The Week in Review 2/27/23

“The greatest leader is not necessarily the one who does the greatest things. He is the one that gets the people to do the greatest things.” –Ronald Reagan

Good Morning,

Another poor week in the markets, shortened by the holiday… another jump in Treasury yields, and a growing belief that the Fed is likely to keep rates higher than expected for longer than expected.

More Fed “higher for longer” thoughts were heard when investors received the FOMC Minutes for the Jan. 31-Feb. 1 meeting. Investors are bracing for still higher rates as the Fed fights some very stubborn inflation.

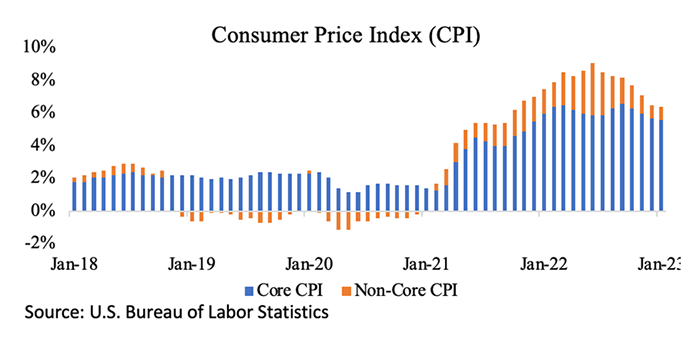

While inflation is declining, it is just not fast enough for the Fed… a stronger than expected January employment report, the stronger than expected ISM Services PMI, the January CPI and PPI reports, all capped off by this week's stronger than expected core-PCE Price Index, which is the Fed's preferred inflation gauge.

Some anxiousness surrounding rate hikes may have been tempered on Friday by St. Louis Fed President Bullard (not an FOMC voter), who is generally a more hawkish Fed official. Mr. Bullard, after the hotter than expected core-PCE Price Index was released, remarked that "it appears that the Fed may be able to disinflate in an orderly manner and achieve a relatively soft landing."

There were some upside moves in the market Thursday following NVIDIA's impressive earnings and guidance before the positive bias was overshadowed by rate hike concerns. The downside bias last week had the S&P 500 take out support at its 50-day moving average before flirting with its 200-day moving average, which ultimately held up.

Price action in the Treasury market was another headwind for equities last week, creating valuation concerns and worries about competition for stocks. The 2-yr note yield rose 17 basis points to 4.78% and the 10-yr note yield, which tested the 4.00% level, rose 12 basis points to 3.95%. The U.S. Dollar Index also rose noticeably this week, up 1.4% to 105.26.

Only one of the 11 S&P 500 sectors registered a gain this week -- energy (+0.2%) -- while the consumer discretionary (-4.4%) and communication services (-4.4%) sectors suffered the steepest losses.

|

Index |

Started Week |

Ended Week |

Change |

% Change |

YTD % |

|

DJIA |

33827 |

32817 |

-1009.7 |

-3 |

-1 |

|

Nasdaq |

11787 |

11395 |

-392.3 |

-3.3 |

8.9 |

|

S&P 500 |

4079.1 |

3970 |

-109.05 |

-2.7 |

3.4 |

|

Russell 2000 |

1946.4 |

1890.5 |

-55.87 |

-2.9 |

7.3 |

WTI crude oil futures fell 0.1% this week to $76.41/bbl. Natural gas futures surged 10.1% to $2.50/mmbtu.

Another robust week of economic data…

Market participants took some money off the table Tuesday following the strong start to 2023 amid rising market rates and increasing geopolitical tension. By Tuesday's close, the Dow Jones Industrial Average had given back all of its 2023 gains. The S&P 500 for its part closed the session just a whisker shy of the 4,000 level.

Geopolitical angst was helping to drive price action in both the bond and stock markets on Tuesday. The Wall Street Journal reported that China's President Xi will likely head to Moscow in April or May to meet with President Putin and encourage peace talks. That view runs counter to Secretary of State Blinken's accusation over the extended weekend, reported in The New York Times, that China is considering providing lethal assistance to Russia. Also, President Putin announced Russia will suspend its participation in the New START nuclear treaty.

Recession concerns were also in play following disappointing full-year guidance from Dow components Home Depot and Walmart. A big loss in Home Depot helped to drive the S&P 500 consumer discretionary sector to last place on Tuesday.

Plenty to chew on Tuesday…

- February IHS Markit Manufacturing PMI - Prelim 47.8; Prior 46.9

- February IHS Markit Services PMI - Prelim 50.5; Prior 46.8

- January Existing Home Sales 4.00 mln (consensus 4.12 mln); Prior was revised to 4.03 mln from 4.02 mln

- The key takeaway from the report is that sales remain pressured by high mortgage rates and economic uncertainty, which in turn have led to an extended time of existing homes for sale remaining on the market and a decided moderation in median selling prices.

Wednesday's trade started on a more positive tone that had the main indices oscillating around a narrow range right above their flat lines. Moves were modest in scope, though, as investors awaited the FOMC Minutes for the Jan. 31-Feb. 1 meeting at 2:00 p.m. ET. The Minutes indicated that "...substantially more evidence of progress across a broader range of prices would be required to be confident that inflation was on a sustained downward path." There were also a few participants that wanted to raise rates by 50 basis points at the meeting. Nonetheless, there wasn't anything too surprising in the Minutes.

Ultimately, the main indices were able to climb off their post-FOMC Minutes lows by the closing bell. The S&P 500 and Dow Jones Industrial Average were pinned just below their flat lines while the Nasdaq squeezed out a slim gain.

Wednesday's economic data was limited to the weekly MBA Mortgage Applications Index, which fell 13.3% following a 7.7% decline in the prior week.

