Quarter 4 2022 Market Update

- 10.20.22

- Markets & Investing

- Article

We hope you are well as you read this quarter’s Market Update Letter. We will review the past quarter and share our current and forward-looking perspective.

Key points we will cover in this Market Update:

- Review of third quarter performance.

- Inflation shows improvement in some areas more than others at this time.

- Clarity of where interest rates will peak would help settle markets.

- Concerns are rising The Fed will cause a recession

- A lot of potential recessionary pain has already been priced in.

- Calendar and political seasonality are on our side. Fourth quarter performance during mid-term election years tends to be positive.

- Stocks usually recover strongly and quickly off bear market lows.

Review of third quarter performance

This year continues to be one of the most challenging investors and financial professionals have ever experienced. Markets across the globe and most investible asset classes are down this year. Only 15% of stocks in the S&P 500 are positive this year. Most of those are in the Energy sector and those stocks have given some of their gains back recently. Many major economies are facing the challenge of inflationary pressures along with economic fragility. This has cause global markets to decline.

Our title refers to the close attention we are paying to data showing we may be near a peak in inflation and in interest rate hikes by the Federal Reserve (aka The Fed). We will discuss key questions we believe we will need clarity on in order for stock and bond markets to be able to find their footing.

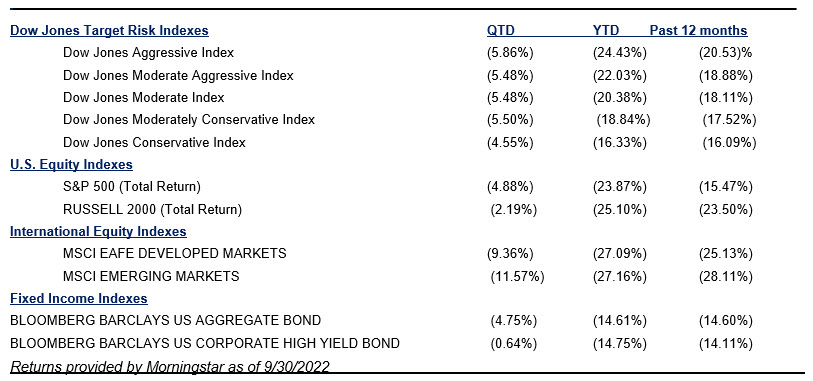

First though, please review the quarter-to-date, year-to-date and past 12 month returns. As we noted in last quarter’s letter, an extremely unusual challenge this year has been that fixed income investments have declined as well as equities. Over the long run diversification will benefit portfolios. This year is an anomaly with a very aggressive Fed, high inflation and rising interest rates, not a reason to change long-term philosophies on investing. We expect that once yields stabilize, fixed income assets will become attractive again.

To quote Warren Buffet “It’s never paid to bet against America”. We don’t’ think this time is any different. We will emerge from this as we have every other challenging time with brighter times and better investment opportunities ahead.

Inflation shows improvement in some areas more than others at this time

The Fed is watching a variety of factors to help determine whether inflation has peaked and is beginning to recede of the very high year-over-year levels we have experienced in recent months. One indication of how high inflation has been is that the Social Security Administration just announced the Social Security cost-of-living adjustment will be 8.7%, the largest increase since 1981.

Inflation on many goods is declining

There is evidence that inflation has peaked in some areas. While prices are still elevated, a number of commodities and prices for various products have started coming down over the past few months. Larry Adam, Raymond James Chief Investment Officer noted in his October 10th webinar “A Time for Finesse” a few examples of inflationary pressures easing:

- A year ago one hundred and six cargo ships sat off the coast of California waiting to unload. Currently there are six. When those ships were finally unloaded after months of delays, companies like Amazon, Target and Nike ended up with too much inventory. Currently they are trying to clear that inventory through discounting and it is likely those sales will continue through the end of the year.

- The UN food price index has declined 6 months in a row and restaurants are now seeing the decline in food prices.

Housing and Rent is a mixed bag

The housing market has slowed markedly as mortgage rates have risen. Rents, which are longer-term agreements are always slower to come down. As folks re-negotiate rents next year it is likely the overall housing contribution to inflation should slowly work its way down.

Services still show inflationary pressure

Services, where demand has been high as spending shifted from goods to services post-pandemic still show too-high levels of inflation month-over-month. Lodging away from home is beginning to decline. Airline tickets though still remain high. Business travel has returned and there is a dearth of pilots, so supply is constrained.

Wage Pressures are still inflationary

The Fed is also watching the labor market closely. Workers have been very slow to come back to the labor market post-COVID. As a result, businesses have had to pay much higher wages to attract workers. There is still a significant shortage of workers in the U.S. to fill many different types of jobs. The Fed may have to raise rates higher than earlier thought to force Americans to pull in the purse strings and lessen demand.

