The Week in Review 3/6/23

Money never made a man happy yet, nor will it. The more a man has, the more he wants. Instead of filling a vacuum, it makes one. --Benjamin Franklin

Good Morning,

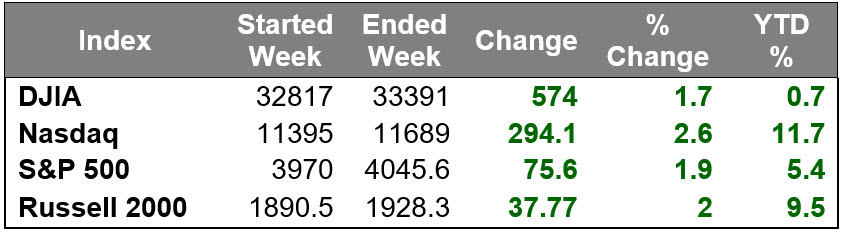

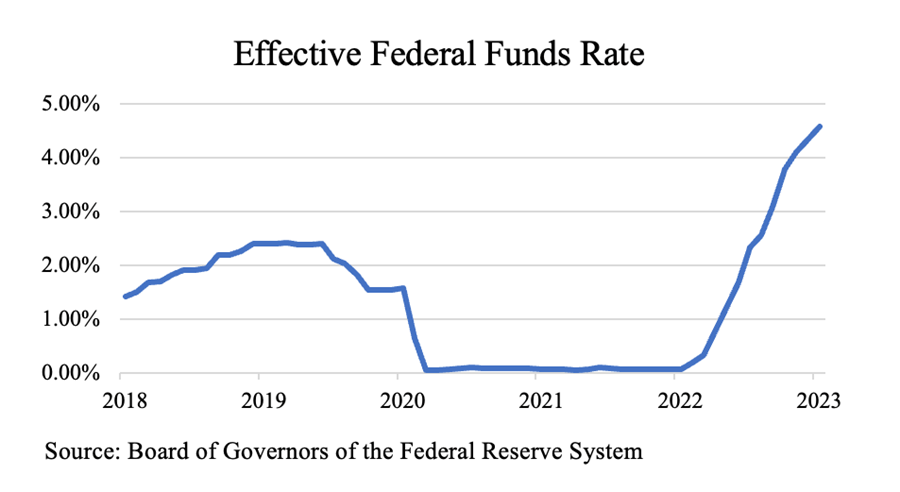

We had a good week, and it came at a critical time… in spite of most fearing the Fed will be raising rates “higher for longer”. The bond market rallied and the stock market followed.

The market was oversold on a short-term basis driving last week's gains. Entering Monday's session, the S&P 500 had declined 5.0% from its close on February 2 (the day before the January employment report was released).1

Inflation concerns were stoked this week by data releases, including the February ISM Manufacturing Index, the weekly initial jobless claims, and the revised Q4 productivity. Weekly claims remained remarkably low, reflecting a tight labor market, while Q4 unit labor costs rose 6.3% from the same quarter last year, reflecting stubbornly high wage-based inflation. The sticking point from the ISM Manufacturing Index was that the Prices Index rose to 51.3% from 44.5%, marking the first price increase in four months. This price data, we would add, followed a higher-than-expected February CPI reading for Germany.

The Treasury market responded strongly to this week's data. The 10-yr note yield surged past 4.00%, hitting 4.07% at its high, before pulling back to 3.96% by Friday's close. The 2-yr note yield, which is more sensitive to changes in the Fed funds rate, rose eight basis points this week to 4.86%.

Despite the rising market rates, the main indices held up okay thanks to technical support. Buyers stepped in when the S&P 500 breached its 200-day moving average, and by Friday's close the index was comfortably back above its 50-day moving average.

Most of the S&P 500 sectors logged gains this week led by materials (+4.0%), communication services (+3.3%), and industrials (+3.3%). The materials and industrials sectors may have been reacting to China reporting stronger-than-expected Manufacturing PMI and Non-Manufacturing readings for February.

The only sectors to decline this week were utilities (-0.7%) and consumer staples (-0.4%).

The U.S. Dollar Index fell 0.7% for the week to 104.50.

WTI crude oil futures rose 4.6% this week to $79.79/bbl and natural gas futures surged 28.7% to $3.14/mmbtu.

Monday's positive bias was partially fueled by some technical catalysts including the S&P 500 closing above its 200-day moving average on Friday, along with the 10-yr note yield staying below 4.00%. A noticeable pullback in Treasury yields from overnight highs was another support factor for equities. The main indices exhibited some fairly strong upside momentum in the early going, likely driven by some short-covering activity, that had the S&P 500, Dow, and Nasdaq up 1.2%, 1.1%, and 1.5%, respectively, at their morning highs.

That momentum quickly dissipated, though, and the market spent most of the session lower. The main indices ultimately settled off their lows for the day thanks to buyers stepping in when the S&P 500 slipped below its 50-day moving average (3,980). The Nasdaq settled with the biggest gain, bolstered by outperforming mega cap stocks.

