Knowledge center

Explore the knowledge center module below to learn what a partnership with Raymond James provides for you.

Raymond James is changing the way financial advisors work. By providing the two things they need most – the resources to build a strong practice and the independence to make their own decisions – we’re placing the power to deliver quality advice and services directly in advisors’ hands.

Consolidation has rocked our industry, but Raymond James stands fast in our commitment to remain independent and competitive.

With approximately 8,800 advisors in the United States, Canada and overseas, the Raymond James Private Client Group serves more than three million individual and institutional accounts. Total client assets are approximately $1.57 trillion.*

*As of 9/30/2024. Past performance is not an indication of future results. The information provided is for informational purposes only and is not a solicitation to buy or sell Raymond James Financial stock.

When you affiliate with Raymond James as a traditional employee:

- You are free to make independent recommendations without account size restrictions or product pushes.

- You own your book of business – you have control of your practice now and you can sell your book when you retire.

- And you get all this while receiving competitive compensation and benefits.

Through AdvisorChoice®, a revolutionary approach to broker/dealer affiliation, Raymond James offers financial advisors the ability to match their career goals to one of five business models, each offering a distinct combination of support and independence. Every advisor is free to build relationships and grow his or her practice through the most suitable arrangement.

Our unique combination of freedom and support is real power that works for you, your practice and your clients. It’s the power of freedom with Raymond James.

An environment of growth

If you plan on steady, upward growth for your career, you should expect the same from your broker/dealer. While other firms have tumbled in today’s volatile market, Raymond James has remained a source of solid strength and consistent growth.

For half a century, Raymond James has built a national reputation as a leader in financial planning for individuals, corporations and municipalities. We’ve achieved this distinction through an unyielding dedication to strong advisor support, and it’s a tradition we plan to continue for the next 50 years – and beyond.

Our commitment to sound, disciplined management has not only helped our firm grow, it’s fostered a culture where advisors find success and careers trend upward. Discover how the support of Raymond James can help your practice thrive, too.

If you’re looking to take control of your business – and your life – you may be on the verge of an exciting discovery. Welcome to a realm of new choices. Welcome to Raymond James.

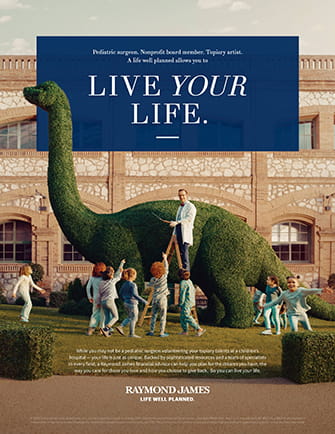

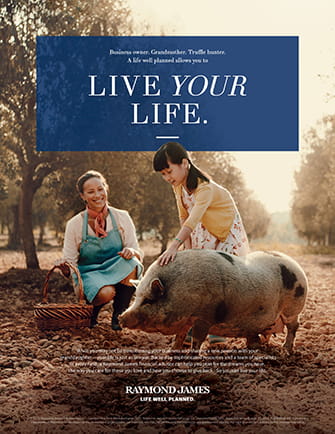

Television Ads

Raymond James' television ads run on various cable financial programming such as CNBC, Fox News Channel, Fox Business, PBS, BBC World News, ABC This Week and NBC Meet the Press, as well as lifestyle stations including Golf Channel and Tennis Channel.

Print and Digital Ads

Raymond James' print ads are featured in Smithsonian Magazine, Travel + Leisure, Food and Wine, Golf Magazine, Fine Cooking, and AFAR Magazine. Online advertising appears on sites such as the Wall Street Journal, The New York Times, CNBC, The New Yorker, Fox Business, and The Washington Post.

Click on any of the following images to view larger size of the ads.

Sponsorships

Raymond James also sponsors National Public Radio (NPR) and partners with notable tennis and golf tournaments.

Your practice

When you affiliate with Raymond James as a traditional employee, you’ll work in a branch environment where service, technology and operations associates are available to help you manage your practice. You’ll benefit from competitive compensation, bonus opportunities, generous deferred compensation and equity participation plans, along with a full range of insurance options. And you’ll get it all from a firm that respects your client relationships, granting you full ownership of your book of business. You’ll have the freedom to build your business in a branch office setting and enjoy the synergy and support of working with other financial professionals.

What makes Raymond James different?

If you ask us: everything. We truly believe no other firm can match our distinct combination of world-class resources, enduring strength and long-standing commitment to providing robust, personal support to talented financial advisors. But when it comes to your professional future, it doesn't matter how different a firm says it is – it matters how different a firm proves it is. So, here's what sets Raymond James apart from any other firm in our industry:Here, you’ll have the freedom to make your business exactly that – yours.

When you affiliate with Raymond James as a traditional employee, you’ll have access to the resources of an international broker/dealer, but get the individual attention you’d expect from a regional firm. You’ll benefit from an environment that encourages long-term branch manager tenure, giving you the reliable local support you need. You’ll also be free to make independent recommendations without account size restrictions or product pushes. And with certain criteria met, you’ll own your book of business – you will have control of your practice now and you can sell your book when you retire. And you’ll get all of this while receiving competitive compensation, without haircuts on insurance and annuities.

Advisor Bill of Rights

At Raymond James, we trust you to determine the best course of action for your business. We trust you to create investment plans designed to meet your clients’ financial goals. Our strong commitment to professionals like you led to the creation of the firm’s Financial Advisor Bill of Rights.

- You own your client base, including the right to sell it.*

- You develop and operate your practice with our assistance, not constraints.

- You’re free to work with your clients, without regard to account size or asset levels, while respecting existing Raymond James advisor-client relationships.

- You have access to world-class resources and personalized attention from a firm that puts the focus on you.

- You can count on our financial strength to support your business, even when the marketplace is challenging.

- You benefit from the stability of our firm, a public company traded on the New York Stock Exchange.

- You are never influenced to do anything that’s not in your clients’ best interests – no sales quotas, account size restrictions or product pushes designed to influence your decisions.

- You’re entitled to enthusiastic support from associates throughout the Raymond James organization.

- You will be fairly compensated, and can expect a consistent pay schedule with straightforward, transparent commission architecture and no holdbacks on dealer allowances.

* Certain qualifications apply.

The brand we’re most interested in building is yours.

