Quarter 1 2023 Market Update

- 02.07.23

- Markets & Investing

- Article

We hope your new year is starting off well as you read this quarter’s Market Update Letter. It is a longer Market Update than normal because we thought we should address the numerous questions we have been receiving in recent months about what has been impacting markets.

Key Points we will cover in this Market Update:

- 2022, The year the Fed fought inflation

- Rapid pace of interest rates hikes to date and where rates may peak

- Inflation comparisons to 1935-1945 post World War 2 may be more comparable than comparisons to the 1970’s, which is most discussed by media.

- Inflation is currently moving in the right direction

- Envisioning bluer skies ahead markets rally to begin 2023

- What currently concerns us most

- Reasons for optimism about the market forecast in the months and years ahead

____________________________________________________________________________________

Market Update Summary:

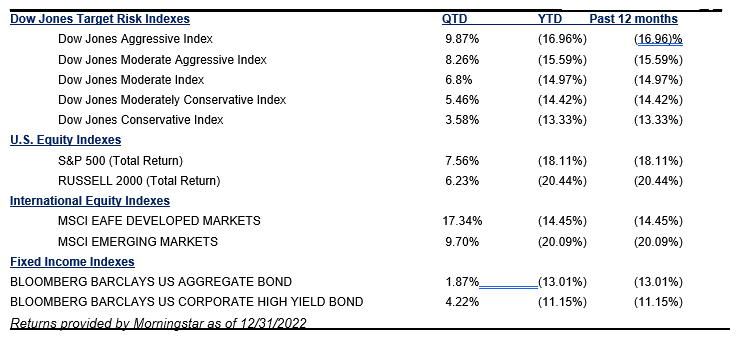

Last year began with The Federal Reserve (The Fed) acknowledging inflation was not as “transitory” as they thought during the second half of 2021. They stated the need to begin raising interest rates to tamp down demand and combat inflation. A year ago, three 0.25% interest rate hikes were expected. As the year wore on and inflation became stickier than hoped for, it became increasingly clear The Fed would need to raise rates much faster and higher than initially anticipated. Stocks and bonds both fell throughout the year as they kept adjusting to the reality of higher and higher projected interest rates. This resulted in a volatile year as the S&P 500 was down 1% or more 122 days, an average of two per week! 2022 was the first year since 1976 that stocks and bonds were both negative.

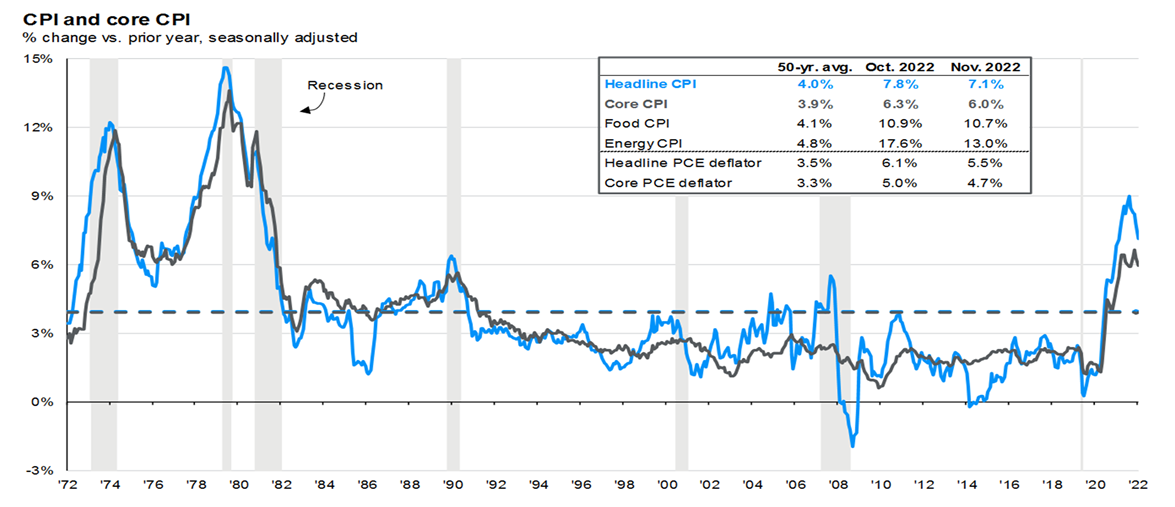

Multiple signals in recent months point to inflation receding in several areas, particularly Goods inflation. We still need to see wage pressure ease and there is still some inflationary pressure in commodities.