Monday's economic data…

- Durable goods orders declined 4.5% month-over-month in January (consensus -3.9%) following a downwardly revised 5.1% increase (from 5.6%) in December. Excluding transportation, durable goods orders rose 0.7% month-over-month (consensus +0.1%) following a downwardly revised 0.4% decline (from -0.1%) in December.

- The key takeaway from the report was the strength seen in nondefense capital goods orders, excluding aircraft -- a proxy for business spending. Those orders were up 0.8% month-over-month following a 0.3% decline in December. Shipments of these same goods, which factor into GDP forecasts, were up a healthy 1.1% after declining 0.6% in December.

- Pending home sales rose 8.1% in January (consensus +1.0%) following a revised 1.1% increase in December (from +2.5%).

The stock market was mixed on Tuesday, the last trading day of the month. Both buyers and sellers were lacking conviction on Tuesday, which had the main indices chopping around fairly narrow trading ranges. The S&P 500 spent a good portion of Tuesday's session above its 50-day moving average (3,979), thanks to some technical buying interest after the S&P 500 closed above that level on Monday, before things started to deteriorate in the afternoon trade. Ultimately, the main indices closed near their lows for the day, but losses were relatively modest in scope.

Mixed reactions to the latest slate of earnings news helped contribute to the mixed price action. Target, Zoom Video, AutoZone, Occidental Petroleum, Workday, J.M. Smucker, and Universal Health were among the standouts in that regard.

Tuesday supplied quite a bit of economic data…

- January Adv. Intl. Trade in Goods -$91.5 bln; Prior was revised to -$89.7 bln from -$90.3 bln

- January Adv. Retail Inventories 0.3%; Prior was revised to 0.4% from 0.5%

- January Adv. Wholesale Inventories -0.4%; Prior 0.1%

- December FHFA Housing Price Index -0.1%; Prior -0.1%

- December S&P Case-Shiller Home Price Index 4.6% (consensus 5.8%); Prior 6.8%

- February Chicago PMI 43.6 (consensus 45.0); Prior 44.3

- February Consumer Confidence 102.9 (consensus 108.4); Prior was revised to 106.0 from 107.1

- The key takeaway from the report is that the monthly decrease was driven entirely by consumers' short-term outlook, which entailed becoming considerably less upbeat about their short-term income prospects. That view is cutting into plans to buy homes, autos, and major appliances. It was also reported that vacation intentions declined in February.

The new month started Wednesday but on a mostly downbeat note. The S&P 500 and Nasdaq closed with decent losses, weighed down by weakness in the mega cap space, while the Dow managed a slim gain. Downside momentum was somewhat limited though, thanks to the S&P 500 finding support at its 200-day moving average (3,940) twice on Wednesday.

Rising market rates, in response to the ISM Manufacturing Index and comments from Fed officials, were a big headwind for stocks on Wednesday. The sticking point from the ISM Manufacturing Index was that the Prices Index rose to 51.3% from 44.5%, marking the first price increase in four months. This price data, followed a higher-than-expected February CPI reading for Germany.

Rate hike concerns were stoked by Minneapolis Fed President Kashkari (2023 FOMC voter) saying he is leaning toward raising rates further and pushing up his own policy path forecast and Atlanta Fed President Bostic (2024 FOMC voter) saying he thinks the Fed should get to 5.00-5.25% and hold there well into 2024, according to CNBC.

Negative reactions to disappointing earnings and/or guidance from the likes of Lowe's, Rivian, Kohl's, and Agilent Technologies provided yet another headwind for stocks.

Wednesday's economic data…

- Weekly MBA Mortgage Applications Index -5.7%; Prior -13.3%

- February IHS Markit Manufacturing PMI - Final 47.3; Prior 47.8

- February ISM Manufacturing Index 47.7% (consensus 47.8%); Prior 47.4%

- The key takeaway from the report is that manufacturing activity continued to contract in February, albeit at a slightly slower pace, yet it did so against a backdrop of prices increasing for the first time in four months in a move that will keep the Fed with a tightening bias.

- January Construction Spending -0.1% (consensus 0.3%); Prior was revised to -0.7% from -0.4%

- The key takeaway from the report is that new single family construction continued to decline (-1.7%), clipped by higher interest rates that are making construction projects more expensive to finance at a time when broader economic activity is slowing due in part to the higher interest rates.

On Thursday the stock market traded lopsided for most of the session. The Dow Jones Industrial Average was trading up right out of the gate, supported by gains in Salesforce following its better than expected earnings, guidance, and share buyback plan. The S&P 500 and Nasdaq, meanwhile, spent Thursday morning stuck in negative territory, reflecting concerns about rising market rates.

The 10-yr note yield, which hit 4.00% overnight after the Eurozone reported core CPI was up a record 5.6% year-over-year in February versus 5.3% in January, settled Thursday up eight basis points to 4.07%. Selling interest picked up in the Treasury market following the release of the weekly initial jobless claims and revised Q4 productivity data at 8:30 a.m. ET.