You can expect two things from Raymond James that you won’t find at any other firm – the freedom to create a unique brand for your practice and the team to help you build it. Raymond James Marketing is your in-house marketing, advertising and public relations agency. Our creative professionals are highly skilled at meeting the nuanced needs of financial advisors, and they’ll work closely with you to develop materials that fit your style, reflect your standards and connect with your target audience.

The doors to the corner offices are always open.

At Raymond James, our reputation for providing exceptional personal support can be felt in every area of our firm – and it starts at the top. Our senior leaders have always been dedicated to working closely with financial advisors because many of them started out with the same title. So, it’s not uncommon to see them in the halls getting to know an incoming trainee class, or hear them on phone calls offering their influence and insight to help advisors like you get things done. And their dedication is shared by every Raymond James associate at every level. Because you deserve to get the help you need to reach your biggest goals – from all of us.

We are a family of collaborative professionals cleverly disguised as a financial services firm.

“What made you choose Raymond James?” “The culture.” We hear this from nearly every advisor who joins our firm. To be precise, 92% of recently transitioned advisors listed our culture as a key factor in their decision. They tell us that coming here felt like coming home. And we think there’s a good reason for that, because despite the fact that we are a leader in an industry driven by change, we hold fast to the belief that some things never should. For 50 years, we’ve remained committed to our core values of conservatism, independence, integrity and putting clients first. They’ve guided our business and shaped our culture – and they always will.

Book Ownership

As an employee advisor at Raymond James, you own your client base, including the right to sell it. Owning your book of business means that if you elect to terminate from Raymond James, the firm will not solicit your client relationships provided you have satisfied the following conditions: You have no outstanding financial obligations to Raymond James, you have no outstanding compliance or legal issues, and you are paid according to the payout grid (minimum T12 equals $250,000).Qualifications

The Raymond James traditional employee option is for financial advisors who want the freedom to build their business in a branch office setting while enjoying the synergy and support of working with other financial professionals.

A minimum of five years’ experience and $300,000 or higher in annual fee and commission revenues is a prerequisite for joining our firm as an experienced advisor.

Payout & compensation

Our product-neutral payout schedule is intended to provide straight-forward, transparent and competitive payout to advisors in an environment that supports their control and growth of their business.

| Trailing 12 Gross Commission |

Payout Percentage |

|

|---|---|---|

| - | 200,000 | 20.0% |

| 200,000 | 250,000 | 25.0% |

| 250,000 | 300,000 | 28.0% |

| 300,000 | 350,000 | 38.0% |

| 350,000 | 400,000 | 40.0% |

| 400,000 | 500,000 | 41.5% |

| 500,000 | 600,000 | 43.0% |

| 600,000 | 800,000 | 43.5% |

| 800,000 | 1,000,000 | 44.0% |

| 1,000,000 | 1,500,000 | 44.5% |

| 1,500,000 | 2,500,000 | 45.0% |

| 2,500,000 | 3,500,000 | 46.0% |

| 3,500,000 | 5,000,000 | 47.0% |

| 3,500,000 | 5,000,000 | 48.0% |

| 5,000,000 | 100,000,000 | 50.0% |

NOTES

This payout schedule is applicable only to financial advisors with at least seven years industry service. If industry service is less than seven years and the financial advisor is not a participant in the Raymond James NFA program, their payout will be determined by their divisional director.

Regardless of production level, the following products are paid according to the following schedule:

- Collar Transactions - 50%

- Investment Banking Referral Fees - 70%

Raymond James & Associates' standard discounting policy for equity, fixed income and option transactions is as follows:

- Trades with a gross commission of $100 or more receive full payout;

- Trades with a gross commission between the client minimum and $100 receive 25% payout;

- Trades with a gross commission below the client minimum receive no payout.

- Client minimum applies to Equity, Option and Fixed Income products. The minimum is currently $75 for Equities and Fixed Income products and $60 for Options.

No transaction charges are deducted from gross commission prior to determining payout. Payouts are calculated at the above percentages. Production levels are computed on a trailing-12-months basis, adjusted quarterly the month following the end of each fiscal quarter. While there is no retroactive adjustment, the entire payout is adjusted prospectively, which is different from many firms who pay on an incremental basis when changing brackets. To compare total commission compensation with that of other firms, the payout schedule should be considered in conjunction with the fact that the gross commission credit on investment products includes all selling concessions, that substantial deferred commission bonuses are accrued and that there are no transaction charges deducted.

Chairman's Council, President's & Leaders Clubs

Raymond James’ Chairman's Council, President's Club and Leaders Club follow a point system for annual qualification. Points are accumulated as follows:

RJA PCG Recognition Level Qualification Point System

Each $ of Production = |

1 point |

Each $ Million of assets under management (AUM) = |

2,000 points |

Competency points are granted for designations such as CFP®, CFA, CIMA and MBA, or can be awarded by attending specific professional educational sessions offered by Raymond James. |

for FY 2015 up to maximum |

For example, an advisor who has $1,500,000 of annual production, has $150 million AUM and has earned his CFP designation would be awarded 1,950,000 points and would qualify for the FY2015 Chairman’s Council I:

$1,500,000 in production |

1,500,000 points |

$150 million AUM |

300,000 points |

Certified Financial Planner™ |

150,000 points |

Total points |

1,950,000 points |

Benefit Summaries:

Chairman’s Council

FY2014 Benefits:

- Chairman’s Council qualifiers for FY14 are invited to the 2015 Chairman’s Council recognition trip to Ontario, Canada (June 14-20, 2015) with stays at both The Rosseau in Muskoka and The Four Seasons in Toronto.

- Chairman’s Council members are invited to the Summer Development Conference, July 7-12, 2015.

- RJF Restricted Stock Unit awards will price as of November 20, 2014, for those who qualified for retention during FY14.

- RJF Stock Options (based on the award levels below) will also price as of November 20, 2014, for those who qualified during FY14.

- The credit for state registration fees will be $900 for those who qualified in FY14.

FY2015 Qualification Levels:

- Minimum points required in FY15 to qualify for Chairman’s Council are 1,850,000.

