Three reasons the stars have aligned for a September rate cut

- 08.02.24

- Markets & Investing

- Commentary

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Confidence in the labor market is deteriorating

- Wage growth resumed its downward trend

- Interest rate sensitive areas of economy remain weak

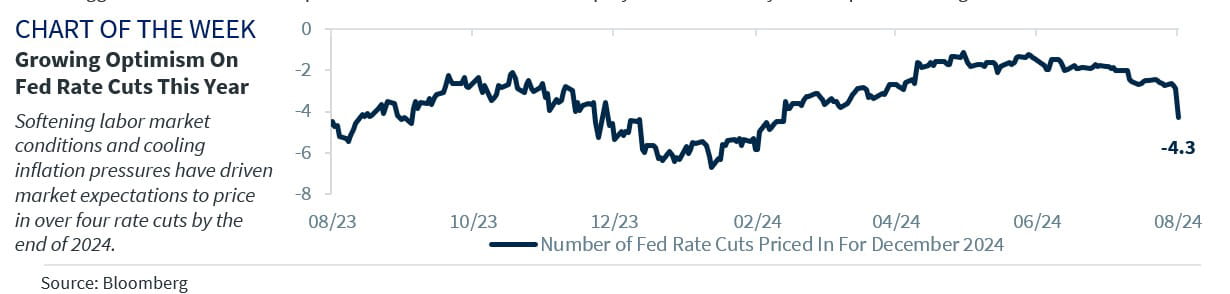

Over the last few weeks, there has been a growing chorus of market pundits (including us) suggesting the Federal Reserve (Fed) needs to start dialing back its policy restraint. However, policymakers are grappling with the appropriate timing to begin their easing campaign. The stakes are high as they try to nail the soft landing. Their dilemma: waiting too long could unnecessarily weaken economic growth and the labor market, whereas cutting too soon could derail the progress the Fed has made on inflation. While the Fed tries to thread the needle as the risks to its dual mandate (i.e., stable inflation and full employment) appear evenly balanced, we think the stars have aligned for a September rate cut. Here are three reasons why:

- Easing labor conditions | To date, job growth has remained resilient – with the U.S. economy adding 2.5 million jobs over the last 12 months. However, minor cracks are building, and the Fed needs to remain on guard that the welcome cooling does not turn into an unwelcome deterioration. Here are a few indicators that highlight how much the labor market has eased:

- Consumer attitudes | Consumers are growing less confident in the labor market. In fact, the percentage of consumers that viewed jobs as ‘hard to get’ climbed to its highest level since March 2021. The quits rate (which is historically correlated with rising wages and increased labor market confidence) is also at a multi-year low.

- Job openings fall | Labor market shortages were a key theme in the post-pandemic recovery. However, this has normalized with job openings falling from a peak of 12.0 million to 8.2 million, a decline of over 30%!

- Hiring is slowing | While job growth remained positive in July, the number of jobs added (+114k) was the second lowest monthly gain since December 2020. The unemployment rate (4.3%) rose to the highest level since October 2021 with the number of workers unemployed >27 weeks moving higher – which suggests it is getting harder for workers to find work.

- Signs of cooling inflation are everywhere | Inflation has held the attention of the Fed, as the rate of core inflation has remained above the Fed’s 2.0% target for 39 consecutive months. With signs that inflation continues to decelerate, the Fed should be confident that inflation is on a downward path to eventually hit its target. Below are three promising signs:

- Slowing wages | After a brief pause in Q1, wage growth resumed its downward trend with the Q2 Employment Cost Index slowing to its slowest pace (+4.1% YOY) since December 2021. With labor market dynamics more balanced as the number of job openings decline, wage pressures should moderate further moving forward.

- Businesses lose pricing power | Two key themes throughout 2Q earnings season have been the weakening consumer and the subsequent decline in pricing power for businesses. This week, companies such as Procter & Gamble and McDonald’s highlighted their inability to pass on prices. As businesses struggle to raise prices, inflationary pressures should ease.

- Higher productivity | Productivity improved in 2Q, rising at a 2.3% annualized pace and climbing >2.5% on a YoY basis for four consecutive quarters. A continued boost in productivity (which should be supported by AI gains going forward) should dampen future labor costs and give the Fed confidence that the disinflationary trend will continue.

- Interest rate sensitive areas remain under pressure | The U.S. economy has been resilient in the wake of the most aggressive tightening cycle in forty years. However, the interest rate sensitive sectors have not been spared. Ongoing weakness in key areas of the economy suggests the Fed needs to provide relief to avoid further deterioration.

- Weak manufacturing | The ISM Manufacturing PMI Index has been in contractionary territory (below 50) for 20 out of the last 21 months. Demand remains weak as signaled by four consecutive declines in the New Orders sub-index and weakness in several of the regional Fed surveys (Kansas, Richmond, and Dallas).

- Sluggish recovery in housing | High mortgage rates are plaguing the housing market. Home sales remain low, despite a modest uptick in inventories. Homebuilder confidence (NAHB) remains in the doldrums, falling to its lowest level in seven months. And, housing affordability is poor, with only 12% of consumers saying it’s a good time to buy a house.

- Auto industry facing challenges | High borrowing rates and soaring prices are hampering the auto industry. This has caused manufacturers/dealers to increase incentives to stoke demand. Q2 earnings confirm that the industry is facing numerous headwinds – increasing costs, a tough pricing environment, elevated inventories, and rising competition.

Bottom line | The case for a rate cut is building. While the Fed held rates steady at this week’s FOMC meeting, Powell’s dovish comments make a September rate cut likely – consistent with our forecast that the Fed will cut rates at least two times this year. The biggest question now is whether the Fed will be too late, causing the economy to falter more than the market expects (i.e., a growth scare). Our economist believes that the economy will struggle (RJ 3Q GDP est: 1%) but avert a recession. However, the likely sluggish economic data is expected to lead to an increase in equity market volatility and keep a lid on longer-term interest rates.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.