The Week in Review: 2/3/25

We build too many walls and not enough bridges. ~ Isaac Newton

Good Morning,

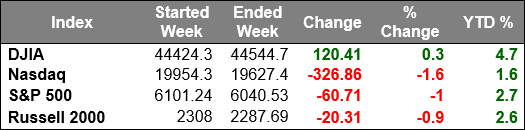

The Dow Jones Industrial Average eked out a 0.3% gain last week while the S&P 500 declined 1.0%, the Nasdaq Composite fell 1.6%, and the Russell 2000 logged a 0.9% loss.

The week started on a sharply lower note following weekend focus on a Chinese AI platform DeepSeek, which garnered popularity for being less resource-intensive than alternatives like ChatGPT.

This called into question the competitiveness of companies that are powering the AI sector, and it could alter capital spending plans if the DeepSeek model proves to be as good as advertised.

NVIDIA dropped 17% on Monday, logging its largest single-day loss in market capitalization ever. Shares were 15.8% lower than last Friday by the end of the week.

It was a busy week that featured earnings news from about 40% of the S&P 500 in terms of market capitalization, a decision by the FOMC, and influential economic releases.

Apple, which closed 5.9% higher last week, Microsoft, which declined 6.5% last week, Meta Platforms, which jumped 6.4%, and Tesla, which declined 0.5% last week, were some of the top names that reported quarterly results.

IBM (+13.8%), Starbucks (+9.0%), Boeing (+0.3%), General Motors (-8.3%), and Lockheed Martin (-6.8%) were also among the headliners in terms of earnings news.

On Wednesday, the Federal Open Market Committee (FOMC) voted unanimously to leave the target range for the fed funds rate unchanged at 4.25-4.50%. That was in-line with the decision widely expected by the fed funds futures market.

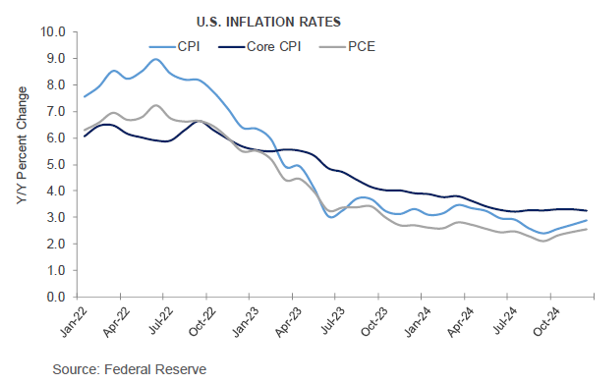

It was noted in the directive that "Inflation remains somewhat elevated." The last directive in December said the same. What was missing this time was the added statement in the December directive that, "Inflation has made progress toward the Committee's 2 percent objective..."

Also noted in the January directive was that "...labor market conditions remain solid." This messaging pointed to the Fed remaining inclined to wait and see what messages avail themselves in future data.

Fed Chair Powell communicated that stance more than once during his press conference, noting right off the bat that, "With our policy stance significantly less restrictive than it had been, and the economy remaining strong, we do not need to be in a hurry to adjust our policy stance."

There was some volatility in stocks and bonds in immediate response to these developments, but markets ultimately settled the day little changed from levels seen ahead of the 2:00 ET policy announcement. This was an indication that participants didn't see anything truly surprising in Wednesday's decision or in the Fed Chair's comments.

Last week's economic lineup featured an encouragingly low level of initial jobless claims (207,000) for the week ending January 25 and a refreshingly strong 4.2% growth rate for personal spending in the fourth quarter, which was the best since Q1 2023.

Also, the core-PCE Price Index (the Fed's preferred inflation gauge) was up 2.8% year-over-year for the third month in a row following a 0.2% month-over-month increase.

Stocks sold off late Friday after the White House confirmed that 25% tariffs for Canada and Mexico, and a 10% tariff for China, will begin Saturday (February 1). The basis for the tariff actions were tied to immigration, trade deficit, and fentanyl issues.

It wasn't exactly breaking news as there were similar reports out on Thursday, but the added uncertainty heading into the weekend was enough to drive selling interest and quell any buy-the-dip action. There were subsequent reports hinting at behind-the-scenes negotiations that may lead to the tariff actions being called off or at least watered down, but that didn't help stocks much.

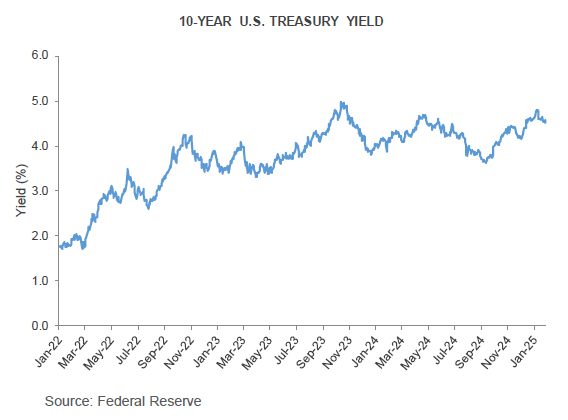

Treasuries had a volatile week, ultimately settling with gains. The 10-yr yield was six basis points lower than last Friday at 4.57% and the 2-yr yield was three basis points lower than last Friday at 4.24%

Notable earnings this week… Marathon Pete, Merck, PayPal, Pepsi, & Alphabet, among many others.

Economic numbers this week… JOLTS, Initial Claims, Unemployment Rate, & Consumer Sentiment, to name a few. Should be a busy week!!

Have a wonderful week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.