- Chairman's Council qualifiers are eligible for a retention bonus at the end of FY15, provided no outstanding note is in effect. The sales title of Managing Director may be added to your Senior or First Vice President, Investments titling as a member of the Chairman’s Council. Points will determine eligibility with FY15 production used to calculate the bonus award. Retention bonuses are awarded as follows:

Chairman’s Council I: |

1,850,000 – 2,349,999 points |

18.75% of T12 production |

Chairman’s Council II: |

2,350,000 – 2,999,999 points |

25.00% of T12 production |

Chairman’s Council III: |

3,000,000 – 3,899,999 points |

30.00% of T12 production |

Chairman’s Council IV: |

3,900,000+ points |

35.00% of T12 production |

- All awards will be in RJF RSUs with five-year cliff vesting. As in the past, optional “step-ups” will be continued as long as the program exists.

- RJF Stock options awards as follows:

Chairman’s Council I: |

1,850,000 – 2,349,999 points |

1,000 options |

Chairman’s Council II: |

2,350,000 – 2,999,999 points |

1,200 options |

Chairman’s Council III: |

3,000,000 – 3,899,999 points |

1,500 options |

Chairman’s Council IV: |

3,900,000+ points |

1,800 options |

- Long Term Incentive Plan (LTIP) contributions awarded as follows:

Chairman’s Council I: |

1,850,000 – 2,349,999 points |

3.00% of T12 |

Chairman’s Council II: |

2,350,000 – 2,999,999 points |

3.50% of T12 |

Chairman’s Council III: |

3,000,000 – 3,899,999 points |

4.00% of T12 |

Chairman’s Council IV: |

3,900,000+ points |

4.50% of T12 |

President’s Club

FY2014 Benefits:

- President’s Club qualifiers for FY14 are invited to the 2015 President’s Club recognition trip at The Cove Atlantis, Paradise Island, Bahamas, April 29 - May 3, 2015.

- President’s Club members are invited to the Summer Development Conference, July 7-12, 2015.

- RJF Restricted Stock (RSU) awards will price as of November 20, 2014, for those who qualified for retention during FY14.

- The credit for state registration fees will be $600 for those who qualified during FY14.

FY2015 Qualification Levels:

- Minimum points required in FY15 to qualify for President’s Club are 1,300,000.

- President’s Club qualifiers are eligible for a retention bonus at the end of FY15, provided no outstanding note is in effect. Points will determine eligibility with FY15 production used to calculate the bonus award. Retention bonuses are awarded as follows:

President’s Club I: |

1,300,000 – 1,549,999 points |

12.50% of T12 production |

President’s Club II: |

1,550,000 – 1,849,999 points |

15.00% of T12 production |

- All awards will be in RJF RSUs with five-year cliff vesting. As in the past, optional “step-ups” will be continued as long as the program exists.

- The Long Term Incentive Plan (LTIP) for FY15 qualifiers is 2.30% for President's Club I and 2.60% for President’s Club II.

Leaders Club

FY2014 Benefits:

- Leaders Club qualifiers for FY14 are invited to the 2015 Summer Development Conference, July 7-12, 2015.

- Advisors who earned Leaders Club in FY14 (or will earn it in FY15 or future years) and have 20 years or more in length of service at Raymond James will be awarded the title of Senior Vice President, Investments in recognition of your prolonged contributions to the firm.

- RJF Restricted Stock Unit (RSU) awards will price as of November 20, 2014, for those who qualified for retention during FY14.

- The credit for state registration fees will be $400 for those who qualified during FY14.

FY2015 Qualification Levels:

- Points required in FY15 to qualify for Leaders Club are 975,000.

- Leaders Club qualifiers are eligible for a retention bonus at the end of FY15, provided no outstanding note is in effect. Leaders Club qualifiers are eligible to receive a retention bonus of 10% of T12 production, and awards will be in RJF RSUs with five-year cliff vesting.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, Certified Financial Planner™, CFP® (with plaque design) and CFP® (with flame design) in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements.

Benefits

We believe successful work merits a few perks. And at Raymond James, this means more than offering a dynamic, creative workplace with opportunities to freely transfer within the firm. Our benefits package has been designed to provide highly desirable features that contribute to the financial and personal well-being of each associate. It means we support you with generous benefits including group insurance, both traditional and Roth 401(k) plans, annual bonuses, stock purchase plans, and corporate discounts to theme parks, entertainment events, hotels, gyms and various businesses.

We also provide profit sharing and employee stock ownership programs that give you the chance to take part in our success. Raymond James will also match all donations to the United Way or other charities up to $5,000 per associate. Furthermore, we’ll encourage you to reach your full potential through specialized training and continuing education programs at Raymond James University. Plus, we offer tuition reimbursement for higher education and work-related study.

Healthcare

With physician and hospital costs rising, it is important to have healthcare that works for you. Our comprehensive package includes health insurance with your choice of HMO or PPO options with dental, vision and prescription drug coverage.

Insurance

You and your loved ones should be protected if an emergency arises. With our insurance benefits, we offer basic and supplemental life and accidental death and dismemberment, long-term disability and care, salary continuation, business travel accident and spouse and dependent life.

Investment and retirement

We reward loyalty and hard work. To encourage it, we provide our associates with a wide range of investment and retirement benefits, including 401(k)s, profit sharing, an employee stock ownership plan, and our employee stock purchase Plan. Also, a securities discount allows associates to pay less for trade transactions.

Associate programs

We have established several other programs to help our associates, including healthcare and dependent care flex plans, an employee assistance program that provides mental health and substance abuse support, and parking and mass transit flex plans.

Changing broker/dealers doesn’t have to be a bigger hassle than it’s worth. When you join Raymond James, we take every step to ensure a smooth, seamless transition. Once you commit, our Transitions team will proactively manage the details from start to finish – down to monitoring the final client account transfer – allowing you to continue with business as usual. Our devoted professionals will guide you through the following steps:

Preparation

- Develop a customized timeline that includes a target date for your official transition to Raymond James.

Organization

- Gather all necessary paperwork for the eventual transfer of your clients’ accounts to Raymond James.

- Obtain appropriate licensing and insurance coverage, being sure to clear any related issues through Raymond James Compliance.

Orientation

- Set up all technology, supplies and communication infrastructure in your office, providing orientation on the many new resources at your staff’s disposal.

- Design and deliver customized marketing collateral – including stationery, letterhead, press releases, ads and more – to promote your affiliation with Raymond James and educate clients on how they will benefit.

Affiliation

- Deliver official termination notice to your current broker/dealer.

- Provide ongoing support and consultation to ensure you and your staff are completely comfortable with all new tools and processes.

