Quarter 1 2024 Market Update

- 01.25.24

- Markets & Investing

- Article

The end of 2024 and holiday season flew by, as it usually does. We hope you and your loved ones enjoyed time together to appreciate your blessings and each other. We spent Christmas with family and enjoyed a few days in the mountains where we were surprised with a ground-covering amount of snow. Just enough to create a beautiful New Year.

Market Update Summary:

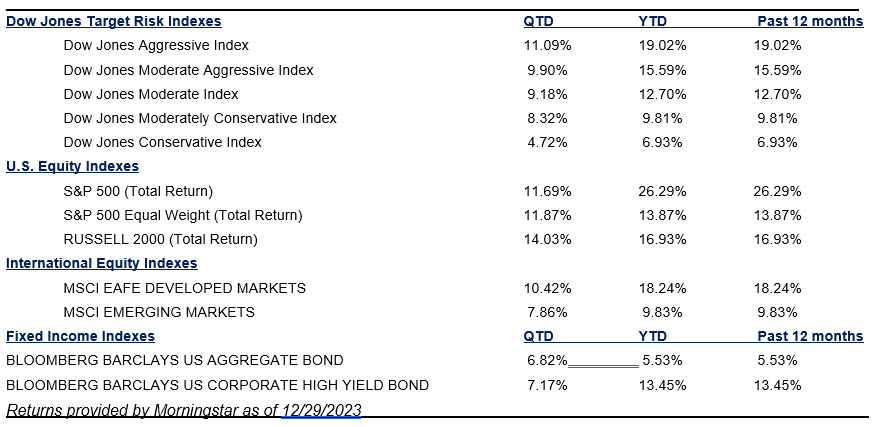

After a pullback late summer into early fall, markets enjoyed widespread gains the last few months of the year.

The Federal Reserve added fuel to the rally in December when they left rates unchanged and Fed Chairman Jerome Powell indicated there may not be a need to raise rates further. Market watchers took this as evidence that we are at peak rates and the likely next move by The Fed would be to lower rates throughout 2024.

For the year, market gains were dominated by a narrow group of technology stocks dubbed “The Magnificent 7”. A broader group of stocks participated in the fourth quarter rally, a healthy development. This is evidenced below in the fourth quarter returns.

Market Update Key Topics:

- 2023 - The year most everyone got wrong

- 2023 S&P 500 returns dominated by “The Magnificent 7”, but diversification still reigns long-term

- Will 2024 bring more rate hikes or of rate cuts?

- We maintain a cautious stance regarding a possible recession

- Asynchronous mini-recessions during 2022 and 2023 could support the case for in a mild recession

- Investors may experience higher levels of volatility during 2024

2023 - The year most everyone got wrong

Many economists and media predicted a recession that didn’t happen: A year ago, most economist and Wall Street strategist predicted the U.S. economy would enter recession at some point during 2023. Instead, the economy held up better than expected, supported by several factors: Consumer continued to spend, supported by the built up savings from pandemic stimulus, there was an uptick in layoffs, but overall employment numbers remained strong, supply chains untangled, energy prices peaked during summer and fell during the fall and inflation rates steadily fell as well.

10-year Treasury yields were predicted to continue rising when they hit 5%, but they fell instead: 10-year Treasury yields hit 5% in October, the highest rate in 16 years, according to The Wall Street Journal. At that time many predicted rates would continue rising, but instead they began to decline, falling to 3.86% at the end of December.

Bearish forecasts for the S&P 500 were easy to find, but instead it bullishly charged forward: Facing negative forecasts for the economy and availability of higher yields, record amounts of cash went into CDs, savings accounts and money-market funds. This made the prospect of gains in the S&P 500 hard to anticipate. The S&P 500 defied expectations and gained much more than anyone expected, although much of that was by a narrow group of stocks, which will be discussed in more detail below. We believe the current high levels of cash could fuel future gains in equity markets if investors gain confidence in the future of corporate earnings and the U.S. economy.

This past year was a great example of why not to get too caught up in political, economic and market forecast. Forecasts have a mixed track record and value in the short term. We focus much more on the data we have to work from and the broader trend than at what level prognosticators say the S&P 500 will be, how many rate cuts will occur or who will win the election.

