Quarter 3 - 2024 Market Update

- 08.07.24

- Markets & Investing

- Article

By: Eric and Jenny Hilliard

Summer has been busy and enjoyable for our family so far and we hope you are enjoying yours. We treasure the time away from the school calendar and the flexibility to relax together more.

In addition to our Market Update, this issue contains a Lifestyle Resources section providing transportation services available to seniors who no longer have their driver’s license. Too often lack of reliable transportation leads to isolation and missing out on key health care appointments and basic necessities.

With regards to the economy, inflation and future interest rate cuts, the past quarter brought about slight shifts from what we wrote about in our April Update. The economy is slowing, but remains resilient overall, as indicated by record travel experienced over the July 4th holiday. By a little bit, but enough to matter, employment data weakened during the quarter, and inflation declined. Federal Reserve Chairman Jerome Powell has shifted his emphasis from a laser focus on fighting inflation as he noted softening in the job market and the need to balance their dual mandate of a strong labor market, along with stable prices. This shift indicates that while we are currently in the dog days of summer, the end of summer may see the sun may set on peak federal funds rates of 5.25%-5.50%. The Federal Reserve is expected to make their first cut at the September 17th and 18th Federal Reserve meeting. As investors wake to the last few sunrises of summer they will hopefully be feeling the relief of slightly lower rates.

Key Highlights:

- Second quarter market performance recap

- Narrow market shows signs of broadening

- Historical calendar indicates possible heightened volatility

- Historical pattern of the S&P 500 during presidential election year

- Lifestyle Resources: Transportation for seniors without a driver’s license

Second quarter market performance recap

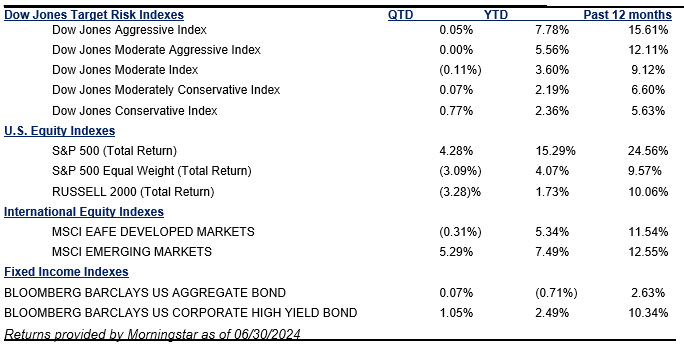

Most asset allocation portfolio benchmarks were little changed during the second quarter after gaining during the first quarter. The S&P 500 was up 4.28% for the quarter, but that performance was driven by just a few stocks in the market-weighted index.

The Russell 2000 Index, which tracks the stocks of smaller sized companies, declined by 3.28% during the second quarter. Smaller companies, which tend to be more reliant on borrowing to fund their businesses and growth are most negatively impacted by sustained higher interest rates. Trading days when economic data shows improvement on inflation the Russell 2000 tends to perform well as investors anticipate the arrival of an interest rate cutting cycle. The reverse happens on any hint that rate cuts may be put off further. Raymond James’ view is that the Fed will lower rates twice this year, starting in September, so perhaps small caps will be able to build some momentum from that.

Here are returns of various indices as of June 30th:

Narrow market shows signs of broadening

Nvidia (NVDA) alone accounted for nearly one-third of the S&P 500’s 15.29% return for the first half of 2024. The company and Its stock continue to benefit from an explosion of interest in Artificial Intelligence (A.I.) that is creating strong demand for their semiconductor chips.

According to a Wall Street Journal article “Why Your Fund Manager Can’t Beat Today’s Stock Market” written by Jason Zweig July 5th he notes that in addition to Nvidia, if you add Microsoft, Meta Platforms (aka Facebook), Amazon and weight loss drug maker, Eli Lilly 55% of the S&P 500’s return came from just those five stocks during the first half of 2024.

His article explains that investment managers construct portfolios that control risk. Part of that risk management is to own a diversified group of stocks. Concentrating so much money in just a few stocks violates that mantra. As money has plowed into stocks expected to benefit from A.I. those stock’s market cap and their percentage of share in the S&P 500 has grown as well. As of June 30th Microsoft, Apple and Nvidia made up nearly 21% of the S&P 500’s total market value. The top ten stocks account for more than 36% of the total market value of the S&P 500 and have driven much of the performance of the index.