New to the industry? Thinking about launching your career as a financial advisor?

If you have the skills, desire and commitment to pursue a career as a financial advisor, our comprehensive paid trainee program will provide you with the foundation you need to build a successful, satisfying career. The resources offered through our cutting-edge trainee center put you at an immediate advantage as you embark on this rewarding professional path. We’ll stand behind you, providing the personal attention and service you need to offer the same to your valued clients. Click here to launch our trainee program website.

Raymond James offers a sound suite of investment and financial planning products to equip you for any client need. Our capabilities in virtually every arena - from asset management to capital markets to insurance - put you at a distinct advantage when it comes to delivering high-caliber service. Take some time to explore the depth and quality of products and services we offer to complement your practice. You'll see why advisors who affiliate with us are known for their ability to provide truly comprehensive strategies to clients' financial planning needs.

Services for affluent investors

Raymond James helps advisors compete effectively for high-net-worth clients. This affluent audience responds particularly well to our support of the advisor-client relationship, and advisors find our support tools and research valuable as they enter or expand their presence in this market.

Raymond James can work with you behind the scenes or can take a more active role to provide case management support that is unrivaled in the industry.

“By Invitation Only” visits

Invite your clients to our home office to experience the stability and strength of Raymond James. The firm’s “By Invitation Only” (BIO) visits bring your best clients to our international headquarters in Florida to meet with our experts and interact with management. The BIO program has been in existence at Raymond James for over 18 years. Hundreds of prospective clients, existing clients and referral sources have visited the Raymond James Financial headquarters in St. Petersburg, Florida, to learn more about the products, services and support available. During your visit, you’ll also have the opportunity to tour The Tom and Mary James/Raymond James Financial Art Collection, one of the largest privately owned collections in the Southeast.

As a result of these BIO visits, many prospects have become clients, many existing clients have invested additional assets, and many referral sources have sent our financial advisors new business. Feedback from our advisors on these visits shows a success rate of 90%. BIO visits allow our advisors to bring their clients in to see firsthand why they are so proud to be affiliated with Raymond James.

Bring more to your client relationships with the impressive array of services available through the Raymond James Financial Planning Group. This team of consultants provides guidance on a multitude of issues including financial, estate and retirement planning.

You can rely on the Financial Planning Group to provide:

- Continuing education and seminars across the United States

- Technical interpretation or research of regulatory topics

- Marketing materials such as brochures and pre-packaged seminar kits covering various retirement plan topics

- Financial planning software you can use to illustrate asset allocation, needs analysis, cash flow schedules and various calculators

- Consultation on third-party planning tools

The Financial Planning Group also provides support to advisors through the Raymond James advisory process, your resource for information and tools to help you be the best possible advisor to your clients. Emphasizing the importance of using a process in your practice, the Financial Planning Group will offer you featured processes from your peers, links to useful checklists and forms to support your current methodology, and an off-the-shelf advisory process model you can put to use if you don’t currently have a defined process.

Goal Planning & Monitoring (GPM)

This online financial planning software, powered by MoneyGuidePro®, enables you to create interactive goal plans for clients, build actionable recommendations and monitor plans to help keep clients on track. Because the software is integrated with your client’s information and offers intelligent defaults, you can build a robust retirement analysis in minutes with minimal data input. Four key features differentiate GPM from similar tools:

- Fully integrated – From the Raymond James Advisor Access platform and Client Center you can immediately create and monitor client plans with key relationship data passing automatically or you can create new plans for prospects.

- Client collaboration – Output is highly visual and designed to build and present a live, interactive plan that you can change in real time with your client.

- Easy to use yet sophisticated – A streamlined workflow with smart data entry and prefilled defaults to make the process more efficient for the most common planning needs; but also the ability to do more sophisticated planning.

- A living plan – Once a plan is adopted, GPM will automatically track key plan variables on a quarterly basis to let you know when a client gets off track.

The projections or other information generated by Goal Planning & Monitoring regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. Goal Planning & Monitoring results may vary with each use and over time.

With a wealth of fee-based programs available through Raymond James Asset Management Services, it’s easy to create a strategy to every investor’s needs. Clients have the choice of managing their own assets, letting you manage them, or leveraging a third party.

Our team of carefully screened portfolio managers is one of your best resources. With as little as $100,000, your clients can access nationally known portfolio managers who normally impose account minimums of $5 million or more. These managers can develop a program to fit your clients’ individual needs, from conservative fixed income to more aggressive growth equity portfolios.

The programs also have tax planning advantages that make sense for many high-net-worth investors. Plus, we allow the aggregation of fees between various accounts, enabling you to offer competitive pricing to your clients regardless of which money managers you prefer.

Managed Accounts

The managed money programs offered through the Raymond James Asset Management Services are founded on institutional-quality investment management principles, including forward-looking risk and return assumptions and advanced manager research techniques. These principles extend from our separately managed and unified managed account programs to our mutual fund and ETF wrap programs, providing a single integrated platform for all your managed account business.

We don’t believe there should be any bias among your clients’ money management options. That’s why, at Raymond James, you can aggregate fees from various separately managed accounts, allowing you to offer competitive pricing to your clients regardless of which money managers you prefer. We offer extensive educational training, dedicated sales support and proposals that can be customized with a wide range of helpful exhibits.

Raymond James Asset Management Services offers a wide variety of managed account options, including:

Freedom Account*

Freedom is a discretionary, turnkey account offering six professionally designed asset allocation models, automatic fund selection and annual rebalancing. The Freedom Mutual Funds platform offers six models addressing a spectrum ranging from conservative to more aggressive strategies. Similar portfolios of exchange traded funds (ETFs) are also available on the Freedom ETF platform. The Freedom Retirement Income Solution offers three models specifically designed to address longevity risk, while the Freedom UMA includes more than 50 models constructed with mutual funds and separately managed accounts (SMAs) to accommodate a wide range of client goals. All of these portfolios are carefully chosen and constructed by Raymond James professionals.

Raymond James Consulting Services (RJCS)

RJCS brings an institutional focus to portfolio management for individual clients. Using rigorous due diligence to select and retain skilled managers while identifying active risk, we help you construct portfolios with a combination of managers and styles to fit the diverse needs of investors.

Outside Manager Program

If you have an existing relationship with a money manager not currently approved by Raymond James, we can often help you continue the relationship.

