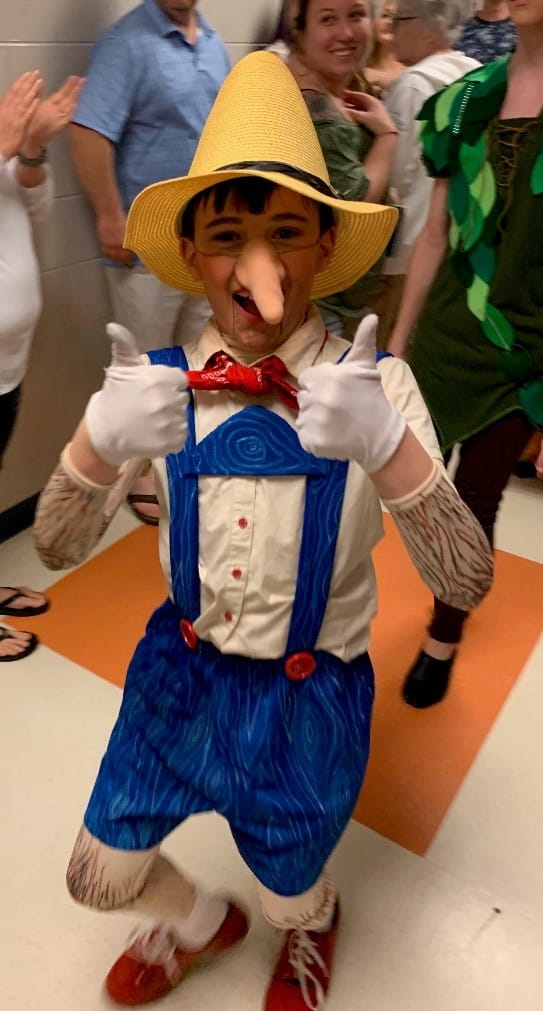

Shannon’s son, Jack, just finished his very first play... He played the role of Pinocchio in “Shrek, Jr. the Musical”. The play was a smash hit and next stop could be Broadway! Well, maybe 7th grade, but who’s counting.

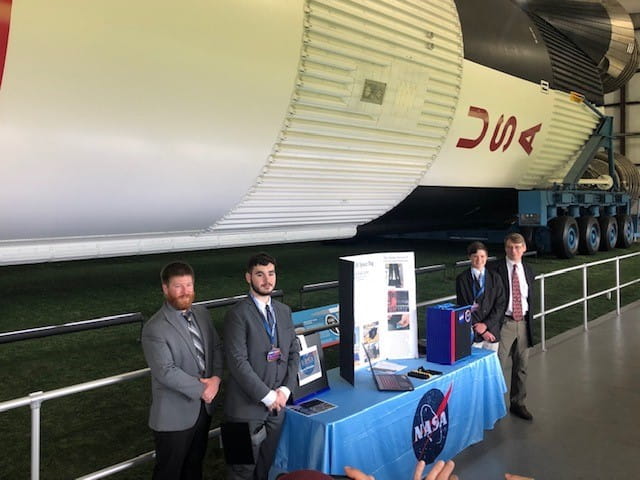

Scott’s son, Clay was accepted into the Engineering College at Virginia Tech and was a top ten finalist for NASA’s HUNCH program through his high school. Finalists received a trip to Houston to compete at Johnson Space Center where they presented to and met astronauts from the International Space Station.

May Trivia

“Sell in May and go Away?”- This phrase is thought to originate from an old English saying “sell in May and go away, come back on St. Leger’s Day.” The phrase refers to a custom of aristocrats, merchants, and bankers who would leave the city of London and escape to the country during hot summer months.

Over the last 50 years the Dow Jones has risen 7.55% during Nov 1st to April 30th, while up only .31% from May 1 to Oct 31st. Though recently, the disparity has narrowed. In the last 5 years the May 1st to Oct 31st period has returned 4.31% versus 5.48% for Nov 1st to April 30th.

As always, call with any questions or concerns on your portfolio or changes to your goals and objectives.

We have listed a link to the most recent quarterly market data for your review. Raymond James’ Capital Markets Review reflects current market and economic conditions. You can access the report by clicking on the link http://www.raymondjames.com/pdfs/capital_markets_review.pdf.

We, the Legacy team, work collaboratively and each have a hand in the content of this quarterly commentary; however, we understand that not everyone enjoys or wants quarterly updates. If you would prefer not to receive the updates please send back a response and we will take you off our e-mail list. Also, feel free to forward to interested friends or family.

