The Week in Review 3/20/23

“I’m a great believer in luck, and I find the harder I work the more I have of it.” –Thomas Jefferson

Good Morning,

Banking worries continued to plague investors throughout last week.

Investors learned Sunday through a joint statement from the Federal Reserve, Treasury, and FDIC that all depositors at Silicon Valley Bank and Signature Bank of New York would be fully protected even though both banks had been taken over by regulators.

In turn, the Fed also introduced a Bank Term Funding Program (BTFP) that will help banks avert selling Treasury and other government securities at a loss by allowing them to offer those securities to the Fed, which will value them at par, as collateral.

Those actions were designed to shore up confidence in the banking industry, but price action in the bank stocks last week suggested confidence had yet to be restored.

First Republic Bank was at the epicenter of the bank stock trade, having been the beneficiary of news that 11 large banks, including JPMorgan Chase, will collectively make $30 billion of uninsured deposits into the bank.

That news on Thursday triggered a massive reversal in shares of FRC to the upside, but by Friday, FRC was seeing large losses again after announcing the suspension of its common share dividend and that its borrowing from the Federal Reserve from March 10-15 varied from $20 billion to $109 billion.

The latter news coupled with the report that banks borrowed $11.9 billion from the newly announced Bank Term Funding Program and approximately $153 billion from the Fed's discount window for the week ending March 15 once again rattled investors and led to widespread selling of the bank stocks to end the week.

With investors lacking confidence in the banking industry, a risk-off mentality drove price action for most of the week. Buyers piled into mega cap stocks that are viewed as being distant from the banking sector fallout, having strong balance sheets and being more resilient in an economic slowdown. Alphabet, NVIDIA, and Microsoft all gained more than 12.0% this week.

The influence of the mega cap stocks was evident in the outperformance of the communication services (+6.9%), information technology (+5.7%), and consumer discretionary (+2.4%) sectors, all of which house mega cap constituents. That outperformance was more of a safety trade that also manifested itself in the outperformance of the defensive-oriented utilities (+3.9%), consumer staples (+1.3%), and health care (+1.3%) sectors.

Similarly, price action in the Treasury market also reflected a flight to safety in conjunction with concerns the economy may weaken considerably because of the banking sector's problems. On a related note, oil prices dropped 13.5% this week to $66.33/bbl on demand concerns.

The 2-yr note yield plunged 77 basis points this week to 3.82% and the 10-yr note yield fell 30 basis points to 3.40%, also driven in part by a belief that the Fed isn't going to be able to raise rates as much as previously thought and may be forced to cut rates relatively soon.

The latter point notwithstanding, the CME FedWatch Tool shows a 64.2% probability that the Fed will raise rates by 25 basis points at the March 21-22 FOMC meeting. That is up from 59.8% a week ago.

Notably, the European Central Bank agreed this week to raise its key policy rates by 50 basis points despite worries surrounding Credit Suisse (CS), saying it did so because "inflation is projected to remain too high for too long."

With all the anxiety about banks, investors almost overlooked the real adversary of the stock market… inflation.

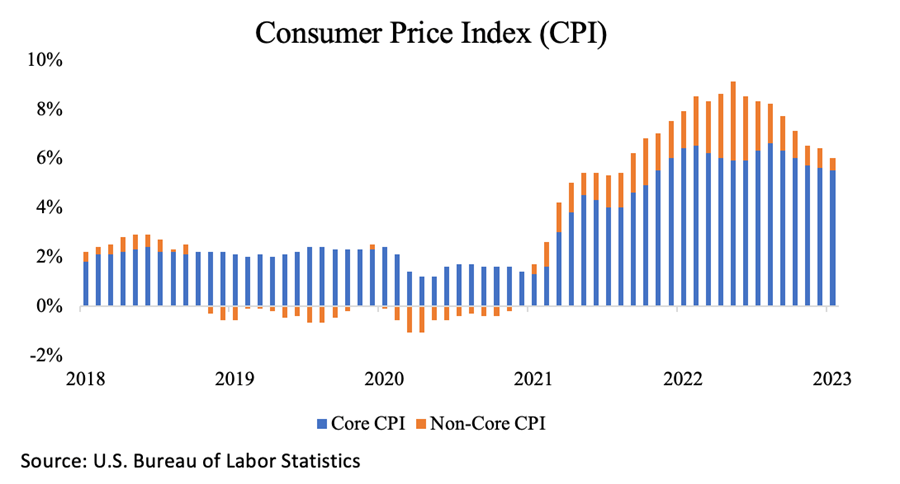

February’s CPI report came in line with estimates, up 0.4% for the month, down slightly from January’s 0.5%, and 6.0% year-over-year. This marks the sixth consecutive month that the headline rate has declined.

It is clear that inflation is receding, just not fast enough for the Fed… though these banking challenges may force the Fed to pause? The Fed’s super aggressive rate hikes have exacerbated the banking challenges considerably. Some might argue Chairman Powell and Co’s haste to raise rates might actually have caused them.

Market Snapshot...

- Oil Prices – Oil prices nosedived, falling more than $3/barrel. West Texas Intermediate crude was down $1.43, or 2.1%, to $676.92/barrel, while Brent futures fell by $1.59, or 2.1%, to settle at $73.11/barrel.

- Gold– Gold prices surged as the banking crisis shook the markets. Spot gold climbed 3.1% to $1,977.89 per ounce, while U.S. gold futures gained 2.6% to $1,973.50 per ounce. Silver closed the week at $22.462.

- U.S. Dollar– The dollar index slipped over concerns about more turmoil in the banking sector. The index fell 0.6%. Euro/US$ exchange rate is now 1.074.

- U.S. Treasury Rates– The yield on the benchmark 10-year Treasury was 3.423% after falling 16 basis points.

- Asian shares were down in overnight trading.

- European markets are trading in the green.

- Domestic markets are trading flat this morning.

Looking ahead...

The Fed will be meeting this week to discuss a potential policy change to the federal funds rate. Recent economic reports about the labor market, CPI, PCE, productivity, and consumer spending, lead many to believe that further rate hikes would be necessary. However, we are now experiencing a repercussion of their rapid pace.

The question this week is: Will the Fed continue ahead, holding true to its belief that the banking system is as strong as they say it is, or will it pause to prevent further stress to the system?

The futures market tells us that the Fed will either pause or raise rates by 25 basis points (0.25%). After Chairman Powell’s hawkish testimony in front of Congress a few days ago, both those occurrences seemed unlikely a mere two weeks ago. Either way, the Fed is likely done ... or close.

Have a great week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.