The Week in Review: 1/27/25

Never spend your money before you have earned it.” ~ Thomas Jefferson

Good Morning ,

It was an historic week for the country, and the stock market.

Donald J. Trump was inaugurated Monday as the 47th President of the Unites States of America. His inauguration happened to line up with Martin Luther King, Jr. Day, which was a market holiday.

When markets reopened on Tuesday, they wasted little time picking up where they left off in terms of the previous week's bullish bias. They did so digesting President Trump's declaration of a national energy emergency and a barrage of executive orders that, strikingly, did not include any implementation of tariffs for China.

There was a suggestion by the president, though, that he is thinking of 25% tariffs for Canada and Mexico starting February 1.

It was the lack of a hard-hitting tariff on China, however, that spurred a relief trade that boosted the broader market along with the news of a $500 billion AI infrastructure initiative, dubbed Stargate, that involved OpenAI, Softbank, and Oracle.

The positive price action continued Wednesday after Netflix wowed the street with its earnings report and paid subscriber growth. Dow components Procter & Gamble and Travelers also provided earnings-related leadership.

The price action pushed the S&P 500 to a new all-time high that was ultimately followed by a record closing high on Thursday.

The latter was driven by blue chip stocks and coincided with President Trump's virtual address to the World Economic Forum in Davos, in which he said he will be pressuring OPEC and Saudi Arabia to lower oil prices.

He also expects NATO countries to spend 5% of their GDP on defense, and that foreign companies that manufacture their products in the U.S. will enjoy a lower tax rate while those that don't face the prospect of tariffs.

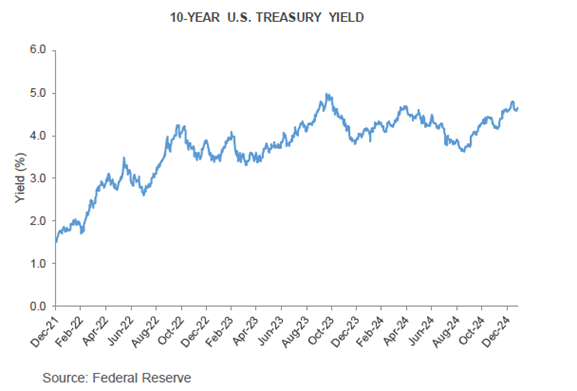

The president also added that he will demand that interest rates come down immediately. That was interpreted as a tacit shot at Fed Chair Powell, who will be leading the FOMC meeting January 28-29.

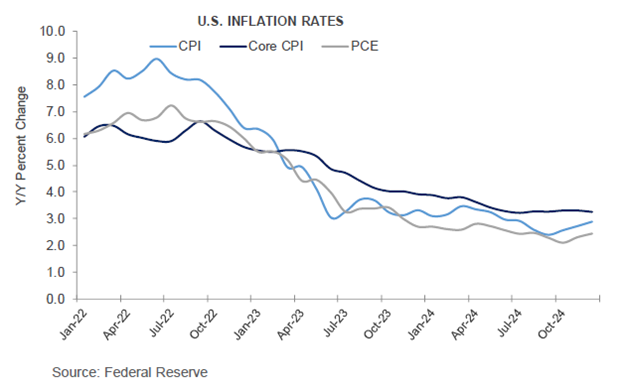

The FOMC meeting will be a focal point in a big week this week that will include earnings reports from Apple, Microsoft, Meta Platforms, Amazon.com, and Tesla, as well as the Advance Q4 GDP Report and the Fed's preferred inflation gauge in the form of the PCE Price Index.

The FOMC meeting is not expected to produce a rate cut, but with President Trump's statement on interest rates, the intrigue surrounding the press conference has gone way up.

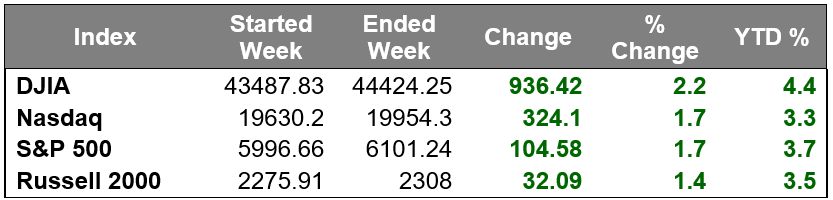

In terms of the week we're leaving behind, it was a good week for the broader market. The major indices increased between 1.1% and 2.2%. Ten of the 11 S&P 500 sectors registered gains ranging from 0.8% (consumer discretionary) to 4.0% (communication services).

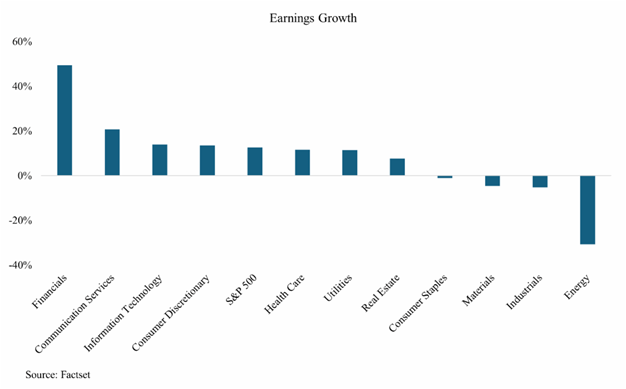

The missing link was the energy sector (-2.9%), which traded down along with oil prices on some worries that a "drill, baby, drill" approach could lead to a supply-demand imbalance.

The Treasury market maintained a relatively calm disposition, which also helped support stocks. The 2-yr note yield was unchanged for the week at 4.27% while the 10-yr note yield rose just two basis points to 4.63%. The U.S. Dollar Index was down 1.7% to 107.47.

Earnings season is well underway, and companies are reporting strong earnings growth.

With 16% of S&P 500 companies reporting, the year-over-year growth rate is 12.7%. 20% of S&P 500 companies will be reporting their earnings results this week, including five of the Magnificent 7 stocks.

Have a wonderful week!

Michael D. Hilger, CEP®

Managing Director

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The S&P 500 is an unmanaged index of widely held stocks that is generally representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs and other fees, which will affect investment performance. Individual investor’s results will vary. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government.

The companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapit obsolescence. There are additional risks associated with investing in an individual sector, including limited diversification.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

The prominent underlying risk of using cryptocurrencies as a medium of exchange is that they are not authorized or regulated by any central bank. Cryptocurrency users are not registered with the SEC, and the cryptocurrency market is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involve a high degree of risk. Investors must have the financial ability, sophisticated/experience and willingness to bear the risks of an investment, and a potential total loss of their investment.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.