The Outside Manager Program is designed to assist advisors in maintaining third-party-manager relationships in a wrap-fee format when joining Raymond James from another firm. After screening a requested money manager, Raymond James may establish an operational and custodial relationship with that manager in order to make your transition as seamless as possible for your clients.

*Investors should understand that the annual advisory fee charged in the Freedom ETF Account program is in addition to the management fees and operating expenses charged by exchange-traded funds. These additional considerations, as well as the Freedom fee schedule, are listed more fully in the Client Agreement and the firm’s Form ADV Part II. Further information on the funds selected for the Freedom Portfolios is available by prospectus. Investors should carefully consider the investment objectives, risks, charges and expenses of exchange-traded funds before investing. All investments are subject to risk. The prospectus contains this and other information about the funds and should be read carefully before investing.

Non-Managed Accounts

When clients trust you to manage their assets, our fee-based alternative gives you the flexibility to choose from an extensive investment variety – stocks, bonds, load and no-load mutual funds and more. Whether you prefer a platform that allows you the flexibility to customize almost every facet of the account or opt to have Raymond James take care of the details, it’s your choice.

Fee-Based Accounts

What else clients should know about fee-based accounts

In an asset-based fee relationship, clients pay a fee (charged quarterly) based on the level of assets for the advice and services provided by their financial advisor as a part of the advisory relationship. This fee is based on the level of assets in their account, independent of the level of trading activity. By deciding to pay a fee based on services provided rather than transactions, clients should understand that the fee may be higher than the cost of a commission alternative during periods of lower trading activity.

Clients should understand that the advisory fee charged in the investment account is in addition to the management fees and operating expenses charged by open-end, closed-end and exchange-traded funds. To the extent that clients intend to hold fund shares for an extended period of time, these internal fund expenses should be added to the advisory fee when evaluating the costs of the account. Additionally, certain mutual fund families impose short-term trading charges (typically 1% to 2% of the original amount invested) which are generally NOT waived for fee-based accounts.

Additional considerations

Clients should consider these factors when deciding whether a fee-based account is right for them: i) their past and anticipated investment activity, ii) past and anticipated use of the products and services available in the account, iii) the value and type of eligible assets, iv) the costs and potential benefits of the service, v) investment objectives and goals, vi) additional financial and planning services provided by their financial advisor, vii) personal preferences concerning available payment alternatives.

Clients should also consider whether it would be better to pay separately for each trade executed and each product and service used. Since these factors may change, clients should periodically re-evaluate whether the ongoing use of a particular asset-based fee program continues to be appropriate for their needs.

These additional considerations, as well as the fee-based schedule are listed more fully in the client agreement and the firm’s Form ADV Part II.

In addition to a broad range of fee-based alternatives, Raymond James offers one of the largest selections of mutual fund families available from a single source. With more than 6,500 open-end mutual funds, our research analysts make extra efforts to evaluate individual mutual funds for our advisors and their specific client needs. This includes responding to due diligence questions, providing general sales and marketing support, as well as coordinating field trips to marketing companies.

Mutual fund marketing

Advisors with Raymond James have the advantage of buying and selling from a generous list of approximately 200 mutual fund families, while most companies may only have between 20 and 30 families of funds. Plus, you’ll also have ample marketing and sales materials, as well as fact sheets from fund companies featuring timely market information.

Intuitive mutual fund networking and operations

We connect electronically with more than 200 of the largest families of funds, enabling you to provide your clients with consolidated monthly statements and tax reporting. Our easy-to-use order-entry system allows you to place trades for both load and no-load funds, as well as set up periodic investments and withdrawals.

For a list of the mutual fund companies we partner with, click here.

Your clients should carefully consider the investment objectives, risks, charges and expenses of a mutual fund before investing. The prospectus contains this and other information about mutual funds. The prospectus can be obtained through our home office and should be read carefully before investing.

If appropriate for your particular business model, you can easily add to the services you provide with an impressive variety of nearly 50 insurance carriers. Our general insurance agent affiliate, Raymond James Insurance Group (RJIG), offers annuities, long-term care coverage and life and disability insurance, none of which are proprietary. No-load annuities are also available to our fee-only advisors.

Advisors who handle insurance sales through RJIG are supported by a trained staff of approximately 60 professional associates and receive access to:

- Marketing support

- An online annuity order entry system

- Monthly annuity values on consolidated client statements

- Point-of-sale assistance for life insurance

- Advanced life insurance case design and illustration support

- An on-staff long-term care professionals

Domestic trading

Raymond James’ extensive institutional sales network positions us as a premier distribution system both nationally and abroad – an advantage you can extend to corporate clients and prospects looking to generate capital through a public offering. A testament to our strong presence in the market, we maintain a track record of being among the top traders for our firm’s lead-managed underwritings. In addition, we make markets in over 700 Nasdaq securities.

International trading

Our International trading area trades all over-the-counter American depository receipts (ADRs), ordinary (foreign) and Canadian shares. We have the ability to access the majority of foreign exchanges directly for sizable orders. Our traders also handle all foreign currency trades for Raymond James.

Unit investment trusts

Our Unit Investment Trust department distributes new-issue UITs and maintains a secondary market for existing UITs, which include taxable bond and equity alternatives. Through the professional selection and diversification inherent in UIT portfolios, individual investors can benefit from competitive returns with specific time horizons.

Fixed Income Portfolio Analysis

To promote a more proactive and professional approach to fixed income investing, Raymond James provides our financial advisors with investment tools, such as Fixed Income Portfolio Analysis (FIPA), to assist in the decision-making process. Utilizing our comprehensive FIPA reports, Raymond James financial advisors can:

- Monitor portfolios’ progress toward investors’ goals

- Assess portfolios’ profiles

- Analyze position details including cost basis, market value and unrealized gain/loss information

- Provide maturity and cash flow schedules

- Determine risk exposure, including interest rate risk and duration, credit risk and reinvestment risk

To learn more about our Fixed Income overview, click here.

Raymond James maintains a full-service Investment Banking department that is national in scope, providing public and private offerings of equity and debt, as well as merger and acquisition services. The extensive industry knowledge and transactions expertise of our more than 650 capital markets professionals delivers a full array of transactional services, enhanced by strategic advice and planning for every stage of a company’s life cycle.