We have seen extraordinary times like this before, when certain stocks or sectors can attract a lot of money over a short period of time and become very extended. Successful investors don’t tend to chase highflyers. Once stocks have already made significant gains the risk to the downside becomes greater and the last few investors to pile in often end up with losses. These situations have always turned out to be temporary and these stocks have already seen significant corrections during July. As the euphoria surrounding A.I. dampens and when interest rates begin to fall, more investment will likely flow to other areas of the economy that are growing earnings, pay dividends and are also attractive investments.

Case in point, July 11th was an incredibly unusual day of trading and illustrated how quickly the nature of trading can change when the market has been dominated by just a few stocks. July 11th began with a benign inflation report that cheered the market. A complete reversal in trading occurred as stocks that had been dominating the market gains recently, like Tesla, Nvidia, Costco, Meta Platforms, Microsoft and Apple were sold and ended down between 2% and 4%. Overall market breadth, however, was incredibly strong, with over 90% of NYSE operating companies stocks ending positive for the day.

The resulting index returns were losses by the S&P 500 of 0.88% and 1.95% for the technology-led NASDAQ 100, while the equal weight S&P 500 (meaning that all companies carry the same weighting) and Russell 2000 both gained for the day, 1.17% 3.63% respectively! That is a 5.58% performance disparity between the Russell 2000 and NASDAQ 100!

Investors took gains from those few stocks who have run up recently and invested in a broader group of companies, many of which were in sectors outside of technology that could benefit from the prospects of lower interest rates. As investors become more confident that rate cuts will commence soon, the more likely a broader array of stocks will participate in market gains. This all illustrates why it is prudent to remain invested in a diversified portfolio.

Uncertain conditions and historical calendar indicate possible heightened volatility

Each year experiences on average three to four pullbacks of 5%. Through mid-July the market had experienced one, during April. The average maximum drawdown during any given year, going back to 1980, has been 13%. The stock market has been experiencing a swift pullback to end July and begin August. So far, the pullback is nearing 6%. The Federal Reserve held the federal funds rate steady in July, indicating they may begin lowering rates in September. Many companies reporting earnings have expressed softness in consumer spending. Economic data has come in a bit lower than expectations recently as well. This is causing concern about whether the Fed is falling behind the data and could cause a recession by waiting too long to lower rates. The market was technically overbought and optimism had been pretty strong, so this may just be a re-set of expectations that although the economy is doing all right, risks of a weaker economy do remain. The Federal Reserve Committee should take notice of all this and a rate cut in September is becoming even more likely.

Historically, volatility in markets has been higher August through October. The Presidential election is approaching, and tensions have heated up in the Middle East, so the ingredients have been building for increased volatility. Pullbacks should provide good buying opportunities, particularly if we get a full 5%-10% correction, as we continue to be in a secular bull market.

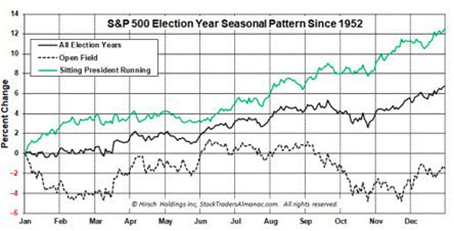

This chart below shows seasonal patterns of S&P 500 performance during presidential election years since 1952. This has certainly been an extraordinary election season thus far. In July alone we have watched an assassination attempt on former President Trump and President Biden dropping out of the race after his poor debate performance amid concerns about his mental and physical capacity. This is the first time since Lyndon B. Johnson in 1968 that a sitting president will not formally seek reelection. In spite of all the uncertainty and chaos, the chart of the S&P 500 so far has followed pretty closely to the All Election Year pattern below. Perhaps this is pre-election proof that markets tend to perform according to economic conditions and not because of which person or political party resides in the White House.

Lifestyle Resources: Transportation for seniors without a driver’s license

We understand losing a driver’s license is challenging, both emotionally and logistically. Thankfully, there are organizations that can help. Below are three such resources:

State of NC DHHS

https://www.ncdhhs.gov/divisions/aging/transportation-services

Transportation Provider Consultant

919-855-3400

leslee.breen@dhhs.nc.gov

RESOURCES FOR SENIORS, INC.

