Trusted advisors, helping our clients invest, preserve and distribute wealth since 1973.

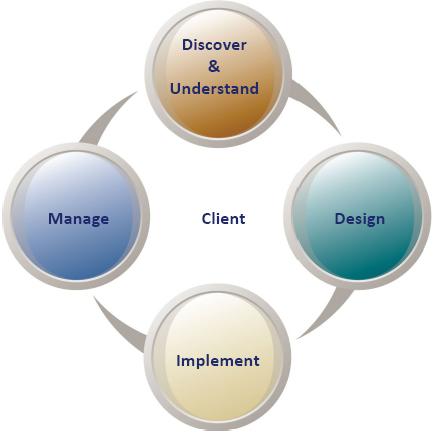

Our Advisory Process places you in the center and is never-ending.

Your plan will be uniquely devised for you.

Through this process, numerous tools can be utilize to help determine exactly what you need in order to achieve your particular goals, leaving you with confidence all important matters have been addressed. Here are a few of the many ways we can help you achieve a greater sense of financial independence.

Investing your assets according to your needs for growth, stability and income

- Transfer and consolidate 401K, 403b and other retirement savings plans from former employers.

- Develop a customized asset allocation, selecting investments with the appropriate consideration for balancing risk and growth opportunities.

- Monitor where we are in the economic cycle and what current market conditions are.

- Utilize high quality portfolio managers, ETFs and a variety of other investment vehicles.

- Conduct regular reviews of your investments.

Planning for and through Retirement

There are several risks we must consider when building a plan for retirement:Longevity - Outliving your money

Inflation - Your money buys less over time

Spending and withdrawals - Taking too high a percentage of income can result in running out of money

Market risks - Markets will fluctuate over time

Unknowns - What if there is a need for long-term care? What if a disability occurs?

We will work with you to assess your situation and attempt to minimize these risks, as appropriate. Additionally we can:- Transfer and consolidate 401K, 403b and other retirement savings plans from former employers.

- Consolidate retirement accounts and coordinate investments designed to provide a needed income stream.

- Ask key questions so we can gather as much information as possible and construct the best possible plan for you.

- Factor the impact of pension plans, Social Security and Medicare to a retirement plan.

- Engage an estate planning attorney to develop an estate plan. We can ensure the plan is consistent with your overall retirement plan and that beneficiary designations are up to date.

- Discuss potential long-term care needs

Preserving Wealth

- Balance growth opportunities with consideration of risk in building your portfolios. This will be reviewed periodically.

- Utilize insurance strategies to help reduce downside risks.

- Consider tax implications in our investment process*.

Providing Family Wealth Management Solutions

- Guiding through significant life events such as marital status changes, the birth of children or receipt of inheritance.

- Sale of a business.

Building your Legacy

- Sufficiently prepare for a child's upcoming college costs through the use of vehicles such as 529 Plans.

- Help you establish beneficiaries so that, in the event of death, your money is distributed according to your wishes.

- Utilize estate planning, trust and charitable giving strategies to fulfill your desired transfer of assets to the next generation.

*Please note, changes in tax laws or regulations may occur at any time and could substantially impact your situation. You should discuss any tax matters with the appropriate professional. Asset allocation does not guarantee a profit nor protect against loss. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional.