The Week in Review: 2/18/25

“Never let the fear of striking out keep you from playing the game.” — Babe Ruth

Good Morning,

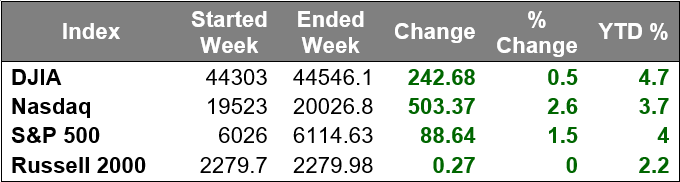

The major equity indices again logged gains last week.

Upside moves were supported by solid buying in the mega cap space, more of the same leadership that has been so impressive.

The market-cap weighted S&P 500 jumped 1.5% versus a 0.5% gain in the equal-cap weighted S&P 500. As the mega caps did the heavy lifting.

The outperformance of mega cap shares was also apparent in S&P 500 sector performance. The information technology sector was the top performer by a decent margin, jumping 3.8%, followed by communication services (+2.0%). Both of which contain mega cap constituents.

Market participants were dealing with a lot of economic data, news about tariffs, and commentary from Fed Chair Powell.

Fed Chair Powell's semiannual testimony before Congress was last week and didn't feature any big surprises. He again said that there is no hurry to adjust the policy stance, repeating comments made at the conclusion of the January FOMC policy meeting.

On the tariff front, President Trump imposed 25% tariffs on steel and aluminum, which will go into effect on March 12 with Australia potentially receiving an exemption.

Also, President Trump's reciprocal tariff plan was seen as less economically provocative as feared. To wit, the tariffs won't be applied until April 1 at the earliest, and at that time will be applied on a case-by-case basis.

Economic releases last week were mixed…

- The New York Fed's January Survey of Consumer Expectations showed one-year ahead inflation expectations unchanged at 3.0% (versus Friday's release of the February Univ. of Michigan Consumer Sentiment Index, which showed year-ahead inflation expectations surging from 3.3% to 4.3%).

- Total CPI was up 0.5% month-over-month and 3.0% year-over-year (versus 2.9% in December) while core CPI, which excludes food and energy, was up 0.4% month-over-month and 3.3% year-over-year (versus 3.2% in December), which created more angst about inflation not making it back to the Fed's 2.0% target and the Fed itself not making its way back to cutting rates anytime soon.

- The January PPI report was greeted with some relief on the basis that it should help keep the PCE Price Index (the Fed's preferred inflation gauge) in check after various components in the PPI report, like airfares and physician care, showed month-over-month declines.

- The retail sales report for January was noticeably weak and the industrial production report for January showed growth without any help from manufacturing or mining output (i.e., cold weather drove a spike in the output of utilities, which was cranking to meet demand for heat).

Treasuries settled with modest gains. The 10-yr yield was one basis point lower than the previous Friday at 4.48% and the 2-yr yield dropped three basis points last week to 4.26%.

The unofficial end to 4Q24 earnings season will culminate with Walmart reporting. Thursday. What will be telling is any input from management on tariffs and pricing strategies.

Overall 4Q24 S&P 500 earnings were on track to rise 17%YoY, beating street estimates of 11.6%. The best quarter since 4Q21.

Have wonderful week!

Michael D. Hilger, CEP®

Managing Director

Senior Vice President, Wealth Management

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.