The Week in Review 11/22/22

Our goal has never been to make the most. It’s always been to make the best.” - Tim Cook

Last week we got a pause after a most impressive week before… as Fedspeak returned to their “hawkish” tone, but left hints of slowing the pace of rate hikes.

The Fed has been in the middle of those growth concerns as Fed officials have reiterated that they are not done yet raising rates. Comments from St. Louis Fed President Bullard (2022 FOMC voter) were the most impactful for market participants this week. He acknowledged that the fed funds rate is not yet at a sufficiently restrictive level and then showed in a Taylor Rule exercise that it may need to go to 5-7% in the battle to get inflation under control.

Other remarks from Fed officials included:

- Fed Governor Christopher Waller (FOMC voter), who said "we've still got a ways to go" before stopping interest rate hikes. Later in the week he said, that he's more comfortable stepping down to a 50-basis point hike at the December FOMC meeting following the economic data releases from the last few weeks.

- Fed Vice Chair Brainard said it may 'soon' be appropriate to slow the pace of rate hikes.

- Kansas City Fed President George (2022 FOMC voter) for her part said a real slowing in labor markets and a contraction in the economy may be needed to reduce inflation, according to CNBC.

- Boston Fed President Collins (2022 FOMC voter) said in a CNBC interview that a 75 basis point rate hike is still on the table.

- San Francisco Fed President Daly (2024 FOMC voter) said that the idea of the Fed pausing its rate hikes is not even on the table for discussion right now and that she thinks a 5.00% fed funds rate is a reasonable level where the Fed can hold rates.

The continued inversion along yield curve this week reflected worries about the Fed over tightening. The 2-yr Treasury note yield rose 19 basis points this week to 4.50% while the 10-yr note yield fell one basis points to 3.82%.

Meanwhile, market participants received some data this week that played into investors' concerns about a deteriorating economic outlook. The October Producer Price Index revealed some welcome disinflation at the producer level with total PPI up 8.0% yr/yr, versus 8.4% in September, and core PPI, which excludes food and energy, up 6.7% yr/yr, versus 7.1% in September.

There was also the Retail Sales Report for October, which reflected a 1.3% increase following a flat reading in September. Despite the stronger-than-expected retail sales data, there is a concern that discretionary spending activity is apt to slow in coming months as more consumers feel the pinch of rising interest rates, stubbornly high inflation, a reduced wealth effect, and increased layoff announcements and concerns about job security.

Retailers Target and Walmart acknowledged that consumers were pulling back on discretionary purchases after reporting earnings this week. Walmart reported good results for its fiscal third quarter, but CEO John David Rainey noted that consumers were "making frequent trade-offs and biasing spending toward everyday essentials."

In general, there was a positive response to earnings reports from retailers this week. Lowe's , Macy's, Bath & Body Works, Ross Stores, Foot Locker, Gap, and Dow component Home Depot all traded up after reporting their respective quarterly results.

For the tech sector, Cisco, Applied Materials, and Palo Alto Networks also enjoyed some gains after their earnings reports.

There were some not-so-great quarterly results, too, that were met with selling efforts. William-Sonoma and Advance Auto both suffered losses after disappointing with their earnings reports.

Micron was another standout individual after cutting its DRAM and NAND wafer starts by ~20%, saying that the market outlook for calendar 2023 has recently weakened. Micron also said it is working toward additional capex cuts.

An added point of concern that market participants dealt with this week is that earnings estimates for 2023 are too high and will be subject to downward revisions. Investors took some money off the table this week and are mindful about how much they are willing to pay for every dollar of earnings.

To be fair, some contrarian buying interest was stoked by BofA Global Fund Manager Survey early in the week that showed an elevated cash position of 6.2%.

There was a knee-jerk response to a halting report earlier this week that a Russian bomb had killed two people in NATO state Poland. This development raised the market's anxiety level about the geopolitical situation and potential for a wider conflict in Russia's war with Ukraine. However, follow-up intelligence reports suggested the missiles were not fired by Russia and there wasn't any deliberate action here. That finding helped mitigate the angst surrounding the initial report.

Also, the cryptocurrency market continues to be in focus as more news emerges about the FTX meltdown.

Only three S&P 500 sectors squeezed out a gain this week, utilities (+0.8%), health care (+1.0%), and consumer staples (+1.7%). On the flip side, energy (-2.4%) and consumer discretionary (-3.2%) were the biggest losers.

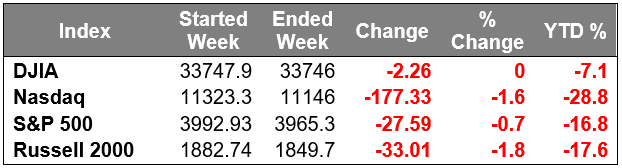

Market Snapshot…

- Oil Prices – West Texas Intermediate crude had its worst week since April. WTI finished the week 9.98% lower on Friday. It settled down 3.2% at $79.01/barrel, while Brent crude settled down 2.41% for the day and 8.72% for the week at $86.96/barrel.

- Gold – Gold prices fell on Friday. Spot gold fell 0.7% to $1,748.55 per ounce, while U.S. gold futures also fell 0.7% to $1,750.6 per ounce. Silver closed out the week at $20.763.

- U.S. Dollar – The dollar index gained slightly Friday and was up 0.23% to close at 106.95.Euro/US$ exchange rate is now 1.026.

- U.S. Treasury Rates – The 10-year Treasury yield was last at 3.814% after rising to 3.83%.

- Asian shares were mixed in overnight trading.

- European Markets are trading mostly higher.

- Domestic markets are indicated to open softer this morning.

This week will be a short and light due to the Thanksgiving holiday. However, we will hear from several FOMC members and receive updated Consumer Sentiment and Expectations from The University of Michigan survey. The Fed speakers so far have been tempering our expectations since the last CPI report. The core CPI is running more than three times the Fed’s 2% target.

We hope you have a safe and happy Thanksgiving!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

The prominent underlying risk of using cryptocurrencies as a medium of exchange is that they are not authorized or regulated by any central bank. Cryptocurrency users are not registered with the SEC, and the cryptocurrency market is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involve a high degree of risk. Investors must have the financial ability, sophisticated/experience and willingness to bear the risks of an investment, and a potential total loss of their investment.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.