The Week In Review 11/29/22

"I became a good pitcher when I stopped trying to make them miss the ball and started trying to make them hit it." - Sandy Koufax

Good Morning,

We hope everyone had a wonderful, safe and happy Thanksgiving… we all have so much to be thankful for!

The markets enjoyed further gains in the holiday shortened week which was consistent with a seasonal positive market trend during Thanksgiving week. The seasonality helped to offset the market's ongoing growth concerns, which were put on the backburner this week despite more news about China's COVID-related measures.

China confirmed its first COVID-related deaths in six months and new lockdown measures have reportedly brought Beijing to a near standstill.

These further recovery gains were fueled by better than expected earnings reports from retail issues like Best Buy and Abercrombie & Fitch, along with some names from the tech space like Analog Devices and Dell Technologies. Also, farm equipment company Deere was among the more notable earnings-driven winners.

Another individual winner this week was Disney, which traded up on the news that Bob Chapek stepped down as CEO and that former CEO Bob Iger is coming back to run things for a two-year stint. Chapek’s time at the helm was quite short.

Movement in the Treasury market was generally supportive of the stock market this week. The 10-yr note yield fell 13 basis points to 3.69% and the 2-yr note yield fell 2 basis points to 4.48%.

Market participants also had a slew of economic data to digest last week. Some reports, like October Durable Goods Orders, October New Home Sales, and the November University of Michigan Index of Consumer Sentiment, were better than expected, but others, like the Weekly Initial Claims and Preliminary November IHS Markit Manufacturing and Services PMIs, were worse than expected.

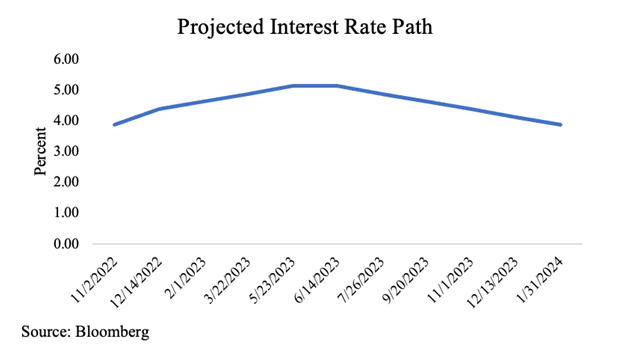

The FOMC Minutes for the November 1-2 meeting revealed that, "a substantial majority of participants judged that a slowing in the pace of increase would likely soon be appropriate." This coincided with the market's expectation that the Fed is likely raise rates by 50 bps in December rather than the previously expected 75 bps rate hike.

What if we told you that the Fed could cut rates in 2023? Well there is a growing expectation that they might…

How would the market react to an easing Fed?Time will tell…

All 11 S&P 500 sectors closed with a gain this week. The materials (+3.0%) and utilities (+2.9%) sectors sat atop the leaderboard while energy (+0.2%) showed the slimmest gain as market participants continue to deal with growth concerns.

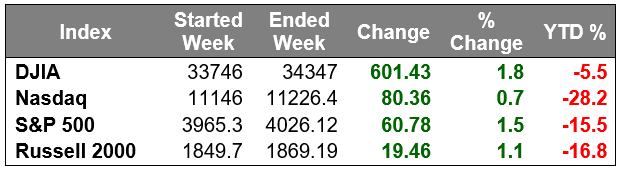

Market Snapshot…

- Oil Prices – Worries about Chinese demand caused prices to fall last week. West Texas Intermediate crude was down 1.7% lower on Friday, or $1.32 to finish at $76.62/barrel, while Brent crude dropped 1.61% for the day or $1.37 to trade at $83.97/barrel.

- Gold – Gold prices traded flat on Friday. Spot gold fell to $1,754.76 per ounce, while U.S. gold futures rose 0.55% to $1,755.2 per ounce. Silver finished the week at $21.43.

- S. Dollar – The dollar index gained slightly Friday and was up 0.23% to close at 106.95. The current exchange rate for Euro/US$ is 1.047.

- S. Treasury Rates – The 10-year Treasury yield was slightly lower at 3.698% on indications that the interest rate hikes would be slowed in the coming months.

- Asian shares were down in overnight trading.

- European Markets are trading lower.

- Domestic markets are indicated to open soft this morning.

This week’s focus will be Friday’s jobs report. Estimates call for an addition of 200K jobs for the month of November. The labor market is still extremely robust and adding jobs at a healthy pace. However, the announced layoffs in the tech space continue to add up.

Meta will be cutting 11,000 jobs, Amazon will be cutting 10,000, and HP will be cutting 3,000. The list goes on. As the economy and markets catch up to the Fed’s policies, we could see smaller jobs prints in the coming months - which is exactly what the Fed wants.

We are less than three weeks away from the Fed’s next policy meeting, which will set the tone for the start of 2023. A 50 bps (0.50%) hike is now the expected outcome but another overly robust jobs report, or if November’s CPI number creeps back up, we could see yet another 75 bps (0.75%) hike instead.

Favorable reports could bring about a Santa Claus rally to close the year on somewhat of a high note.

Have a wonderful week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.

If you would like to be removed from this e-Mail Alert Notification, PLEASE click the Reply button, type "remove" or "unsubscribe" in the subject line and include your name in the message, then click Send.