Our M&A expertise covers the full scope of services, including buy- and sell-side representation, advisory services, valuations, financial restructurings for distressed companies and takeover defense. Yet another resource that you can bring to your relationships, Investment Banking can help provide a substantial increase in liquidity for your retail clients, along with many other income-enhancing benefits.

Because we understand the important role reliable, timely information plays in your clients’ investment and financial plans, Raymond James has developed one of the most diversified internal research capabilities in the industry. We produce detailed reports on more than 600 closed-end funds and conduct forward-looking open-end mutual fund analysis. Our fixed income analysis delves distinctly in-depth, and our stock recommendations have been nationally lauded year after year. To help you place this wealth of factual information into perspective, we also make sure you have exclusive access to the latest market and economic commentary by our firm’s top internal professionals.

We understand the scope and complexity of the choices you face in today’s market, as well as your commitment to delivering quality long-term investment results. That’s why we put the resources in your hands to help you make sound investment decisions on behalf of your clients.

Equity Research

Broad scope, deep coverage

Raymond James’ equity research is a cornerstone of the organization. Raymond James and its affiliates in Canada, Europe and Latin America employ 100 research analysts who cover nearly 1,400 companies in nine highly focused industries: Consumer, Energy, Financial Services, Healthcare, Industrial, Mining & Natural Resources, Real Estate, Technology & Communications and Transportation. We are a top 5 provider of equity research in both the U.S. and North America in terms of companies covered.

Our research analysts and their teams seek attractive niches within broader industries and then cover these sectors deeply to develop differentiated sector expertise and relationships. While our focus is middle- and small-capitalization companies, our go-deep philosophy typically results in our coverage of large, medium and small companies across each sector; overall about one-quarter of our global coverage universe is large cap companies.

We believe our research philosophy is further distinguished by our supply chain approach. Many of our analysts and industry groups have constructed coverage universes that include the complete supply chain for that industry: key suppliers, manufacturers and distributors. Analysts also collaborate to produce supply chain surveys, reports and industry updates designed to help investors “connect the dots” in key industries.

Finally, to help our clients place this wealth of fundamental data into perspective, we also provide exclusive access to the latest market and economic commentary from our firm’s top internal experts, including our chief market technician, investment strategist and chief economist.

Technology, small-cap, and mid-cap securities generally involve greater risks.

Expert Commentary

In addition to research on specific companies and industries, Raymond James provides timely and insightful commentary on general market and economic conditions through our own in-house professionals. These nationally known professionals often appear on CNBC and Bloomberg TV and frequently contribute to publications such as The Wall Street Journal, New York Times and Barron’s.*

|

Economic Commentary by Scott J. Brown, Ph.D.Chief Economist Scott Brown provides information on current economic data releases and expectations for future data releases, Federal Reserve policy and interest rates on a daily basis. Most recent Economic Commentary |

To get more of the valuable resources Raymond James provides to its advisors delivered to your inbox, sign up for our bimonthly Practice Insights Newsletter.

Additional strategic resources

In addition to commentary by Raymond James professionals, our advisors receive access to a weekly Market Strategy report issued by Credit Suisse First Boston and Goldman, Sachs & Co. that provides analysis on specific industry groups within the market. Contributors include Abby Cohen, CFA, managing director and chair of Goldman Sachs’ investment policy committee, and Credit Suisse First Boston strategist Paddy Jilek.

*The Wall Street Journal, The New York Times, Barron’s, Bloomberg and CNBC, are not affiliated with nor sponsor, endorse or approve the investment programs of Raymond James & Associates or its parent, subsidiaries or affiliates.

Mutual Fund Research

Raymond James has the distinction of being among the first firms in the nation to publish mutual fund research reports recommending individual funds to investors. Today, our research remains unique in that it offers clients our clear opinion of how a particular fund will perform in the future.

You won’t need to rely on ratings that analyze what a fund has done in the past; with our strong mutual fund research capabilities, you’ll provide research reports that not only include Raymond James’ recommendations for the fund, but feature easy-to-understand performance data, top holdings, general data and hypothetical illustrations that make this information come alive for your clients. Then you’ll go a step beyond your competition, providing reports that review the fund’s objectives and management style and offer the analyst’s conclusion about future performance overall.

|

Closed-End Fund Research

Our Closed-End Fund Research department provides information and recommendations on more than 600 closed-end funds available to investors.

Advisors at Raymond James receive closed-end fund quarterly performance reports that provide updated performance statistics, portfolio breakdowns, asset allocations and more. You can even create a list of closed-end funds that interest you and our analysts will automatically email updates on those particular funds. As an added resource, the closed-end fund Research Literature Line offers Wiesenberger and Morningstar Principia reports, article reprints, client-approved marketing pieces and monthly commentaries.

Fixed Income Analysis

Fixed income securities – particularly municipal bonds – have traditionally been a significant foundation for investment portfolios. Ironically, very few firms provide the research necessary to help advisors make informed fixed income investment decisions on behalf of their clients.

Raymond James is one of the few firms that conducts this type of research, focusing on the volatility and maturities of bonds, the outlook for interest rates, credit fundamentals and the performance attributes of our bond recommendations. Our analysts cover a broad range of municipal bonds, including healthcare, housing, public power, school district, student loan, transportation and escrowed bonds. They’ll provide you with timely information on the general economy, plus electronic access to other sales support resources, including:

- Extensive online real-time and executable inventories of both taxable and municipal bonds (from our own internal inventory, as well as other industry market makers)

- Portfolio evaluations upon request

- Customized laddered bond portfolio proposals

- Check-a-month portfolio proposals

- Economic forecasts and interest rate monitoring services

Alternative investments and banking & trust services

To serve the more extensive financial needs of higher-net-worth investors, the Raymond James Alternative Investments Group (AIG) researches and selects high-quality, non-traditional investment products to serve their extensive financial needs including such areas as:

- Exchange funds

- Private equity

- Venture capital

- Hedge funds

- Managed futures

- Equipment leasing

- Real estate

- Sector-specific opportunities

AIG consists of a team of professionals that offers analytical, marketing and sales support. This group was created to provide a broader array of high-quality investment choices for you and your clients in varied market conditions, as well as extensive due diligence to assist with navigating this sometimes volatile portfolio sector.*

Using a combination of quantitative and qualitative analysis in researching and selecting managers, the Alternative Investments Group evaluates characteristics such as:

- Manager background and experience

- Manager tenure in the specific investment style

- Manager historical performance and volatility

- Historical correlation of manager performance to traditional benchmarks

- Manager performance during various markets environments

- Risk management policies and techniques

- Manager policies toward the use of leverage and other speculative strategies

*Alternative investments involve specific risks that may be greater than those associated with traditional investments and may be offered only to clients who meet specific suitability requirements, including minimum-net-worth tests.