It does seem that we are nearer the end of the rate increases, with current expectations for perhaps one or two more increases and then for The Fed to pause and monitor how the economy absorbs the rate increases already made in coming months. The market views this as things beginning to get better on that front. Corporate earnings are being watched closely to see how consumer demand and corporate profits hold up. There is still hope The Fed can engineer a soft landing with the rate increases slowing the economy, but not putting it into a significant recession. We give it a 50/50 chance.

This has allowed both equities and fixed income to begin 2023 with a rally. We do expect more back and forth in the months ahead as earnings, economic data and corporate earnings are watched closely, but expect this to be a more productive year for investors than last year was. Towards the end of this Market Update we provide several positive statistics that are in the favor of the bulls currently.

____________________________________________________________________________________

2022, The year The Fed fought inflation

From an investor’s perspective 2022 was a year we were ready to close the books on. The year began with the S&P 500 making new highs on January 4th and went south from there. Inflation was high and was rising far faster than expected prompting the Federal Reserve (The Fed) to raise rates at a historically fast pace. At the beginning of the year three rate increases were expected, but by March the Fed felt they needed to raise rates far beyond what was originally expected. Outside of the energy sector due to the war in Ukraine, a broad sell off in equities and fixed income ensued. There were a few attempts over the summer to rally back on comments from the Fed that the markets interpreted as dovish. However, those comments were walked back by the Fed Chair Jay Powell during the late August Jackson Hole meeting causing a push towards the October lows. It felt there was a cloud hanging over the markets for much of the year and while skies have not yet completely cleared, we have reason to be hopeful for brighter times ahead. Thankfully, the fourth quarter did recover and might have given us a glimpse of those clearer skies in the future.

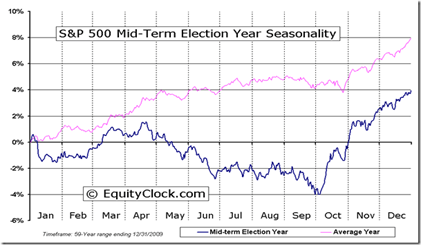

We shared this chart below with you in last quarter’s letter. After bottoming in October, we did, in fact, get the fourth quarter Mid-Term Election Year rally that we expected to occur if the S&P 500 followed the typical historical path. International markets had an especially strong quarter and have recently begun outperforming U.S. markets. Even Fixed Income rebounded as inflation showed signs of peaking.