2023 equity returns dominated by “The Magnificent 7”, but diversification still reigns long-term

There was great dispersion between the performance of “The Magnificent 7” (Apple, Microsoft, Google, Amazon, Nvidia, Facebook and Tesla) and all other stocks during 2023. The S&P 500 is a cap-weighted index, meaning that the companies with a larger market capitalization have a bigger weighting and therefore a bigger impact on the performance of the index. As “The Magnificent 7” stocks gained and their market cap grew, so did their impact on the index. In fact, it is estimated that “The Magnificent 7” accounted for 70% of the 2023 gains in the S&P 500! Raymond James Investment Management dove into the details and revealed some statistics that offer perspective in their January 2nd piece “Diversification is Still Important”.

For 2023:

- “The Magnificent 7” gained an average of 112%

- The average S&P 500 stock was up 15%

- Dividend paying stocks (with a yield over 2%) gained 6% on average.

Most of this “Magnificent 7” outperformance was due to two factors:

- Hype over artificial Intelligence and its potential impact on future earnings of companies who stand to benefit from the growth of artificial intelligence.

- A reversion to the mean because for 2022 the opposite was true:

- “The Magnificent 7” stocks were down 46%

- The average S&P 500 stock was down 9%

- Dividend-payers were down 6% on average.

Looking at the two-year performance over 2022 and 2023:

- “The Magnificent 7” are up 8%

- The average S&P 500 stock was up 2%

- Dividend-paying stocks are down 1%.

The S&P 500 Index versus the S&P 500 Equal Weight Index:

- The S&P 500 Equal Weight Index outperformed the S&P 500 by 7% during 2022

- The Equal Weight Index underperformed the S&P 500 Index by 12.41% during 2023

- The 3-year annualized performance is much closer with the S&P 500 returning 8.29% and the S&P 500 equal weight index returning 7.31% (as reported by S&P Dow Jones Indices website)

While certain areas of the market can over or underperform by a wide margin on a short-term basis, historically longer term returns tend to smooth out, which supports maintaining diversified portfolios to achieve longer-term goals. It also illustrates why chasing returns just because an investment experienced recent gains is often not a recipe for success.

Will 2024 bring more rate hikes or rate cuts?

The Federal Reserve has a dual mandate to achieve maximum employment and maintain stable pricing. The past two years inflation was in focus and bringing it down became The Fed’s primary short-term goal as they embarked upon the fastest series of rate hikes in over forty years. December statements by Fed Chairman Powell shifted significantly to indicate that with inflation falling their focus on achieving both mandates is now more balanced.

Powell also indicated there may not be a need to raise rates further, which left many believing that unless inflation begins rising again the next likely move would be a reduction of interest rates. Some have predicted the first rate-cut would occur in March with others, like our own CIO at Raymond James, Larry Adams indicating mid-year is more likely. March seems too soon to us as well. The Fed will want to ensure inflation does continue falling and the strength of current economic activity is not providing an impetus to cut rates. Availability of jobs has been coming down and additional weakening in the labor market may cause The Fed to begin lowering rates, but they may not feel it is necessary yet to begin in March.

Inflation remaining above their 2% goal does not mean they can’t begin dropping rates yet. As noted in Larry Adam webinar Ten Themes for 2024, nine of the past ten times The Fed has begun lowering rates inflation was above their 2% target.

If a development, like deterioration of the job market or credit shock due to high rates does occur, that could spur them to begin lowering rates more quickly. In the absence of such a crisis, we suspect June is a more likely time for the first rate cut. When this occurs fixed income (bonds) should begin to appreciate as investors look for higher yielding bonds. In this environment, fixed income should offer positive returns for well-diversified investors during periods of volatility.

We maintain a cautious stance regarding a possible recession

- The last eleven times The Federal Reserve has embarked upon rate-hiking cycles the economy has entered a recession approximately two years following the first hike. Since March 2022 began this cycle, it is still within reason for the impact of the higher rates to still results in a recession.

- The Conference Board’s Leading Economic Index fell for the 20th straight month in December. As defined by The Conference Board’s website “The Leading Economic Index provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term”. It has a pretty accurate history of predicting recession when LEI is negative for prolonged consecutive months. According to VettaFI Advisor Perspectives website, on average there are usually 10.6 months from a peak LEI reading and a recession. Currently we are 23 months off from the 2021 peak. As a result of the December LEI reading The Conference Board wrote “Despite the economy’s ongoing resilience – as revealed by the US CEI – and December’s improvement in consumer confidence, the US LEI suggests a downshift of economic activity ahead. As a result, The Conference Board forecasts a short and shallow recession in the first half of 2024”

- Another historically reliable indicator of a recession, the curve between the 10-year and 2-year treasury yields remains inverted. We currently remain within the typical period after the curve first inverts that a recession begins.

- Once The Fed initiates rate-cuts consumers may put off large purchases in anticipation of lower interest rates in the future. That action can send an already fragile, slow-growing economy into a recession.