Clarity on where interest rates will peak would help settle markets

There has been a lot of uncertainty around where the Federal Funds Rate will peak. The Federal Reserve members including Chairman, Jerome Powell understand that persistent high inflation will erode the spending power of every American’s dollars. Each year inflation remains high it further erodes what a dollar today would be able to buy in the future. If inflation becomes systemic it can feed on itself and become even more difficult to bring down. Because of this, the Fed has engaged in the most aggressive rate hiking cycle in decades, reminding us consistently they will do whatever it takes to fight inflation (referred to as being hawkish). They are willing to take short-term pain in the stock and housing markets to win the longer-term battle with inflation. They know if they are successful the economy and likely equity and fixed income markets will benefit down the road. Currently, the Fed Funds Rate sits at 3.00%-3.25%.

Here's a list of Fed rate hikes we've seen so far in 2022:

- March 16th, 2022: 0.25% rate hike, the first increase since 2018.

- May 4th, 2022: 0.5% rate increase, the biggest change in two decades.

- June 15th, 2022: 0.75% rate increase, the largest single interest rate hike since 1994.

- July 27, 2022: 0.75% rate hike, the second such increase in a row this year.

- September 22, 2022: 0.75% rate hike, the third increase in a row.

Interest rates are now at a level economist refer to as restrictive, which means consumers are likely to think more carefully about their spending, especially on larger items like cars and homes. As the higher rates impact buying behavior, it should lessen demand and lower prices for goods and services would likely follow.

Currently, the expected peak in interest rates by sources we follow is somewhere between 4.5% and 5%.

Concerns are rising about The Fed causing a recession

The Fed has received criticism for hanging on to the ‘transitory’ inflation story for too long last year. Since they realized their mistake they have been trying to build back credibility by expressing their determination to beat down inflation. Now they are receiving criticism from some who believe they are stepping on the brakes too hard and too fast and that the U.S. economy is more likely to enter a recession as a result.

At this time we are skeptical that The Fed will manage the soft-landing of reducing inflation without sending the U.S. economy into recession. The Fed assured us in 2021, while commodities were rising at rapid rates and money supply was increasing due to stimulus from the Federal Government that inflation was transitory, and they did not believe they would need to raise rates in 2022. Late 2021 Federal Reserve members acknowledged inflation was stickier that they expected it to be. At the beginning of 2022 only a few rate increases were forecast. Currently, as we mention above, some inflationary pressures are easing and the Federal Reserve members continue to press on about raising rates. It takes six-to-nine-month for the impact of Fed Funds rate increases to be absorbed into the economy, so we are only now beginning to see the impact of the first interest rate hikes. It now seems more possible once the additional rate increases flow through that a recession may occur.

Raymond James now expects the U.S. to enter into recession during the first quarter of 2023. Unless additional stresses come to light any recession we may experience could very possibly be mild:

- As noted by Adam in the “A Time for Finesse” webinar this will be perhaps the most telegraphed recession in U.S. history. It has been talked about for many months now, so consumer and business behavior have been changing gradually.

- While there has been some reduction in hiring and an uptick in layoffs, the employment picture remains strong so far. Even now, 50% of businesses report they still struggle to find qualified help. Because of this struggle they will likely be slower to lay employees off.

- The strong job markets, a healthy savings rate and lower debt levels will help most Americans weather a potential recession.

A lot of potential recessionary pain has already been priced in

The stock market is currently extremely oversold. When so many are this negative, a lot of selling has already occurred. If we can get any iota of good news, the set-up is there for a potential year-end rally. What could be considered good news?

- A few Federal Reserve members have already said they think it would be a good idea to pause or slow rate increases. If Fed Chairman Powell echoed that a pause makes sense, a rally could ensue.

- Any data indicating inflation abating. During times like this bad news indicating a slowing economy is considered good news because it would indicate the medicine the Fed is dishing out is working.

- The Consumer Price Index (CPI) and Producer Price Index (PPI) are being watched very closely for signs of easing. This would boost investors’ confidence that we are getting close to a peak in rates.

Earnings lows versus lows in stocks: Historically, rallies and recoveries off times like this begin long before the news turns positive and it feels good to invest. If we do go into recession, it is helpful to know that when stocks almost always trough before earnings do. By the time earnings trough investors have realized the worst is over, better times are to come and they are buying.

Magazine covers are negative indicators: We are noticing some pretty negative magazine covers, which are historically poor timing indicators. In hindsight tops and bottoms in markets can often be noted with magazine covers expressing exuberance or despair.

Calendar and political seasonality is on our side, as fourth-quarter performance during mid-term election years tends to be positive

Everything else aside, The fourth quarter often a good one for stocks. This trend is even more pronounced during mid-term election years, which are typically more volatile. The pattern the S&P 500 usually follows during mid-term election years is for the second and third quarters to be flat to negative with a rally beginning early to mid-October, as the election uncertainty is removed. The rally typically extends to year-end and then continues into the next year.

According to Larry Adam, since the data has been tracked the S&P 500 has been positive:

- 95% of the time six months following mid-term elections, up an average of 13%.

- 100% of the time 12-months later by an average of near 14%.

- 95% of the time 24-months later by an average of near 25%.