Rapid pace of interest rates hikes to date and where rates may peak

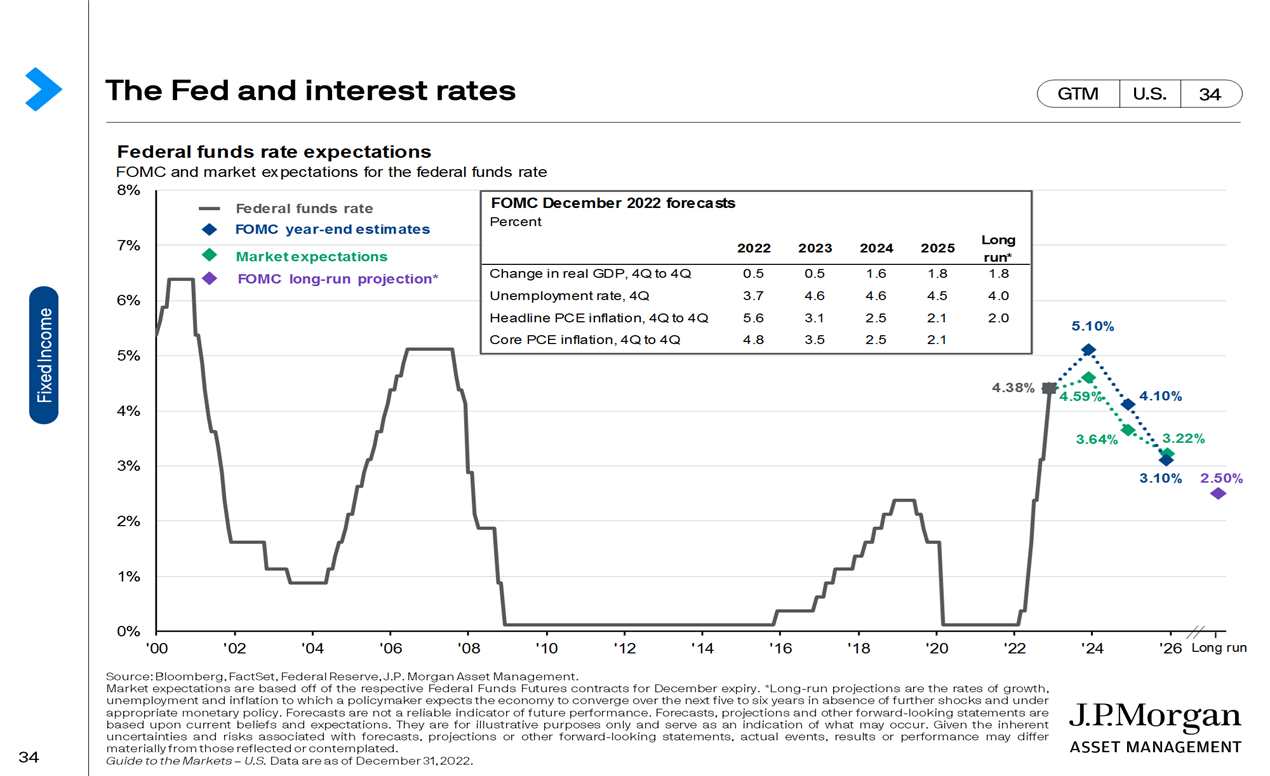

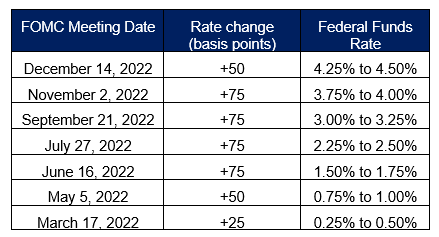

2022 was all about rising inflation and The Fed’s efforts to bring it down. From where we started at a 0%-0.25% Federal Funds Rate, at 4.25%-4.50% currently, we suspect we are close to the end of the interest rate hikes. The pace of hikes has been the fastest since 1980. Fed members have been forecasting rates possibly peaking between 5.0% and 5.50%, although nothing is certain at this point. It will all come down to whether inflation is declining meaningfully. It is expected that whatever future rate hikes do occur, they are more likely to be 25 basis points (.25%) rather than the higher hikes seen the past several months.

As The Fed nears its goal of driving down inflation, they will likely pause on further rate hikes allowing the current rate hikes to work their way into the economy. This will mean slower economic growth for 2023. Maintaining restrictive rates for a time will push the economy closer to a recession.

Inflation comparisons to 1935-1945 post World War II may be more comparable than comparisons to the 1970’s

Raymond James’ Mike Gibbs, Chief Portfolio and Technical Strategist and Tavis McCourt, Director of Equity Research, made a very astute observation after researching past periods of inflation. They note that while we most often hear comparisons to the 1970s, the most recent period the U.S. experienced high inflation, the current situation is more closely aligned with the Post World War II period between 1935 and 1945.

Inflation in the 1970s was driven by previous decades of policies that led to unsustainable high income and wage growth set off by the energy crisis, resulting in a multi-year period of slow growth and rampant inflation that ended with massive rate increases by the Fed in the early 1980s.

Inflation in the post war 1940s came because of disrupted supply chains, millions of GI’s returning to the private sector and the transition of the US economy from making tanks and bombs to refrigerators and automobiles. The demand for goods and labor surged post-war as the world re-built infrastructure. In 1946 the S&P 500 was -8.07% and inflation topped over 9%. Inflation fell back off after a few years as things normalized to pre-war levels.