Thursday began, and ended, on a more upbeat note. The S&P 500 was able to break a four day losing streak following pleasing earnings and guidance from NVIDIA, which fueled buying interest in mega cap and growth stocks. The main indices did, however, spend a good portion of the session pinned below their flat lines as investors digested disappointing earnings and/or guidance from many consumer-oriented companies. eBay, Dollar General, Domino's Pizza, Dutch Bros., and Wayfair were among the more notable standouts in that regard.

The main sticking point for stock market participants was that less discretionary spending is likely to translate to slower growth and further cuts to earnings estimates while the Fed stays committed to raising rates higher than expected for longer than expected.

The downside moves had the S&P 500 fall below the 4,000 level, then its 50-day moving average at 3,980. Buyers stepped in to buy the dip, though, and the main indices all finished the session with decent gains.

Painfully, market rates declined Thursday following some initial jobless claims and Q4 GDP data that supported the Fed's case for continuing to raise rates.

Thursday was full of economic news…

- Initial jobless claims for the week ending February 18 declined by 3,000 to 192,000 (consensus 200,000). Continuing jobless claims for the week ending February 11 decreased by 37,000 to 1.654 million.

- The key takeaway from the report is that it covers the period in which the survey for the February employment report was taken. The remarkably low level of initial claims will contribute to expectations for another strong gain in nonfarm payrolls and the Fed sticking to its tightening ways.

- The second estimate for fourth quarter GDP showed a downward revision to 2.7% growth (consensus 2.9%) from the advance estimate of 2.9%. That was driven by a downward revision in personal spending growth to 1.4% from 2.1%. The GDP Price Deflator was revised up to 3.9% (consensus 3.5%) from 3.5%. The personal consumption expenditures index, meanwhile, was revised up to 3.7% from 3.2%.

- The key takeaway from the report is that it is an off-putting mix for the Fed. Growth is still running above potential and inflation is still running above target.

- Weekly EIA crude oil inventories showed a build of 7.65 million barrels following last week's build of 16.28 million barrels.

- Weekly EIA Natural Gas Inventories showed a draw of 71 bcf versus a draw of 100 bcf last week.

The stock market was decidedly weak on Friday on broad-based selling following the hotter than expected inflation data. The Fed's preferred inflation gauge, the core-PCE Price Index, accelerated to 4.7% year-over-year in January versus 4.6% in December. That is the wrong direction…

Real personal spending was up 1.1% month-over-month, real disposable personal income was up 1.4% month-over-month, and the personal savings rate, after revisions, increased to 4.7% from a previously reported 3.4%, suggesting there is more fuel for consumers to keep spending. The problem of this report was that it showed inflation, not disinflation, and a good bit of spending potential that should keep the economy running above potential. That combination piqued concerns about inflation remaining sticky at higher levels for longer that, in turn, would prompt the Fed to stick to its tightening ways and stick with higher rates for longer than the market previously expected.

The S&P 500 opened below its 50-day moving average (3,981) and quickly headed lower, nearly reaching its 200-day moving average (3,940). The low for the day was 3,943. The main indices were able to recover noticeably, however, from their worst levels of the day despite logging sizable losses by the close.

Friday we saw even more economic data…

- January Personal Income 0.6% (consensus 0.9%); Prior was revised to 0.3% from 0.2%; January Personal Spending 1.8% (consensus 1.3%); Prior was revised to -0.1% from -0.2%; January PCE Prices 0.6% (consensus 0.4%); Prior was revised to 0.2% from 0.1%; January PCE Prices - Core 0.6% (consensus 0.4%); Prior was revised to 0.4% from 0.3%

- The key takeaway from the report is the recognition that there isn't disinflation in this report. There is inflation in it, which is piquing concerns about inflation remaining sticky at higher levels for longer that, in turn, would prompt the Fed to stick to its tightening ways and stick with higher rates for longer than the market previously expected.

- January New Home Sales 670K (consensus 620K); Prior was revised to 625K from 616K

- The key takeaway from the report is that it reflects how rising mortgage rates are impeding sales of higher-priced homes, evidenced by the 46.9% year-over-year decline in the high-priced West region and declines in both median and average selling prices. The 0.7% decline in the median selling price was the first decline since August 2020.

- February Univ. of Michigan Consumer Sentiment - Final 67.0 (consensus 66.6); Prior 66.4

- The key takeaway from the report is the acknowledgment that consumers continue to show considerable uncertainty over short-run inflation.

To wrap this up… the economy remains strong, which is interpreted as inflationary by the Fed. This also keeps our “soft landing” for the economy hopes alive. A ‘double edged” sword indeed.

Market Update…

- Oil Prices – Oil prices edged higher on the week in volatile trading. West Texas Intermediate crude settled at $76.32/barrel, rising 93 cents, while Brent futures settled at $83.16/barrel, up 95 cents.

• Gold– Gold slipped due to a stronger dollar and bond yields. Spot gold was down 0.62% to $1,811.30 per ounce, while U.S. gold futures dipped 0.48% lower to $1,818.10 per ounce. Silver closed out the week at $20.936.

• U.S. Dollar – The dollar index surged after data showed inflation quickened while consumer spending rebounded. The index rose 0.6% to 105.23 after reaching a seven-week high of 105.32. Euro/US$ exchange rate is now 1.059.

• U.S. Treasury Rates – The yield on the benchmark 10-year Treasury rose by 6.8 basis points, reaching a high of 3.949%.

• Asian shares were lower in overnight trading.

• European markets are trading in the green.

• Domestic markets are trading higher this morning.

So we watch, and we listen to the Fedspeak, and we try to remain patient… 2023 is still off to a much better start.

Have a great week!!

Michael D. Hilger, CFP®

Managing Director

Senior Vice President, Wealth Management

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.