Thank you for your interest and as always please do not hesitate to call or email if you have any questions or comments.

Sincerely,

Legacy Financial Group

411 Scotland Street Williamsburg, VA 23185

757-220-9730

877-542-9346

Fax 866-326-9495

www.legacyfingroup.com

Securities Offered Through

Raymond James Financial Services, Inc.

Member FINRA/SIPC

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete

Investment Advisory services offered through Raymond James Financial Services Advisors, Inc. Legacy Financial Group is not a registered broker/dealer and is independent of Raymond James Financial Services. Raymond James Financial Services does not accept orders and/or instructions regarding your account by e-mail, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. E-mail sent through the Internet is not secure or confidential. Raymond James Financial Services reserves the right to monitor all e-mail.

Any information provided in this e-mail has been prepared from sources believed to be reliable, but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in e-mail. This e-mail is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.

The Dow Jones Industrial Average (DJIA) is an index representing 30 stocks of companies maintained and reviewed by the editors of the Wall Street Journal. Please note that international investing involves special risks, including currency fluctuations, different financial accounting standards, and possible political and economic volatility. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. Investing in the energy sector involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors. Diversification does not ensure a profit or guarantee against a loss. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The FINE PRINT…

Links are provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material, is not a complete summary or statement of all available data necessary for making an investment decision, and does not constitute a recommendation. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any opinions are those of W. Scott Mowry and Legacy Financial Group not necessarily those of RJFS or Raymond James. Expressions of opinion are as of this date and are subject to change without notice. There is no assurance that the statements, opinions, or forecasts mentioned in this material will prove to be correct. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. Past performance does not guarantee future results. Investments mentioned may not be for all investors. Rebalancing a non-retirement account could be a taxable event that may increase your tax liability. You should discuss any tax matters with the appropriate professional. The S&P 500 is an unmanaged index of 500 widely held stocks that’s generally considered representative of the U.S. stock market. Dividends are not guaranteed and must be authorized by a company’s board of directors. Sector investments are companies engaged in business related to a specific sector. They are subject to fierce competition and their products and services may be subject to rapid obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Barclays Capital US Aggregate is an unmanaged market value weighted performance benchmark for investment-grade fixed rate debt issues, including government, corporate, asset backed, mortgage backed securities with a maturity of at least 1 year. MSCI EAFE (Europe, Australasia, and Far East) is a free float-adjusted market capitalization index that is designed to measure developed market equity performance, excluding the United States & Canada. The EAFE consists of the country indices of 21 developed nations. The Morningstar® US Style Index Family is designed to provide investors with an accurate and comprehensive depiction of the performance and fundamental characteristics of U.S. equity markets. The NYSE Composite Index is an index that measures the performance of all stocks listed on the New York Stock Exchange. The NYSE Composite Index includes more than 1,900 stocks, of which over 1,500 are US companies.

*This report is not a replacement for the official customer account statements from Raymond James or other custodians. Investors are reminded to compare the findings in this report to their official customer account statements. In a fee-based account clients pay a quarterly fee, based on the level of assets in the account, for the services of a financial advisor as part of an advisory relationship. In deciding to pay a fee rather than commissions, clients should understand that the fee may be higher than a commission alternative during periods of lower trading. Advisory fees are in addition to the internal expenses charged by mutual funds and other investment company securities. To the extent that clients intend to hold these securities, the internal expenses should be included when evaluating the costs of a fee-based account. Clients should periodically re-evaluate whether the use of an asset-based fee continues to be appropriate in servicing their needs. A list of additional considerations, as well as the fee schedule, is available in the firm’s Form ADV Part 2A as well as the client agreement

The Forbes ranking of Best-In-State Wealth Advisors, developed by SHOOK Research is based on an algorithm of qualitative criteria and quantitative data. Those advisors that are considered have a minimum of 7 years of experience, and the algorithm weighs factors like revenue trends, AUM, compliance records, industry experience and those that encompass best practices in their practices and approach to working with clients. Portfolio performance is not a criteria due to varying client objectives and lack of audited data. Out of 29,334 advisors nominated by their firms, 3,477 received the award. This ranking is not indicative of advisor’s future performance, is not an endorsement, and may not be representative of individual clients’ experience. Neither Raymond James nor any of its Financial Advisors or RIA firms pay a fee in exchange for this award/rating. Raymond James is not affiliated with Forbes or Shook Research, LLC.