Our current situation, resulted largely as a result of the pandemic. Government monetary stimulus and heightened individual savings, strong demand for goods, supply disruptions, and the shift of the concept of where people work are all very similar. Therefore, they expect inflation will gradually return to near post-pandemic levels as inflation did back in the 1940s.

Inflation is currently moving in the right direction

Inflation has been coming down meaningfully across a variety of areas, which indicates that The Fed’s monetary tightening seems to be working. Supply chains have been normalizing, assisting the inflation battle. It takes on average 6 months for rate hikes to work their way into the economy, so we still have several more months of monitoring the economy to see how it absorbs the interest rate hikes and how inflation is impacted. Recent signs are encouraging especially in Goods part of the economy:

- Gas prices started 2021 near $3.00/gallon, spiked to over $5.00/gallon after Russia invaded Ukraine, and has round-tripped to around $3.30 currently.

- Used vehicle prices have declined by 15%, falling five months in a row

- Apparel prices have declined three out of the past five months.

- The UN’s Food & Agriculture Organization global food prices fell in December for the 9th month in a row. -WSJ 1/9/2023

- Stores, services, and shelters are all offering more sales and buying incentives, all helping to bringing inflation down.

More progress needs to be made during 2023. First, stimulus still needs to be squeezed out of the system. Wage and services inflation have been a bit more stubborn about declining. If they can get on board with the drop in goods and housing The Fed should be able to make smaller rate hikes, and then possibly stop altogether. Every sign that inflation is abating is cheered. As investors feel more confident that we are near peak interest rates, fixed income and equity markets will likely perform much better. We do need to be prepared that inflation may not fall to the Fed’s 2% target until 2024, so Investors will need to remain patient as they walk a fine line trying to bring inflation closer to that goal while trying to not dramatically harm the economy or jobs market.

Tightness in the job market adds to inflation

Despite recent layoffs and hiring freezes especially in the technology and financial sectors, the unemployment rate remains low. Currently there are 1.7 job openings for every person looking which reflects a strong job market. The already tight labor market coupled with an increase in retirement by those who took early retirement during the pandemic and older workers retiring on-schedule is making the labor market extremely difficult to navigate. Many jobs available are in businesses that were partially or completely shut down and employers have had to offer larger wages to entice workers back. Those workers have had more disposable income to spend, and this dynamic has been one root cause of inflationary pressure. The Fed would like to shrink the number of job openings to a level on par or slightly below with job seekers. Unfortunately for the Fed, they don’t have precise tools to accomplish this, so they may end of causing collateral damage to jobs. We expect to see mainly white-collar service jobs impacted first and slowly filtering towards manufacturing and lower wage earners as the year progresses, especially if the economy does enter a recession.

Energy’s inflation impact, a mixed bag

Because of constrained supplies and the economic reopening of China, there is a risk oil prices will rise again, which would be an added inflationary pressure that is being closely watched. Global energy supply chains were disrupted with the breakout of the Russian-Ukrainian war last year. Oil prices spiked and in response, President Biden ordered the release of oil from the U.S. strategic reserves to help the bring the price down and stabilize the energy markets. That helped in the short-term. Now the U.S. must replenish the oil reserves, which is likely to put a floor on oil prices in the months to come.

China finally re-opening will also put some pressure on materials and oil prices. China imports most of their oil. With the end of zero tolerance, the second largest economy will be rising from its three years of shutdowns to take part in the post-COVID recovery with the rest of the world. This does mean they will be consuming more energy, thus driving the price of oil upwards.

Fortunately, Europe did not have as cold a winter as predicted and has been able to avoid further price shocks. In addition, they have done a tremendous job of rerouting their supply chains so they will no longer be as dependent on Russia for energy.

While we do hope that the war in Ukraine ends soon, we don’t expect the embargo on Russian oil to end quickly so this will be a continuing issue for both markets and consumers.