With the current backdrop and this history on our side, It is certainly possible the stock market will stage a fourth quarter rally. We will be watching for the strength and length of the rally to provide insight as to its durability.

Stocks usually recover quickly and strongly off bear market lows

Data from Mike Gibbs, Head of Equity Portfolio and Technical Strategy indicates:

- Stocks are often up substantially within 60-days of bear market lows (+22% in recessionary bear markets and 17% in non-recessionary bear markets).

- The news is often still very negative within 60-day of bear market lows. The most recent example, 60-days after March 2020 low the S&P 500 was up 33%. The news on the virus was still very negative and uncertainty was at an extreme.

As we watch for signs things are beginning to get better on the inflation front, we recall this quote from Sir John Templeton:

“Bull Markets are born on pessimism, grow in skepticism, mature on optimism and die on euphoria”

It is always more enjoyable during the roughly two-thirds of the time when markets are gaining than the roughly one-third of the time markets are in decline. Famed Argentinian soccer player, Lionel Messi has stated “Sometimes you have to accept you can’t win all the time”. The same could be said about the stock market and investing. Riding through the ups and downs is all part of the cyclical nature of the economy and markets. We look forward to better days as we prepare for the opportunities on the other side of this market decline. The U.S. and global economy have endured many challenging situations over the life of markets. In every circumstance the market has gone on to eventually make new highs, as this chart above shows.

We continue working hard for you in our effort to guide you through this time and towards your long-term goals. We will continue e-mailing you invitations to informative webinars when they occur. Please also check our website and social media pages regularly for timely updates on all these topics.

Facebook: https://www.facebook.com/hfgraymondjames

LinkedIn:

Eric Hilliard, CFP®, Branch Manager – https://www.linkedin.com/in/ewhilliard/

Wade Stafford, CFP®, Associate Financial Advisor – https://www.linkedin.com/in/ericwstafford/

Jenny Hilliard, Investment Executive – https://www.linkedin.com/in/jennyhilliardrj/

Please let us know of any significant changes in your life or situation that could impact your financial plan. In the meantime, we continue to follow the processes we have developed over the years that enable us to provide you our very best.

Thank you for your trust in me and in our practice.

Sincerely,

Eric W. Hilliard

CERTIFIED FINANCIAL PLANNER™

Branch Manager

The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material.

To opt out of receiving future emails from us, please reply to this email with the word “Unsubscribe” in the subject line. The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete.

Investing involves risk, and investors may incur a profit or a loss regardless of strategy. All expressions of opinion are subject to change. Past performance is not an indication of future results and there is no assurance that any of the forecasts, statements, or opinions mentioned will occur.

DJ GLB Aggressive Index - The DJ GLB Aggressive is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Aggressive index is 100% of All Stock Portfolio Risk.

DJ GLB Conservative Index - The DJ GLB Conservative is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Conservative index is 20% of All Stock Portfolio Risk.

DJ GLB Moderate Aggressive Index - The DJ GLB Moderate Aggressive is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate Aggressive index is 80% of All Stock Portfolio Risk.

DJ GLB Moderate Conservative Index - The DJ GLB Moderate Conservative is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate Conservative index is 40% of All Stock Portfolio Risk.

DJ GLB Moderate Index - The DJ GLB Moderate is a total-portfolio index that allow investors to evaluate the returns on their portfolios considering the amount of risk they have taken. These profiles are defined based on incremental levels of potential risk relative to the risk of an all-stock index. It's made up of composite indices representing the three major asset classes: stocks, bonds and cash. The asset class indices are weighted differently within each relative risk index to achieve the targeted risk level. The weightings are rebalanced monthly to maintain these levels. The DJ GLB Moderate index is 60% of All Stock Portfolio Risk.

The Dow Jones Industrial Average is an unmanaged index of 30 widely held stocks. The S&P 500 is an unmanaged index of 500 widely held stocks. The MSCI EAFE (Europe, Australia, Far East) index is an unmanaged index that is generally considered representative of the international stock market. MSCI Emerging Markets Index is designed to measure equity market performance in 23 emerging market countries. The index’s three largest industries are materials, energy and banks. The Russell 2000 is an unmanaged index of small cap securities. The Bloomberg Barclays US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Bloomberg Barclays U.S. Corporate High Yield Bond Index is composed of fixed-rate, publicly issued, non-investment grade debt, is unmanaged, with dividends reinvested and is not available for purchase. The index includes both corporate and non-corporate sectors. The corporate sectors are Industrial, Utility and Finance which include both U.S. and non-U.S. corporations. An investment cannot be made in these indexes. Index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor’s results will vary. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. The performance noted does not include fees or charges, which would reduce an investor's returns. Asset allocation and diversification do not guarantee a profit nor protect against a loss. Any Opinions are those of Eric and Jenny Hilliard and are not necessarily those of RJFS or Raymond James

Securities offered through Raymond James Financial Services, Inc., member FINRA/SIPC. © 2018 Raymond James Financial Services, Inc., member FINRA/SIPC. Investment Advisory Services offered through Raymond James Financial Services Advisors, Inc.