According to The National Bureau of Economic Research (NBER) a recession is defined as a period with “a significant decline in economic activity that is spread across the economy and lasts more than a few months”. Currently evidence still points to any recession being mild, meaning possibly slower economic activity, reducing Gross Domestic Product (GDP) by a few percentage points and perhaps an increase in unemployment by 1% or so, but not a severe recession as we experienced during 2008-2009 when GDP fell 4.3% and unemployment increased from 5% to 9.5%, according to federalreservehistory.org.

We are keeping an open mind that a future unknown could create a more challenging situation than what is currently expected. Hopefully that will not occur, but a year ago few thought the economy would avoid recession and this year few think the U.S. economy will have a recession. Rather than betting heavily on one outcome or another, we favor watching the evidence come in and remaining balanced in our approach.

Asynchronous multiple mini-recessions during 2022 and 2023 could support the case for a mild recession

One interesting reason why any U.S. economic recession we experience may be mild is because over the past few years different sectors of the market have experienced boom periods and recessionary periods. During normal economic times consumers and businesses all spend at similar levels depending on how strong the economy is and how confident or concerned they feel about the economy’s future.

The past few years consumers and businesses have spent money on different things based on economic dislocations and supply disruptions. This has all resulted from the lockdowns the global economy experienced due to the pandemic. While people were mostly confined at home they bought lots of good online, including office furniture and PCs needed to work and learn at home. Restaurants, entertainment and the travel industry fell into deep recession. Goods prices rose because of scarcity as supply disruptions occurred but people had nothing else to spend money on, so consumers competed for the goods they wanted and needed. Once people started moving about spending on goods slowed and spending on entertainment and travel picked up. Those businesses have been strong the past year and a half. Discretionary goods businesses, like clothing, furniture and PCs ended up with excess inventory, lower consumption and went into recession.

These are just a few examples, but similar things have occurred across the global economy. We have been watching for areas of the economy to normalize. That is, to get back on a growth trajectory they likely would have been on currently if the pandemic never happened. This has slowly been happening. Experiencing booms and busts in various sectors of the economy at different times may make any recession to the overall economy milder.

Investors may experience higher levels of volatility during 2024

Geopolitical concerns: We began 2023 with one war between Russia and Ukraine, along with concerns about China’s intention with regards to Taiwan. We begin 2024 with those concerns and another serious war in the middle east, a volatile region that is always one of concern. We certainly pray for all conflicts to be resolved, but currently any escalations could worry markets.

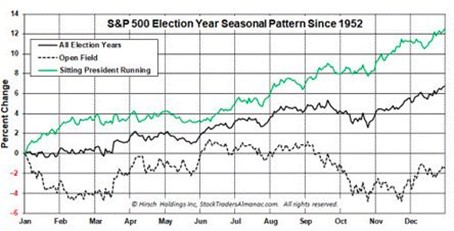

The upcoming U.S. Presidential election: 2024 is an election year and we are already experiencing elevated political rhetoric. Volatility tends to peak during September and October as the election nears. Markets then usually rise once the uncertainty of the election is in the rear-view mirror, regardless of who wins. Additionally, markets have been positive in each of the last eleven election years. This chart shows seasonal patterns of S&P 500 performance during Presidential election years since 1952.

Uncertainty surrounding potential interest rate cuts: Markets being forward-looking have already risen as investors look forward to cuts in The Federal Funds Rate. If The Fed takes longer to initiate rate cuts, markets may pull back in disappointment. Overall, equities are likely to positively react to rate cuts as long as they are not being lowered in response to significant cracks in the economy. Naturally, if inflation were to begin rising again, that would put off rate cuts, which would be disappointing and if it began raising enough to concern The Fed, they could increase rates further. We do not expect this to occur. Managing risk with a well-diversified portfolio helps navigate years of higher volatility.

Looking forward through 2024

Absent a serious deterioration in the economy, investors are likely to perceive Federal Funds Rate cuts as positive for businesses, consumers and the overall economy, which may help stocks and bonds rise. We suspect this will be the dominant trend even as markets pull back from time-to-time. We believe the weak start to 2024 is due to two factors. First, the strong rally to finish 2023 may have pulled ahead some of the gains and the market simply needs to catch up. Second, investors who wanted to realize gains and rebalance portfolios likely waited for the new year so as not to add to their 2023 tax burden.

Another historical trend to note is that stocks often trade choppily leading up to the first rate cut when an easing cycle begins. As explained by Ned Davis Research, since the 1970s the S&P 500 has experienced a median decline of 1.8% in the three months leading up to a first rate cut. After that though stocks have gained 20% on average during the easing cycle.

