The Week in Review: 2/10/25

“The greatest wealth is to live content with little” ~ Plato

Good Morning,

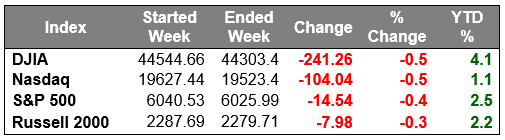

It was a busy week for stock market participants… the major indices ebbed and flowed, ultimately settling lower than the previous Friday. The S&P 500 slid 0.4% and the Nasdaq Composite logged a 0.5% decline.

The news cycle in the first half of last week was dominated by talk of tariffs.

Participants learned the previous weekend that President Trump announced that the U.S. will be implementing a 25% tariff on imported goods from Canada and Mexico (but only a 10% tariff on imported Canadian energy) and a 10% tariff on imported goods from China. He also indicated to the press that tariffs for the EU will likely be implemented fairly soon.

Leaders from Canada and Mexico were able to strike a deal with the US to avoid tariffs for one month. Meanwhile, China said it will be imposing a 15% tariff on imports of coal and LNG from the U.S., and 10% tariffs on crude oil, agricultural machinery, and certain cars starting February 10.

China also imposed further export restrictions on key minerals, such as tungsten, and said it will be starting an anti-monopoly investigation of Alphabet's Google.

The market interpreted China's retaliation as more postural than penal. Furthermore, the tariff talk has been viewed as more of a temporary negotiating tactic than a permanent feature.

There was also a slate of market-moving economic data to get through last week…

The December JOLTS - Jobs Openings Report showed a stark drop in openings to 7.600 million versus an upwardly revised 8.156 million (from 8.098 million) in November; Services PMI readings for January out of China, Europe, and the U.S. were weaker-than-expected, fostering some growth concerns; the January Employment Situation Report featured a 0.5% increase in average hourly earnings, which may not bode well for inflation; and the preliminary February University of Michigan Consumer Sentiment survey showed an increase in year-ahead inflation expectations to 4.3% (from 3.3%).

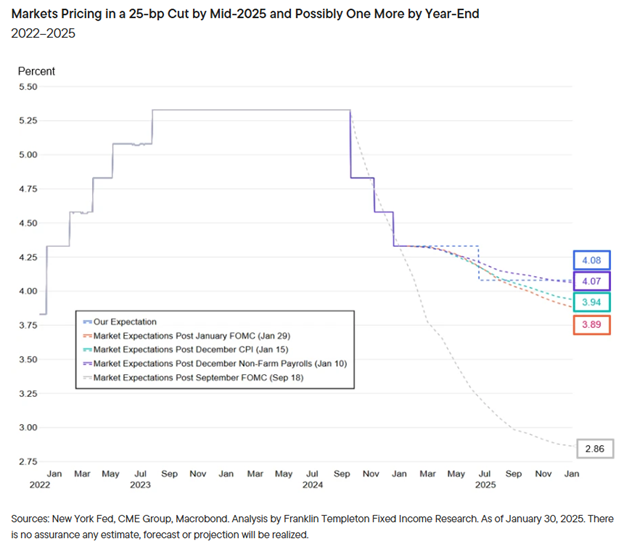

Rate cut expectations adjusted in response to the economic data and tariff news. The fed funds futures market now sees a 52.8% probability of a rate cut by the June FOMC meeting, down from 64.6% yesterday, according to the CME FedWatch Tool.

Treasury yields also adjusted in response to the tariff news and data. The 2-yr yield settled four basis points higher at 4.28% and the 10-yr yield settled eight basis points lower at 4.49%.

The front of the curve was under pressure as the specter of higher inflation following the tariff talk and economic data will likely forestall future rate cuts by the Fed.

The long end, which is more sensitive to inflation pressures, was actually a bit stronger (ironically) as participants mull the notion that demand will wane in the face of higher prices, hurting growth.

It was another big week for earnings news with results from Alphabet, which dropped 9.0%, and Amazon.com, which dropped 3.6%, headlining the calendar. Other notable names included Palantir Technologies, Qualcomm, Spotify, Dow component Merck, Estee Lauder, and PepsiCo.

Looking ahead…

We have some key inflation numbers coming out this week. On Wednesday we get CPI, the street is looking for .3%, and PPI on Wednesday expecting .3% as well, along with Initial Claims, 217K expected. On Friday we get Retail Sales, expect 0.0%.

Quite a few companies report earnings this week as well… Coca-Cola, Humana, Marriott, Shopify, Applied Materials, and many others.

Happy Valentines’ Day!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.