When you affiliate with Raymond James, you’ll be able to offer banking and trust services. It’s an important competitive advantage when you consider the rapid change that’s taking place today on the financial landscape.

Bank Products

Raymond James Bank, N.A.* makes it possible for advisors – particularly those who are not affiliated with us as an advisor in a community bank or credit union – to offer clients banking services like first mortgages, home equity lines of credit, money market accounts, CDs, Internet banking and a variety of consumer loans.

Raymond James Bank also partners with other institutions for corporate loan business, enabling its affiliates to go beyond traditional brokerage services by offering investment products and a comprehensive array of personal and commercial banking services.

You’ll discover that Raymond James Bank, member FDIC, provides an added measure of flexibility most banks can’t offer. For example, our bank can create a customized CD that comes due whenever your clients desire (minimum purchases may apply).

*Raymond James Financial Services and Raymond James & Associates are affiliated with Raymond James Bank, N.A. Unless otherwise specified, products purchased from or held at Raymond James & Associates are not insured by the FDIC, are not deposits or other obligations of Raymond James Bank, are not guaranteed by Raymond James Bank and are subject to investment risks, including possible loss of the principal invested. Products, terms and conditions subject to change. Subject to standard credit criteria. Property insurance required. Flood insurance may be required.

Trust Services

Raymond James Trust N.A. offers a variety of personal and charitable trust services to deepen your client relationships, including revocable living trusts, testamentary trusts, charitable trusts, private foundations, irrevocable trusts, life insurance trusts and marital trusts.

The Raymond James Charitable Endowment Fund

Administered by Raymond James Trust N.A., the Raymond James Charitable Endowment Fund is a national donor-advised fund that will make a real difference in the way you conduct business. Without the up-front cost or significant ongoing expense, your clients can have virtually the same power as a private foundation.

Pooled Income Funds

A truly unique offering, the Raymond James Pooled Income Funds allow clients to make a charitable gift in exchange for an immediate tax deduction and a lifetime stream of income – all while avoiding up-front legal expenses. Upon the death of the last of their designated beneficiaries, your clients’ funds will be donated to the Raymond James Charitable Endowment Fund or charity of their choice.

© 2019 Raymond James Trust, N.A., is a subsidiary of Raymond James Financial, Inc.

Private Client Cash Solutions

Your clients will appreciate having flexibility and choice when it comes to managing their daily finances as it can be as important a part of your long-term financial plan as making the right investment choices. Raymond James offers a complete cash management solution, with online access to all of your clients’ accounts through Capital Access, credit cards, and a cash sweeps program to diversify their cash in the same manner as their investments. There are also premium features for your most valuable relationships, and a world-class client services team to assist both you and your clients.

Capital Access

Capital Access, Raymond James’ easy-to-use cash-management program, provides a comprehensive solution for your clients to handle and consolidate their day-to-day finances. In addition to online access to their account, a dedicated support team is always available to answer any questions.

Capital Access opens the door to a host of privileges including:

- Unlimited check writing with no minimums and free check orders and reorders

- Competitive interest rates

- Enhanced online bill payment with automated payment functionality

- Overdraft protection through Margin

- Visa® Platinum debit card

- Mobile Check Deposit

- Apple Pay, Samsung Pay, Android Pay

- Real-time debit card text alerts

- ATM fee reimbursements

- Industry-leading fraud protection services

- No minimum for opening or maintaining an account

- World-class client service team

Capital Access is free for clients with household account relationships totaling $500,000 or more in market value, clients who make an average monthly direct deposit of $1,000, and clients with eligible fee-based accounts. Capital Access accounts are $150 per year for all other clients.

Raymond James Credit Card

Another component of Raymond James cash management is the Raymond James Credit Card suite. Rounding out the full suite of cash management tools, credit cards help to strengthen the role of Raymond James financial advisors and provide their clients with valuable credit card rewards programs.

Integrated through Capital Access and Investor Access. Raymond James Credit Card program includes unique cards for various client needs. All cards come with an EMV chip, zero liability fraud protects, and are mobile pay enabled.

Cash Sweeps

Cash is an important part of every financial plan, but there is no reason why it should sit idle when it can earn income. Our cash sweep programs help you diversify your clients’ cash the same way you help diversify their investments. That way, their cash can continue working toward their long-term financial goals while remaining accessible for their near-term needs.

We offer a number of programs that maximize FDIC insurance and allow your clients' cash to earn interest while keeping it accessible. We offer four types of sweep programs for your clients to choose from, including money market funds; the Client Interest Program (CIP) that pays interest on cash awaiting investment; Raymond James Bank Deposit Program (RJBDP), and soon, The International Bank Deposit Program (non-FDIC). The money market funds and CIP both offer SIPC and excess SIPC protection. The Bank Deposit Program “sweeps” cash into numerous deposit accounts at banks, providing for up to $2.5 million for an individual account holder (up to $5 million for joint accounts) in FDIC deposit insurance – 10 times the standard limit.

Services & Support

Your clients have unique, evolving needs. With that in mind, we’ve built our firm around supporting your ability to meet those needs with precision and versatility.

At Raymond James, more than 4,600 home office professionals serve as an extension of the knowledge, experience and dedication you bring to your practice. These professionals view you as their client, and work hard to ensure you have all the tools and information at your fingertips to provide the highest-caliber service to your clients. Our in-depth resources are positioned specifically to enhance your interactions with investors and strengthen your business. With a knowledgeable, highly accessible support staff working with you, you’ll serve your clients capably and confidently.

Branch Services

When administrative challenges arise, it is vital to the profitability of your practice to resume serving your clients as quickly as possible. That’s why Raymond James provides Branch Services, administered by a team of licensed home-office professionals dedicated to resolving issues and providing the information necessary to help you focus on more pressing tasks.

As your liaison to the home office, Branch Services increases your practice’s efficiency by responding quickly to general inquiries, taking ownership of problem resolution and providing expedient approval for special account requests. These support professionals can even place trades for you while you’re out of the office. You’ll work more confidently knowing the most precise details are being handled professionally and competently.

