The Week in Review 11/14/22

“Logic will get you from A to Z; imagination will get you everywhere.”

–Albert Einstein

Good Morning,

What a week!!! Tremendous volatility… but this time to the upside!

All is not well in the land of crypto as FTX was crushed for facing a liquidity crunch. The week ended with FTX Group stunningly filing for Chapter 11 bankruptcy.

But even the unknown of what happens to crypto and any contagion from it could not stop buyers from the buying stampede!

There was a midterm election on Tuesday, the final results of which are still unknown as of this writing. Reports suggests the GOP will manage to claim a narrow majority in the House, yet some Senate races are still too close to call. In fact, it might take the December 6 runoff election in Georgia to determine if Democrats or Republicans have control of the Senate. With the GOP holding a narrow majority in the House, though, it is evident that the next few years likely won't include any new major spending plans or tax hikes. In other words, there will likely be legislative gridlock for the next few years.

The stock market was filled with trading excitement that produced the best day for the market on Thursday since 2020 and some huge gains for the major indices.

|

Index |

Started Week |

Ended Week |

Change |

% Change |

YTD % |

|

DJIA |

32403 |

33747.9 |

1344.7 |

4.1 |

-7.1 |

|

Nasdaq |

10475 |

11323.3 |

848.13 |

8.1 |

-27.6 |

|

S&P 500 |

3770.6 |

3992.93 |

222.38 |

5.9 |

-16.2 |

|

Russell 2000 |

1799.9 |

1882.74 |

82.87 |

4.6 |

-16.1 |

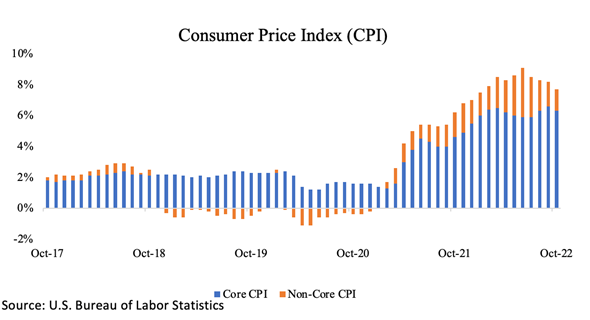

The main catalyst for the excitement was the October CPI report, which came in better than expected and much better than feared.

CPI increased 0.4% month-over-month in October (consensus 0.7%) while core-CPI, which excludes food and energy, increased 0.3% month-over-month (consensus 0.5%). The monthly changes left total CPI up 7.7% year-over-year, versus 8.2% in September, and core CPI up 6.3% year-over-year, versus 6.6% in September.

Investors came away with these takeaways…

- The report helped validate the peak inflation view.

- The report is apt to compel the Fed to take a less aggressive rate-hike approach at the December FOMC meeting.

- Some encouragement was borne out of the understanding that the shelter index (computed with a lag) contributed more than half of the monthly all items increase, suggesting price increases moderated in many other areas.

This welcome inflation news, combined with a huge drop in the dollar and market rates, launched an epic rally. The Nasdaq Composite for its part soared 7.4% on Thursday.

Many of the beaten-up growth stocks made double-digit percentage moves, including Amazon.com, but just about every stock came along for the CPI ride.

Growth stocks, though, were the favored rebound candidates as the 10-yr note yield dove 31 basis points to 3.84%. The 2-yr note yield, which is sensitive to changes in the fed funds rate, plunged 32 basis points to 4.31%.

Those moves were precipitated by changing rate-hike expectations. The fed funds futures market now sees an 83.0% probability of a 50-basis points rate hike at the December FOMC meeting (versus 56.8% before the CPI data) and a terminal rate of 4.75-5.00% by June (versus 5.00-5.25% before the CPI data).

The dollar got clobbered on those same shifting expectations. The U.S. Dollar Index fell a whopping 4.0% on the week to 106.42. The drop in the dollar took some of the pressure off the multinationals and aided in the belief that downward revisions to 2023 earnings estimates may not be as severe as feared, assuming the weakness persists.

