The Week In Review 01/16/24

“There's no such thing as simple. Simple is hard.” - Martin Scorsese

Good Morning,

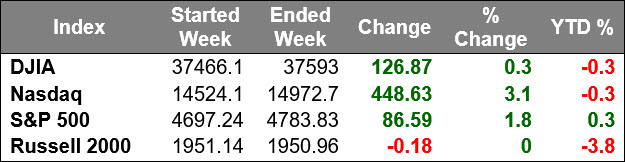

The stock market closed higher last week, which marks its tenth week of gains in 11 weeks.The markets were closed Monday in honor of Dr. Martin Luther King.

The S&P 500, which briefly traded above its all-time high close on Friday, recovered all the previous week's losses, leaving the index up 0.3% for the year.

Strength in mega cap stocks had an outsized impact on index performance.

The best performing S&P 500 sectors all house mega cap constituents. The information technology (+4.9%), communication services (+3.4%), and consumer discretionary (+1.5%) sectors saw the largest gains on the week. Meanwhile, the energy sector logged the steepest decline (-2.4%).

The financial sector was another underperformer, closing down 0.5% for the week. On a related note, the Q4 earnings reporting period started on Friday and included results from Bank of America, and Wells Fargo, JPMorgan Chase, and Citigroup.

Dow component UnitedHealth and Delta Air Lines were also among the notable names that reported earnings. Overall, quarterly results were met with negative reactions and set a tepid tone as participants look ahead to upcoming earnings results. Microchip Technology issued a Q4 revenue warning that was tied to a weakening economic environment.

In other corporate news, Boeing sank 12.6% last week after 737 MAX 9 jets were grounded in response to a fuselage blowout on an Alaska Airlines flight.

Last week's economic data painted somewhat of a mixed picture. The Consumer Price Index (CPI) report for December was slightly hotter than the market's hopeful expectations and weekly initial jobless claims remain below recession-like levels. The Producer Price Index was cooler than expected.

Market participants recalibrated rate cut expectations despite the generally mixed economic data, suggesting the market doesn't believe inflation is likely to reaccelerate. The fed funds futures market now sees a 79.4% probability of a 25-basis points rate cut at the March FOMC meeting versus a 73.2% probability last week and a 68.1% probability the week before.

The price action in the Treasury market reflected this recalibration… the 2-yr note yield, which is most sensitive to changes in the fed funds rate, sank 24 basis points to 4.15%. The 10-yr note yield fell nine basis points last week to 3.95%.

In other news, geopolitical angst was raised after the United States and the UK conducted strikes against military targets in Houthi-controlled areas of Yemen.

Have a wonderful holiday shortened week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.