The Week in Review 01/08/24

“Common sense is not so common.” – Voltaire

Good Morning,

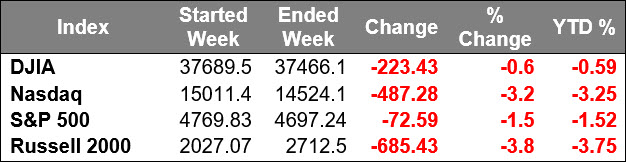

The stock market registered losses to begin the year following nine-straight weeks of gains to close out 2023.

Profit-taking activity in the mega cap stocks, and other stocks that outperformed last year, contributed to the downbeat price action.Many investors waited until the first of the year to take profits… pushing gains into 2024.

Apple was a standout loser last week, dropping nearly 6.0%, after two analyst downgrades and news that the DOJ is getting close to filing an antitrust case against Apple, according to The New York Times.

Some of the areas of the market that held up better last week compared to mega caps were either left out of the last year's gains or saw less robust gains than the mega cap stocks in 2023.

Interestingly, the only three S&P 500 sectors to register a decline in 2023 saw some of the largest gains last week. The utilities sector, which fell 10.2% last year, logged a 1.8% gain last week. The energy sector, which declined 4.8% in 2023, climbed 1.1% last week. The consumer staples sector, which fell 2.2% last year, closed with a 0.03% gain last week.

The health care sector was another top performer, registering a 2.1% gain last week. It was also among the worst performing sectors last year, eking out only a 0.3% gain.

Meanwhile, the heavily weighted information technology (-4.1%) and consumer discretionary (-3.5%) sectors saw the largest declines after outperforming last year.

In addition to profit-taking activity, rising market rates also contributed to the negative bias last week after the 10-yr yield passed 4.00%. The 10-yr note yield climbed 16 basis points to 4.04% and the 2-yr note yield rose 14 basis points to 4.39%.

The price action in Treasuries was partially due to a recalibration of rate-cut expectations after the Minutes from the December 12-13 FOMC meeting were less dovish than hoped. In discussing the policy outlook, the committee viewed the policy rate as likely at or near its peak for this tightening cycle. The Fed made it clear, however, that it isn't divorcing itself entirely from the idea that it might still have to raise rates again.

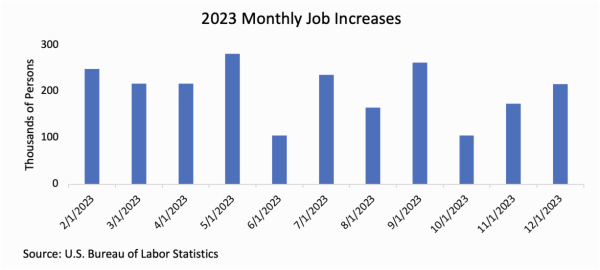

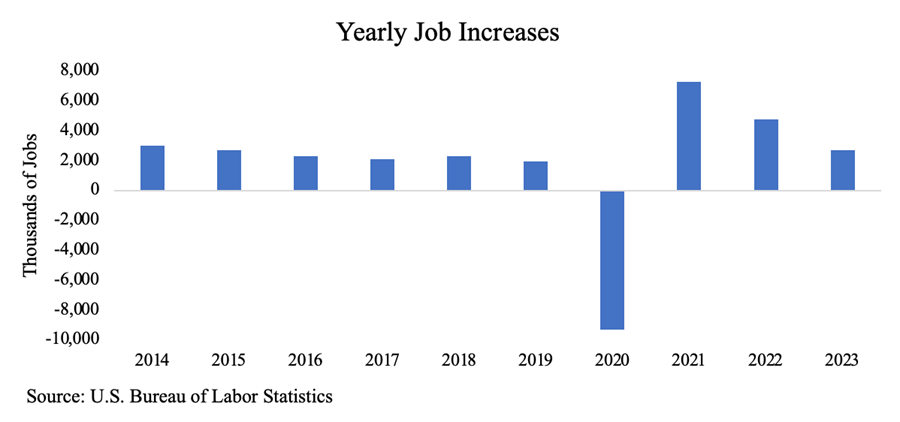

Some economic releases on Friday added to the rate-cut uncertainty. The December Employment Situation Report featured better than expected nonfarm payrolls, average hourly earnings, and a steady unemployment rate versus expectations for an increase. The December ISM Services PMI showed a larger than expected deceleration in December service sector growth.

December’s jobs report showed the U.S. economy added 216,000 jobs for the month of December with the unemployment rate remaining steady at 3.7% and exceeding expectations.

The solid employment numbers may keep the Fed from cutting rates as much as the market had expected, whereas the soft reading for business activity in the nation's largest sector would perhaps keep the Fed aligned with the market's rate-cut expectations.

It is important to keep the longer term in perspective… the jobs report merely illustrates the pandemic shutdown and reopening in our view. And now approaches the median.

The probability of a 25 basis points rate cut to 5.00-5.25% at the March FOMC meeting is now 68.3% versus 88.5% last week, according to the CME FedWatch Tool.

In other news, geopolitical worries intensified in the Red Sea after Iran sent a warship there in response to the U.S. destroying three Houthi boats.

Market Snapshot…

- Oil Prices – Oil prices rose based on continuing Mideast tensions. West Texas Intermediate crude futures (WTI) rose $1.78, or 2.47% to close at $73.97 a barrel. Brent crude was up $1.42, or 1.83%, to close at $79.01 a barrel.

- Gold– Gold prices were steady but posted their first weekly decline in four weeks. Spot Gold rose 0.1% to $2,044.21 per ounce while U.S. gold futures settled mostly unchanged at $2,049.80. Silver completed the week $23.315.

- U.S. Dollar– The dollar changed little in response to mixed data. The dollar index was up 1.1% and was flat at 102.43. Euro/US$ exchange rate is now 1.097.

- U.S. Treasury Rates– Treasury yields moved in mixed directions as traders debated the economic outlook based on the latest nonfarm payroll data. The yield on the 10-year Treasury note was up by 6 basis points at 4.051%.

- Asian shares were mixed in overnight trading.

- European markets are trading mostly lower.

- Domestic markets are trading mixed this morning.

As it has the past three years, price stability will take a front-row seat... there was a lot of disinflationary progress in 2023.

This week we will receive December’s CPI report, which will have final inflation figures for the year. The disinflationary trend will need to continue for the Fed to determine that rate cuts are appropriate soon.

On top of the prominent inflationary reports, fourth-quarter earnings season will kick off. We will hear from several large financial institutions: Bank of America, JPMorgan Chase, and Wells Fargo to name a few. Initial estimates indicate a 1.3% year-over-year earnings growth rate for the quarter for the S&P.

Most companies have been able to perform well given the inflationary environment. We will see if that trend continues.

Have a wonderful week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forecasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. U.S. government bonds and Treasury notes are guaranteed by the U.S. government and, if held to maturity, offer a fixed rate of return, and guaranteed principal value. U.S. government bonds are issued and guaranteed as to the timely payment of principal and interest by the federal government. Treasury notes are certificates reflecting intermediate-term (2 - 10 years) obligations of the U.S. government. The NASDAQ-100 (^NDX) is a modified capitalization-weighted index. It is based on exchange, and it is not an index of U.S.-based companies. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.