Initial claims remained remarkably low at 190,000 while unit labor costs rose 3.2% versus the advance estimate of up 1.1%. Translation: signs of a tight labor market and stubbornly high inflation (unit labor costs were up 6.3% from the same quarter a year ago).

Despite interest rates pressuring the stock market, downside moves were somewhat limited thanks to technical buying interest after the S&P 500 slipped below its 200-day moving average (3,940). The S&P 500 spent the majority of Thursday's session oscillating around that level until things improved noticeably in the afternoon trade.

The afternoon rally effort, which had the S&P 500 close just shy of its 50-day moving average (3,983), was attributed to Atlanta Fed President Bostic (2024 FOMC voter) saying he favors a 25 basis points rate hike in March. That view was spun as a dovish take on things. Notably, though, Mr. Bostic said Wednesday that the Fed needs to go to 5.00-5.25% and then leave its rate there well into 2024.

Mr. Bostic's remarks came at an opportune time with the S&P 500 sitting right on top of a key technical support level, and the market itself seen by some as being short-term oversold, having declined as much as 6.4% from its close on February 2 (the day before the January employment report was released). To that end, his remarks became a convenient excuse for renewed buying interest.

Thursday's economic data…

- Q4 Productivity-Rev. 1.7% (consensus 2.5%); Prior 3.0%; Q4 Unit Labor Costs-Rev. 3.2% (consensus 1.4%); Prior 1.1%

- The key takeaway from the report is the elevated unit labor costs, which were up 6.3% from the same quarter a year ago (which is when the Fed first started raising rates). Moreover, unit labor costs in the nonfarm business sector were up 6.5% in 2022, which is the largest annual increase since 1982.

- Weekly Initial Claims 190K (consensus 197K); Prior 192K; Weekly Continuing Claims 1.655 mln; Prior was revised to 1.660 mln from 1.654 mln

- The key takeaway from the report remains the same, which is to say the remarkably low level of initial claims -- a leading indicator -- remains indicative of a tight labor market where employers are reluctant to cut jobs, fostering a concern that tightness in the labor market will lead to sticky wage-based inflation pressures.

The stock market closed out the week with a decent rally. The main indices moved higher right out of the gate, which had the S&P 500 open above its 50-day moving average (3,987). The positive disposition held up throughout Friday’s session and the main indices closed near their best levels of the day. The Dow, Nasdaq, and S&P 500 rose 1.2%, 2.0%, and 1.6%, respectively.

Price action in the Treasury market was an integral support factor for equities Friday. The 10-yr note yield settled back below 4.00%, down 11 basis points to 3.96%. The 2-yr note yield fell five basis points to 4.86%. The U.S. Dollar Index also fell 0.5% to 104.50.

There may have been some technical buying interest driving Friday's gains after the S&P 500 found support at its 200-day moving average (3,940) on Thursday.

Friday's economic data…

- February IHS Markit Services PMI - Final 50.6; Prior 50.5

- February ISM Services PMI 55.1% (consensus 54.5%); Prior 55.2%

- The key takeaway from the report is that activity remained steady in February despite expectations for a slower pace of growth. Prices continued growing, which gives the Fed another argument to continue its rate hike campaign.

Market Snapshot:

- Oil Prices – Oil prices rose slightly, recovering from an early slump. West Texas Intermediate crude gained $1.04, or 1.3%/barrel, while Brent futures were up 72 cents, or 0.9% to settle at $85.47/barrel.

- Gold– Gold prices climbed to their highest in almost two weeks on the news of a softer dollar. Spot gold was up 0.6% to $1,847.25 per ounce, while U.S. gold futures advanced 0.7% to $1,853.50 per ounce. Sliver closed out the week at $21.212.

- U.S. Dollar– The dollar index fell from a two-month high. The index eased 0.25% to 104.76. So far, the index is down 0.4%. The current Euro/US$ exchange rate is 1.067.

- U.S. Treasury Rates– The yield on the benchmark 10-year Treasury was trading at 3.969% after falling 10 basis points.

- Asian shares were higher in overnight trading.

- European markets are trading mixed.

- Domestic markets are trading up this morning.

Fed Chairman Jerome Powell will testify this week at the House Financial Services Committee and the Senate Banking Committee in regard to the Fed's semiannual monetary policy report. Lawmakers will undoubtedly be asking pointed questions about inflation and the Fed's policy actions.

We will also receive February's jobs report. After January's robust showing and inflation upticks, the Fed will be looking for a modest report to show its policy is continuing to work.

The consensus estimate calls for an addition of 200K jobs for the month and the unemployment rate to remain steady at 3.4%. As we get close to the Fed's next meeting in two weeks, a lot of speculation will be made on how the Fed will adjust its policy, a 25 basis point or 50 basis point hike both seem to be on the table. The economic reports over that time will likely tip the scales one way or the other.

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.