Overall, we expect 2024 to be a reasonably productive one for investors and we look forward to working with you throughout this year.

We will continue e-mailing you invitations to informative webinars as they are announced, so be sure to update us any time your e-mail address changes. Please also visit our website www.raymondjames.com/hilliard and social media pages (listed below) for timely updates. We regularly post information from various sources including:

- JP Morgan and other partner firms

- Raymond James Chief Economist Eugenio Aleman

- Raymond James CIO Larry Adam

- Gibbs Capital Management

Facebook: https://www.facebook.com/hfgraymondjames

Eric Hilliard, CFP®, Branch Manager

LinkedIn: https://www.linkedin.com/in/ewhilliard/

Wade Stafford, CFP®, Associate Financial Advisor

LinkedIn: https://www.linkedin.com/in/ericwstafford/

Jenny Hilliard, Investment Executive

LinkedIn: https://www.linkedin.com/in/jennyhilliardrj/

If any significant changes in your life or situation that could impact your financial plan arise, be sure to contact us. In the meantime, we continue to follow the processes we have developed over the years that enable us to provide you our very best.

Thank you for your trust in me and in our practice.

Sincerely,

Eric W. Hilliard

CERTIFIED FINANCIAL PLANNER ™

Branch Manager

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.

The foregoing information has been obtained from sources considered to be reliable, but we do ot guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision and it does not constitute a recommendation.

To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Investing involves risk, and investors may incur a profit or a loss regardless of strategy. All expressions of opinion are subject to change. Past performance is not an indication of future results and there is no assurance that any of the forecasts, statements, or opinions mentioned will occur.

DJ GLB Aggressive Index - The DJ GLB Aggressive is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Aggressive index is 100% of All Stock Portfolio Risk.

DJ GLB Conservative Index - The DJ GLB Conservative is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Conservative index is 20% of All Stock Portfolio Risk.

DJ GLB Moderate Aggressive Index - The DJ GLB Moderate Aggressive is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate Aggressive index is 80% of All Stock Portfolio Risk.

DJ GLB Moderate Conservative Index - The DJ GLB Moderate Conservative is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate Conservative index is 40% of All Stock Portfolio Risk.

DJ GLB Moderate Index - The DJ GLB Moderate is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate index is 60% of All Stock Portfolio Risk.

The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The S&P 500 is an unmanaged index of 500 widely held stocks. The S&P 500 Equal Weight Index (EWI) is the equal-weighted version of the widely used S&P 500. The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance. Keep in mind the individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. MSCI Emerging Markets Index is designed to measure equity market performance in 24 emerging market countries. The index’s three largest industries are materials, energy and banks. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Bloomberg Barclays U.S. Corporate High Yield Bond Index is composed of fixed-rate, publicly issued, non-investment grade debt, is unmanaged, with dividends reinvested and is not available for purchase. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility and Finance which include both U.S. and non-U.S. corporations. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. The performance noted does not include fees or charges, which would reduce an investor's returns. The Magnificent Seven is a group of companies including Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. Raymond James makes a market in these stocks. This is not a recommendation to purchase or sell the stocks of the companies mentioned. Bond Prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. There is an inverse relationship between interest rate movements and fixed income prices. Generally, when interest rates rise, fixed income prices fall and when interest rates fall, fixed income prices rise.

Asset allocation and diversification do not guarantee a profit nor protect against a loss. Any Opinions are those of Eric and Jenny Hilliard and are not necessarily those of RJFS or Raymond

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC. © 2018 Raymond James Financial Services, Inc., member FINRA/SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.

Raymond James Financial Services does not accept orders and/or instructions regarding your account by email, voice mail, fax or any alternate method. Transactional details do not supersede normal trade confirmations or statements. Email sent through the Internet is not secure or confidential. Raymond James Financial Services reserves the right to monitor all email. Any information provided in this email has been prepared from sources believed to be reliable, but is not guaranteed by Raymond James Financial Services and is not a complete summary or statement of all available data necessary for making an investment decision. Any information provided is for informational purposes only and does not constitute a recommendation. Raymond James Financial Services and its employees may own options, rights or warrants to purchase any of the securities mentioned in this email. This email is intended only for the person or entity to which it is addressed and may contain confidential and/or privileged material. Any review, retransmission, dissemination or other use of, or taking of any action in reliance upon, this information by persons or entities other than the intended recipient is prohibited. If you received this message in error, please contact the sender immediately and delete the material from your computer.