Envisioning bluer skies ahead markets rally to begin 2023

The market is rallying to begin 2023 because markets were deeply oversold, and many do believe we are nearer to the end in the Fed’s rate hikes. While economic numbers are softening, it still seems like the soft-landing scenario is possible. We suspect while 2022 was all about The Fed’s interest rate hikes, 2023 will put more focus on how the economy is holding up to the reality of higher rates, their lagging effects, and the quality of corporate earnings. Quarter 4-2022 corporate earnings, coming out these next several weeks, are being watched closely for indications of weakness. While some companies are laying employees off or freezing hiring, most report that business and earnings are still pretty good. This helps folks envision the soft-landing/mild-recession scenario. As we try and often remind, markets are forward-looking. If things are perceived to be getting better that allows markets to rise in response. It may well be the S&P 500 and other equity indices as well as bonds saw their lows in October.

We do expect more back-and-forth by bulls and bears as everyone tries to discern where rates peak and where the economy bottoms. We expect that if the Fed continues raising rates beyond what is currently expected, and the economy begins to show signs of further deterioration markets may experience a new low before recovering. We will continue watching both technical and fundamental evidence of pace and direction of markets and the economy.

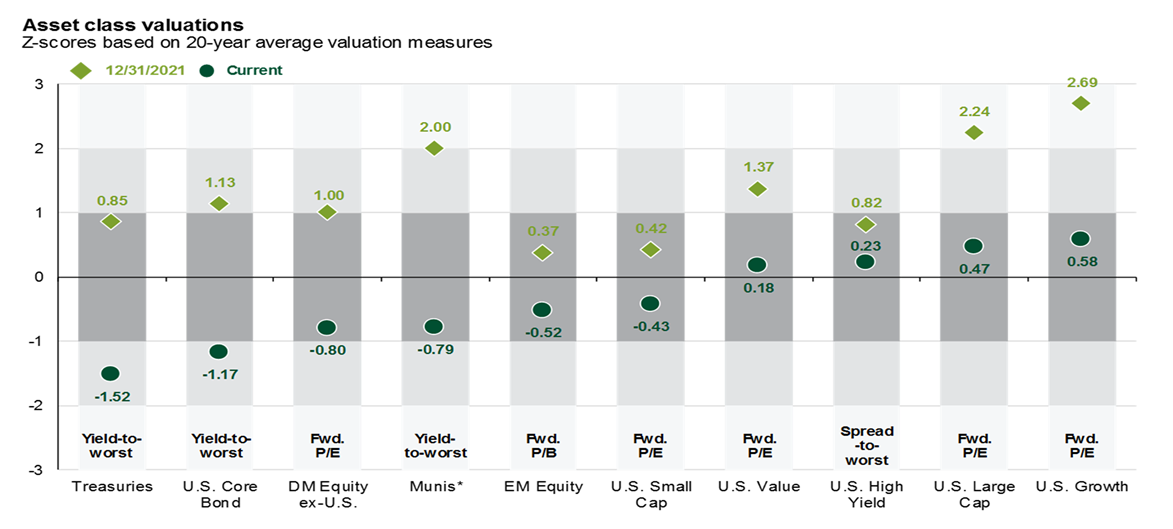

Valuations

We believe most of the damage to asset valuations has already happened. The chart above shows that coming into 2023 investments in fixed income (left) are well below their historical averages. Emerging Market and U.S. Small Company Equities are also under-valued by historical standards. U.S. Value, Large Company and Growth Equities are still slightly elevated; however, they are well off their valuation highs and within their long-term averages. Overall, this is providing attractive investing entry-points for those with a mid to longer term time horizon.

Equities

With the restrictive Fed Funds rate, companies will experience margin compression, and earnings declines. Barring a deep recession though, many companies have strong balance sheets and cash on hand. Leveraged ratios have declined with many companies locking in low borrowing rates during the pandemic. Since stock prices have already come down substantially, this may already be priced into most companies’ stocks.

While we do not expect the same volatility of last year, this year will probably still have some ups and downs as earnings estimates will continue to be revised downward from pressure on revenues. As Sebastian Page, Head of Goldman Sachs Multi-Asset points out, “In 2022 bear markets unfolded in two stages. The 1st was a rate shock as the Fed raised rates 0% to 4% over 9 months. This was followed by a growth shock as investors discounted the risk of an earnings downturn. In 2023, investors could face a third bear market stage, a liquidity shock, in which markets decline across the board as leveraged positions are unwound. While painful, such shocks can create major buying opportunities. A liquidity event could mark the kind of capitulation that typically has marked the bottom of a bear market. Those historically have been very strong buy signals.” The liquidity event does Page refers to does not have to occur, but it could. Investors should remain patient because these events will take time to sort out.