Another factor aiding that belief was a Bloomberg report that China relaxed quarantine guidelines for inbound travelers and is aiming to avoid city-wide testing when COVID transmission chains are clear. This news, which came on Friday, helped boost oil and copper prices.

This also added to the market's newfound enthusiasm for a year-end rally. The S&P 500, which dipped below 3,500 following the disappointing September CPI report in mid-October, peeked its head above 4,000 on Friday and closed just below that level when the final bell for the week rang.

All 11 S&P 500 sectors logged gains last week, none bigger than the information technology sector (+10.0%), which was driven by a huge comeback effort among the semiconductor stocks and by Apple and Microsoft.

For the week, the Philadelphia Semiconductor Index was up 14.9%.

Other standouts included the communication services (+9.2%), materials (+7.7%), real estate (+7.1%), consumer discretionary (+5.9%), and financial (+5.7%) sectors. The weakest performers were the defensive-oriented health care (+1.8%) and utilities (+1.4%) sectors.

Market Snapshot…

- Oil Prices – West Texas Intermediate gained $2.47 to end the day at $88.94/barrel, while Brent crude rose $2.28 cents to $95.95/barrel.

- Gold – Gold prices extended its gain to a near three-month high. Spot gold was 0.06% higher at $1,765.26 per ounce, while U.S. gold futures gained 0.9% to $1,769.60 per ounce. Silver finished the week at $21.667.

- S. Dollar – The dollar index dropped down 1.65% at 106.42.Euro/US$ exchange rate is now 1.034.

- S. Treasury Rates – The yield on the benchmark 10-year Treasury note plunged more than 32 basis points to 3.816%, falling below the psychological 4% level.

- Asian shares were mixed in overnight trading.

- European Markets are trading higher.

- Domestic markets are trading slightly in the red this morning.

This week’s news will be centered around manufacturing, the housing market, and the Producer Price Index (PPI). The PPI is widely considered a leading indicator and could give some inclination on what producers are and are not passing through to their customers and whether October’s positive surprise could be the start of the trend moving forward.

Have a wonderful week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks. VIX is the Chicago Board Options Exchange (CBOE) Volatility Index, which shows the market's expectation of 30-day volatility. It is constructed using the implied volatilities of a wide range of S&P 500 index options. It is a widely used measure of market risk. The McClellan Summation Index is a long-term version of the McClellan Oscillator. It is a market breadth indicator, and interpretation is similar to that of the McClellan Oscillator, except that it is more suited to major trends. The McClellan Oscillator is a market breadth indicator that is based on the difference between the number of advancing and declining issues on the NYSE. It is primarily used for short and intermediate term trading. CBOE Put/Call Ratio Data - Looking inside the market can give us clues about its future direction. Put/call ratios provide us with an excellent window into what investors are doing. When speculation in calls gets too excessive, the put/call ratio will be low. When investors are bearish and speculation in puts gets excessive, the put/call ratio will be high. The Shanghai Stock Exchange Composite Index, is a market composite made up of all the A-shares and B-shares that trade on the Shanghai Stock Exchange. The Nasdaq-100 Index includes 100 of the largest domestic and international non-financial companies listed on The Nasdaq Stock Market based on market capitalization. The Index reflects companies across major industry groups including computer hardware and software, telecommunications, retail/wholesale trade and biotechnology. It does not contain securities of financial companies including investment companies.

Dividends are not guaranteed and must be authorized by the company's board of directors.

Diversification does not ensure a profit or guarantee against a loss.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

The prominent underlying risk of using cryptocurrencies as a medium of exchange is that they are not authorized or regulated by any central bank. Cryptocurrency users are not registered with the SEC, and the cryptocurrency market is currently unregulated. Bitcoin and other cryptocurrencies are a very speculative investment and involve a high degree of risk. Investors must have the financial ability, sophisticated/experience and willingness to bear the risks of an investment, and a potential total loss of their investment.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.