The Week in Review 3/13/23

“Impossible is not a fact. It's an opinion.” – Muhammad Ali

Good Morning ,

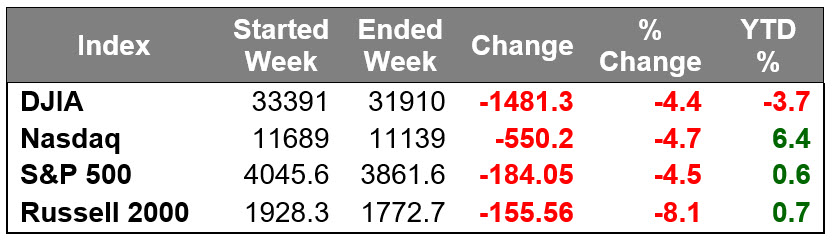

It was a losing week for the stock market as investors digested Fed Chair Powell's testimony before Congress, the February employment report, and news of SVB Financial's Silicon Valley Bank being shut down.

Downside moves last week had the S&P 500 slice through support at its 50-day moving average, then its 200-day moving average.

The market started to get a bit shaky after Fed Chair Powell's remarks to the Senate Banking Committee and House Financial Services Committee had investors rethinking the possibility of a 50 basis points rate hike at the March FOMC meeting.

Participants took notice of the following remarks from his prepared testimony…

"Although inflation has been moderating in recent months, the process of getting inflation back down to 2 percent has a long way to go and is likely to be bumpy. As I mentioned, the latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated. If the totality of the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes. Restoring price stability will likely require that we maintain a restrictive stance of monetary policy for some time."

Mr. Powell, in the Q&A portion of his testimony, acknowledged that it is likely that the ultimate rate the Fed writes down in its Summary of Economic projections at the March meeting is likely to be higher than what was written down at the December meeting. He also added that the economic data thus far suggests that the Fed has not overtightened and still has more work to do.

Notably, the fed funds futures market saw an abrupt turn in expectations for the March FOMC meeting, pricing in a 78.6% probability of a 50 basis points rate hike versus just 31.9% before Fed Chair Powell's testimony. This is in spite of several well respected experts commenting that 50 basis points might be a mistake at this time.

The reaction to Fed Chair Powell's remarks was jarring enough for the capital markets, but things would get even more challenging in the wake of news on Thursday that SVB Financial (SIVB) was seeking to raise capital after it saw elevated cash burn from its clients.

That news was disconcerting for market participants knowing that something typically "breaks" when the Fed is in an aggressive tightening cycle, and that the banks, whether they are the specific problem in that regard, will likely get pulled into it nonetheless given their lending role.

Around 12:30 p.m. ET Friday, it was announced that SVB Financial Group's Silicon Valley Bank was shut down as the FDIC created a Deposit Insurance National Bank of Santa Clara to protect insured depositors of Silicon Valley Bank, Santa Clara, California.

That news contributed to added flight to safety interest in the Treasury market and further prompted market participants to rein in their risk exposure amid concerns about a possible contagion effect.

The 2-yr note yield declined 27 basis points this week to 4.59% while the 10-yr note yield dropped 26 basis points to 3.70%.

With the fallout surrounding SVB Financial, the fed funds futures market pivoted back to thinking that the Fed is likely to raise rates by only 25 basis points at the March FOMC meeting.

The SVB Financial situation largely overshadowed a relatively pleasing February employment report on Friday that was accented with stronger than expected nonfarm payrolls and weaker than expected average hourly earnings growth.

It should be noted that SVB Financial might be considered by many to be a “high risk” lender… lending to venture capital high tech startups, internet start ups, and private equity. They are not a good example of a typical bank, and the banking system is much stronger after the 2008 credit crisis, with higher capital and stronger balance sheets.Also important to note, the FDIC stepped in swiftly to take over the troubled bank and protect depositors.

The crash in crypto has added some stress to other high risk lenders… FTX, Silvergate, and now Signature Bank, but how is that surprising? When the Fed gets this aggressive raising rates, there are usually some casualties and aggressive lenders often have trouble.

The S&P 500 settled Friday near its lowest levels of the week with losses in all 11 sectors.

Last week the worst performing sector was the financial sector, which declined 8.5%, followed by a 7.6% decline in the materials sector, a 7.0% drop in the real estate sector, a 5.6% decline in the consumer discretionary sector, a 5.4% decline for the energy sector, and a 4.5% drop for the industrial sector. The best performing sector this week was the consumer staples sector, which was down 1.9%.

Looking forward…

The CME FedWatch Tool currently shows a 54.2% probability of no rate hike at the March FOMC meeting now and only a 45.8% probability of a 25 basis points rate hike. Shortly after Fed Chair Powell's testimony last Tuesday, there was a 78.6% probability of a 50 basis points rate hike at the March FOMC meeting.

So we wait on the Fed… and watch how the banks sort this all out.

Have a fantastic week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

The prominent underlying risk of using cryptocurrencies as a medium of exchange is that they are not authorized or regulated by any central bank. Cryptocurrency users are not registered with the SEC, and the cryptocurrency market is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involve a high degree of risk. Investors must have the financial ability, sophisticated/experience and willingness to bear the risks of an investment, and a potential total loss of their investment.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.