Typically, Value outperforms Growth during a slower economic environment because they usually come from a lower valuation level to start, have a dividend yield for added growth and typically are less volatile. Overall trends also favor high quality value stocks. Healthcare will continued to be used during a softer economy; most energy stocks are still cheap and pay dividends and infrastructure companies should benefit as America looks to upgrade its energy grid and transportation network. Eventually Ukraine will have to be rebuilt as well.

Small Cap stocks could be a bright spot this year as they typically recover more quickly than Large Caps and are cheaper on an historical valuation basis. Technically they have acted better in recent months.

While we do still see some headwinds in the short term for US equities, we do think patient long term investors will see opportunities this year in finding quality names at good valuations as the year progresses.

Fixed Income

Fixed Income may be in for a very good year following the disastrous one in 2022. The category is off to its best year since 1988. For the first time in many years investors can get paid nicely to invest in bonds because yields have risen to mid-single digits. We had zero interest rates for about a decade and the yield from owning the S&P 500 was higher than the yield for owning risk-free U.S. Treasury bonds. That is no longer the case. This should bode well in the future for diversified portfolios and is positive for those investors needing income. Andrew McCormick, Head of Goldman Sachs Global Fixed Income & CIO notes that “Higher-quality credits in the mortgage backed and asset backed sectors are attracting inflows from investors. This is the first opportunity to try to lock in high-single digit yields in well over a decade.”

Despite the tax loss harvesting the end of last year, Municipal bonds are looking much better this year. According to Nuveen Asset Management, “Municipalities are flush with cash while revenues are setting new highs, making credit quality well-positioned for slower growth.”

We suggest sticking with higher rated credit and extending duration (a measure of interest rate sensitivity) to portfolios. We don’t anticipate a big uptick in defaults but with a looming chance of a recession, we feel a need to be cautious on debt selection.

International

With the 4th quarter decline in the US Dollar, International stocks caught a tailwind in the latter part of 2022. While China’s reopening is a positive for growth, the EU is still facing a recession. The UK is in a recession and Japan has become hawkish with recent adjustments to its tightly controlled yield curve policies allowing more flexibility and possibly yields to move higher. We do see opportunities in Emerging Markets as valuations are at historic lows and the demand for raw materials and infrastructure pick up. International and Emerging Markets have begun outpacing U.S. Equities recently and may continue to do so for a period.

China will be the growth story for 2023. While we do see many positives of them rejoining the global economy, their reopening is likely to come in stutter- steps as the country learns to live with COVID. While prior growth was fueled by property growth it is unlikely that political leaders will want to revive the housing bubble, they were dealing with pre-pandemic. We expect their economic earnings growth to accelerate as the year plays out but in different sectors than real estate.

What currently concerns us most

The Fed received a lot of criticism for hanging on to the ‘transitory’ inflation story for too long in late 2021. They have been trying to build back credibility by expressing their determination to do whatever it takes to lower inflation. Almost in unison, the Fed members continue with their hawkish (aggressive) commentary when it comes to raising rates. They largely rely of backward-looking data, such as CPI (Consumer Price Index) and PPI (Producer Price Index) to inform their decisions about the need for rate hikes. As mentioned above, we see increasing evidence of inflation coming down real-time. So, we are concerned The Fed may raise rates higher than necessary or keep them high for longer than necessary and harm the economy more than what they intend. In that event, we could end up with a more substantial recession rather than a soft-landing (mild recession), what The Fed is aiming for, and many expect at this point. There are many reasons to believe The Federal Reserve members will react to the changing inflationary environment and get it right. We are simply aware of the risk that as they confidently announced inflation was transitory during the fourth quarter of 2021, while we all saw prices rising broadly, they now continue maintaining their ‘we can’t let up on our inflation fight’ rhetoric for too long and make a mistake on the other side.