1110 NAVAHO DR, STE 400 RALEIGH, NC 276097369

Phone: 919-872-7933

Senior Quick Trip

210 Quail Hill St, Fuquay-Varina, NC 27526

https://seniorquicktrip-com.webnode.page/

984-225-2148

If you or someone you know could benefit from services like this you may find helpful information in this article on senior ride services by the care-giving service A Place for Mom.

https://www.aplaceformom.com/caregiver-resources/articles/uber-lyft-for-seniors

As we live through these interesting times, we will continue e-mailing you invitations to informative webinars as they are announced, so be sure to update us any time your e-mail address changes. Please also visit our website www.raymondjames.com/hilliard and social media pages (listed below) for timely updates. We regularly post information from various sources including:

- JP Morgan and other partner firms

- Raymond James Chief Economist Eugenio Aleman

- Raymond James CIO Larry Adam

- Gibbs Capital Management

Facebook: https://www.facebook.com/hfgraymondjames

LinkedIn:

Eric Hilliard, CFP®, Branch Manager https://www.linkedin.com/in/ewhilliard/

Wade Stafford, CFP®, Associate Financial Advisor https://www.linkedin.com/in/ericwstafford/

Jenny Hilliard, Investment Executive https://www.linkedin.com/in/jennyhilliardrj/

If any significant changes in your life or situation that could impact your financial plan arise, be sure to contact us. In the meantime, we continue to follow the processes we have developed over the years that enable us to provide you our very best.

Thank you for your trust in me and in our practice.

Sincerely,

Eric W. Hilliard

CERTIFIED FINANCIAL PLANNER™

Branch Manager

Trusted advisors, helping our clients invest, preserve, and distribute wealth since 1973.

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.

The foregoing information has been obtained from sources considered to be reliable, but we do ot guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision and it does not constitute a recommendation.

To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Investing involves risk, and investors may incur a profit or a loss regardless of strategy. All expressions of opinion are subject to change. Past performance is not an indication of future results and there is no assurance that any of the forecasts, statements, or opinions mentioned will occur.

DJ GLB Aggressive Index - The DJ GLB Aggressive is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Aggressive index is 100% of All Stock Portfolio Risk.

DJ GLB Conservative Index - The DJ GLB Conservative is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Conservative index is 20% of All Stock Portfolio Risk.

DJ GLB Moderate Aggressive Index - The DJ GLB Moderate Aggressive is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate Aggressive index is 80% of All Stock Portfolio Risk.

DJ GLB Moderate Conservative Index - The DJ GLB Moderate Conservative is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate Conservative index is 40% of All Stock Portfolio Risk.

DJ GLB Moderate Index - The DJ GLB Moderate is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate index is 60% of All Stock Portfolio Risk.

The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The S&P 500 is an unmanaged index of 500 widely held stocks. The S&P 500 Equal Weight Index (EWI) is the equal-weighted version of the widely used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance. Keep in mind the individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. MSCI Emerging Markets Index is designed to measure equity market performance in 24 emerging market countries. The index’s three largest industries are materials, energy and banks. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Bloomberg Barclays U.S. Corporate High Yield Bond Index is composed of fixed-rate, publicly issued, non-investment grade debt, is unmanaged, with dividends reinvested and is not available for purchase. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility and Finance which include both U.S. and non-U.S. corporations. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. The performance noted does not include fees or charges, which would reduce an investor's returns. The Magnificent Seven is a group of companies including Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. Raymond James makes a market in these stocks. This is not a recommendation to purchase or sell the stocks of the companies mentioned. Bond Prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Asset allocation and diversification do not guarantee a profit nor protect against a loss. Any Opinions are those of Eric and Jenny Hilliard and are not necessarily those of RJFS or Raymond

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC. © 2018 Raymond James Financial Services, Inc., member FINRA/SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by email, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. Email sent through the Internet is not secure or confidential. Raymond James Financial Services reserves the right to monitor all email. Any information provided in this email has been prepared from sources believed to be reliable but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in this email. This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.