Legal & Compliance

Raymond James’ Legal department help you practice by posting answers to the most commonly asked legal questions. Available on our corporate intranet site, this information is updated regularly and speaks to the situations our advisors face every day.

To help protect you and your business, Raymond James Compliance ensures that all applicable FINRA, SEC and state regulations, as well as internal policies, are followed. Compliance advisors conduct on-site audits of offices and monitor trading activities by reviewing mutual funds, annuity switching and discretionary accounts.

Other important functions of the Compliance department include assisting offices with customer complaints and reviewing marketing materials and stationery. Compliance also reviews criteria for the “Firm Element” portion of the FINRA requirements for continuing education and informs you about regulatory and firm procedures through memos and a bi-monthly newsletter.

Advisor marketing research

If your firm limits your ability to market your practice, get ready for a change. At Raymond James, our advisor-oriented culture extends to marketing support that’s unparalleled in the industry.

You created a successful business; now set it apart with support from a team that delivers industry experience – and agency results.

Whether you want advertising, public relations, strategy or analysis, Raymond James Marketing will develop materials that fit your style, reflect your standards and connect with your target audience. Our team of creative professionals was brought together especially to accommodate the nuanced needs of financial advisors.

Tour our resources at raymondjamesmarketing.com

Compliance approved. Customizable. Free.

Advisors at Raymond James also get access to a number of turnkey marketing and business development tools. These pre-produced, fully compliant advertising and marketing materials are available to you free or at our cost. Many are easily customized with your information.

Financial Planning Library – Forefield

Our advisors get access to the Forefield library, a collection of more than 850 compliance approved articles that lets you create a customized full-color client newsletter with three clicks of the mouse. You can create publication-ready newspaper columns and press releases, too. With an intuitive system that guides you through the process, Forefield gets you going fast and sets you apart from the competition.

Not only does Raymond James give you ownership of your book of business*, we’ll help you sell it when you retire. Through our proprietary program designed to help you establish a formal business succession plan, you’ll build long-term value that will one day help you maximize the rewards of your years of hard work. You’ll also benefit by knowing you can one day exit your practice on your terms while providing your clients with the assurance that their finances will remain in good hands.

We’ll provide strategic guidance through each stage of the succession planning process, beginning with establishing a sustainable infrastructure early on in the business lifecycle. Leveraging comprehensive analysis by Moss Adams LLP, one of the largest CPA firms in the country specializing in valuation of financial planning firms, we’ll help implement an appropriate valuation model for your practice. Then, when it comes time to sell, we’ll provide access to a network of potential buyers and even assist with executing the sale transaction itself.

* Certain qualifications apply

Forming strategic alliances with other professionals in your community – such as CPAs, attorneys, insurance agents or pension administrators – can generate referrals and help you grow your practice.

The Professional Partners Program is designed to support your relationships with local professionals who work with investors that would fit your desired client profile. In addition to helping you identify qualified candidates for a partnership, our program will guide you through the formal process of establishing fee- or commission-sharing relationships with participating professionals.

Professional partnerships can be a source of new business and revenue growth and Raymond James has the proven systems in place to help you leverage such mutually beneficial arrangements.

At Raymond James you can easily and effectively keep your skills sharp and your knowledge current with a wide range of educational opportunities including our Institute of Finance, Trust School and the popular School of Life. Take advantage of courses offered in a variety of disciplines like financial and retirement planning, insurance, trust services and asset management.

Another great way to stay sharp and develop your practice is to listen to AudioFile, a professionally produced CD that features monthly product announcements, marketing programs, research analyst interviews and success stories from your peers. Finally, Raymond James e-learning makes it possible for you and your staff to participate in a broad array of classes from the comfort of your office.

Raymond James hosts annual conferences for financial advisors. Held regionally, as well as nationally, in locations like Chicago, Las Vegas, San Diego, San Francisco, Nashville, Tennessee, and Orlando, Florida, these conferences serve as educational opportunities and networking events. They also provide the chance to earn NASD, CFP®, CPA and a portion of state insurance-licensing CE credits as you expand your knowledge base, network and share best practices with other advisors.

Raymond James also offers the annual Women’s Symposium. This three-day educational forum held each year in the Tampa Bay area is sponsored by the Raymond James Network for Women Advisors and provides the firm’s female advisors with the opportunity to share ideas and experiences with each other, hear from Raymond James senior management and other industry experts, and participate in a wide variety of interactive breakout sessions.

Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®.

At Raymond James, we’re committed to the success of our female professionals. That’s why we established the Raymond James Network for Women Advisors.

The network offers specialized programs and educational opportunities, dedicated resources, and ongoing support to our firm’s women financial advisors, encouraging them to expand their knowledge and expertise and enabling them to put their clients first.

As part of that effort, the Network for Women Advisors holds an annual three-day conference in St. Petersburg, Florida, called the Women’s Symposium, where women advisors from a number of firms share ideas, hear from industry experts and discuss their experiences, challenges and opportunities unique to them. It also facilitates mentoring through its Women’s Advisory Council in monthly conference calls for trainees. The network also provides access to helpful business-building tools through the Women’s Resource Center.

View the Raymond James Network for Women website.

The Women’s Symposium is an annual event held in the Tampa Bay area for the firm’s qualified women financial advisors. The three-day event is designed to appeal to financial advisors at all stages of their careers; it allows women to share ideas and experiences with each other, hear from industry experts, participate in interactive breakout sessions, and confer with senior managers from the home office. To learn more about this unique networking opportunity and view highlights of a recent Women’s Symposium visit rjwomensymposium.com

The Women’s Advisory Council consults on strategies and solutions that help support our firm’s women advisors. Comprised of 12 women advisors who possess a diverse combination of professional experience, the Women’s Advisory Council provides guidance and support to experienced women financial advisors, as well as to women who have recently entered the business.

Council members are integrally involved in monitoring activities, from leading monthly conference calls for trainees to providing similar advice, support and guidance to experienced advisors.

Available through our firm’s intranet site, the Women’s Resource Center provides links to a variety of material intended to help women advisors thrive – useful marketing strategies, tips for growing your business, an “Ask the Experts” page, key information and statistics on women, articles of interest, and a calendar of events. The site also contains information on our Women’s Advisory Council and the annual Women’s Symposium.