Reasons for optimism about the market forecast in the months and years ahead

Several positive statistics based on historical standards are lining up in favor of the bulls

Positive historical data post mid-term elections:

According to Larry Adam, since the data has been tracked the S&P 500 has been positive:

- 95% of the time six months following mid-term elections, up an average of 13%.

- 100% of the time 12-months later by an average of near 14%.

- 95% of the time 24-months later by an average of near 25%.

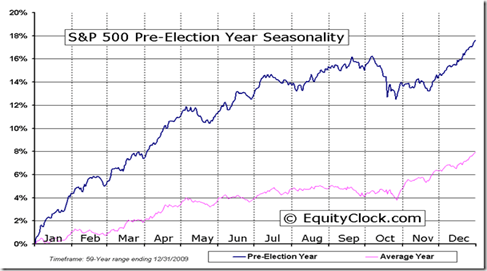

Positive political seasonality of Presidential third year

Since the data has been tracked the third year of the Presidential Cycle is the strongest and the S&P 500 has never ended the third year of a Presidential Cycle with a negative return.

After 15% or more declines in the S&P 500 stronger-than-average performance usually follows.

Adam notes the following gains after such a decline:

- 10% one year later

- 5% average annual return two years later

- 9% average annual returns five years later

Positive follow through when the first five days of January are positive:

Gibbs noted these statistics in a conference call the second week of January that when the first five days of January are positive the remainder of the year is up 83% of the time by an average of 14%. The positivity grows even stronger when the month of January finishes with a positive return, which it has.

We were also reminded by Larry Adam that following the last four bear markets the market bottomed or strongly rallied during the first quarter of the following year.

Stocks usually recover quickly and strongly off bear market lows

We shared this in our last Market Update letter, but will continue to remind you of this data from Mike Gibbs that markets often experience a very swift recovery off bottoms:

- Stocks are often up substantially within 60-days of bear market lows (+22% in recessionary bear markets and 17% in non-recessionary bear markets).

- The news is often still very negative within 60-day of bear market lows, so it does not wait to pay for skies to clear before trying to get back into the market, for those trying to time the market.

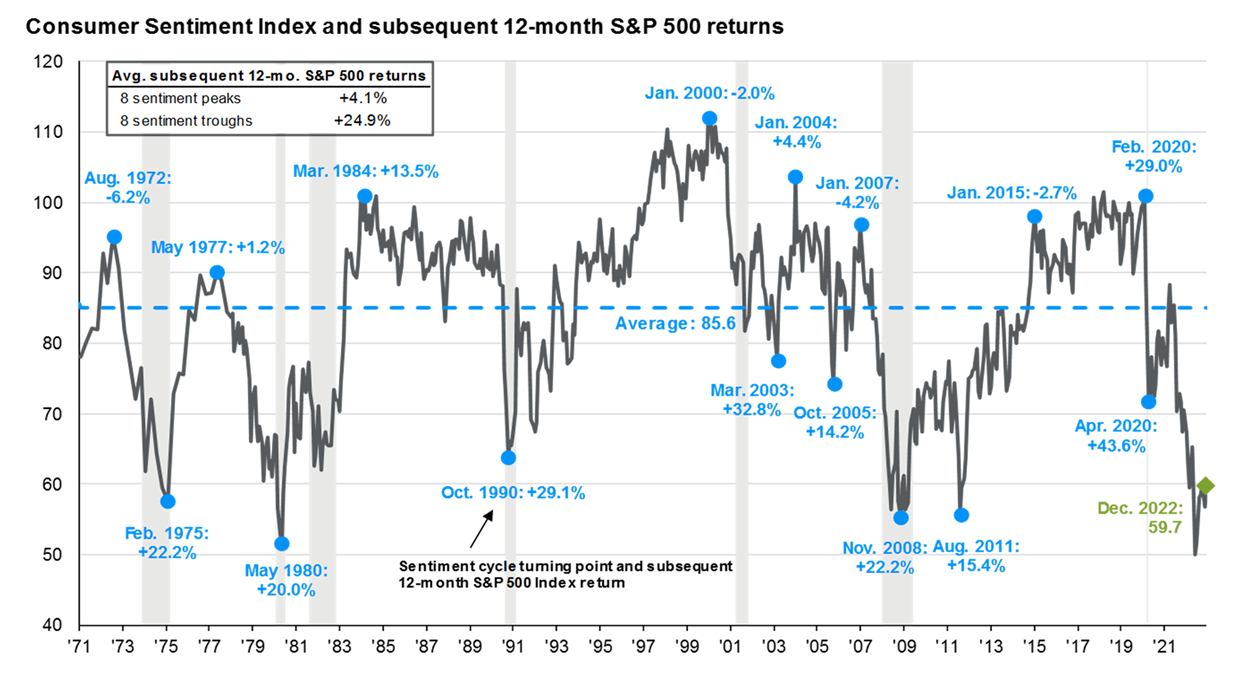

Extreme Negative Consumer Sentiment is usually positive for stocks

Legendary investor Sir John Templeton is famous for his phrase “Bull Markets are born on pessimism, grow in skepticism, mature on optimism and die on euphoria”. We believe this chart below is a nice illustration of this. The average Consumer Sentiment reading since 1970 has been 85.6. When the index plummets to 60 or below it has often signaled extreme pessimism and bottoms or near-bottoms in markets. Currently the index has risen from and extreme low of 50 to near 60. Investing when most are pessimistic historically has paid off.

“It’s never paid to bet against America”.

– Warren Buffett

The U.S. and global economy have endured many challenging situations over the life of markets. In every circumstance the market has gone on to eventually make new highs, as this chart above shows. We expect we are much closer to clearing skies and better opportunities to make gains in markets. We are working hard for you in our effort to guide you through this time and towards your long-term goals. We will e-mail you invitations to informative webinars as they are announced. Please also check our website and social media pages regularly for timely updates on all these topics.

Facebook: https://www.facebook.com/hfgraymondjames

LinkedIn:

Eric Hilliard, CFP®, Branch Manager – https://www.linkedin.com/in/ewhilliard/

Wade Stafford, CFP®, Associate Financial Advisor – https://www.linkedin.com/in/ericwstafford/

Jenny Hilliard, Investment Executive – https://www.linkedin.com/in/jennyhilliardrj/

Please let us know of any significant changes in your life or situation that could impact your financial plan. In the meantime, we continue to follow the processes we have developed over the years that enable us to provide you our very best.

Thank you for your trust in me and in our practice.

Sincerely,

Eric W. Hilliard

CERTIFIED FINANCIAL PLANNER™

Branch Manager

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.

Investing involves risk, and investors may incur a profit or a loss regardless of strategy. All expressions of opinion are subject to change. Past performance is not an indication of future results and there is no assurance that any of the forecasts, statements, or opinions mentioned will occur.

DJ GLB Aggressive Index - The DJ GLB Aggressive is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Aggressive index is 100% of All Stock Portfolio Risk.

DJ GLB Conservative Index - The DJ GLB Conservative is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Conservative index is 20% of All Stock Portfolio Risk.

DJ GLB Moderate Aggressive Index - The DJ GLB Moderate Aggressive is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate Aggressive index is 80% of All Stock Portfolio Risk.

DJ GLB Moderate Conservative Index - The DJ GLB Moderate Conservative is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate Conservative index is 40% of All Stock Portfolio Risk.

DJ GLB Moderate Index - The DJ GLB Moderate is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate index is 60% of All Stock Portfolio Risk.

The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. MSCI Emerging Markets Index is designed to measure equity market performance in 23 emerging market countries. The index’s three largest industries are materials, energy and banks. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Bloomberg Barclays U.S. Corporate High Yield Bond Index is composed of fixed-rate, publicly issued, non-investment grade debt, is unmanaged, with dividends reinvested and is not available for purchase. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility and Finance which include both U.S. and non-U.S. corporations. An investment cannot be made in these indexes. Index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. The performance noted does not include fees or charges, which would reduce an investor's returns. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Any Opinions are those of Eric and Jenny Hilliard and are not necessarily those of RJFS or Raymond James

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC. © 2018 Raymond James Financial Services, Inc., member FINRA/SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.