The Week in Review 11/07/22

“Someday computers will make us all obsolete.”

–Bobby Fischer

Good Morning,

Last week was another week of watching the Fed and hanging on every word they said to try to discover in their innuendo what the future might hold. And frankly for the markets it is becoming exhausting.

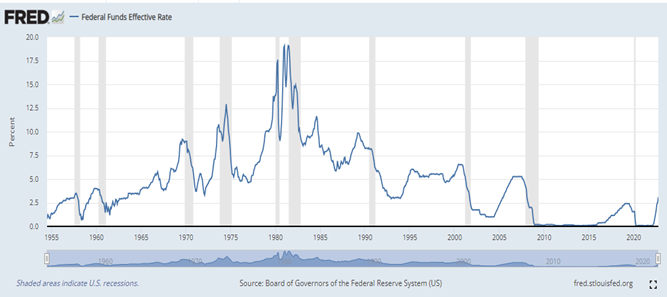

As we expected, the Fed raised rates .75%, which is the fourth .75% hike in a row, and the 6th hike this year… we have one of the most aggressive Feds we have ever seen in history.

Interest rates are now the highest they have been since 2008.

Fed Funds have gone from virtually zero to 3.75% - 4.25% in less than a year?

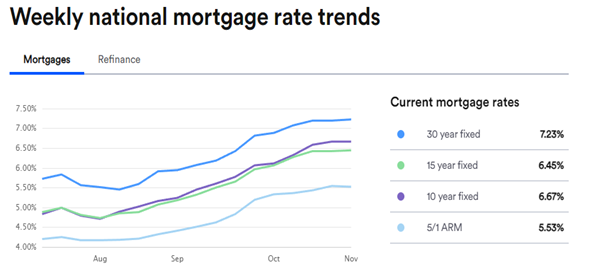

Mortgage rates have gone from below 3% to over 7%?

Source: Bankrate

We are seeing the housing market, and especially new home sales, hit the brakes rather dramatically.

What the markets were hoping for was Fedspeak to become more “dovish”, when referring to future policy, and we got very little of that. Instead we were almost guaranteed yet another rate hike in December.

The only positive taken out of Chairman Powell’s speech was that the size of future hikes could be less? A small concession indeed, but a concession.

Stocks fell and rates rose… until an attempt to “circle the wagons” gave us a very nice gain on Friday of 400+ Dow points. At the end of the week it was too little and too late to allow the week to produce a gain.

Market Snapshot…

- Oil Prices – Oil prices rose last Friday amid uncertainty around future interest rate hikes. West Texas Intermediate crude was up $4.39 or 4.98% at $92.56/barrel, while Brent crude was up $4.40, or 4.99%, at $98.61/barrel.

- Gold – Gold prices surged 3%. Spot gold rose nearly 3.19% to $1,684.90 per ounce, while U.S. gold futures were up 3.3% to $1,684.70 per ounce. Silver finished the week at $20.784.

- U.S. Dollar – The dollar index slumped on Friday for a weekly decline of around 1.93% and closed at 110.75. Euro/US$ exchange rate is currently 1.002.

- U.S. Treasury Rates – The 10-year Treasury yield traded about 5 basis points higher after rising earlier to 4.171%.

- Asian shares were higher in overnight trading.

- European Markets are trading mixed.

- Domestic markets are also trading mixed this morning.

Looking ahead…

These aggressive rate hikes are bound to start showing up in slowing CPI & PPI, and when/if we see these ease, the Fed will hopefully move to the “pivot” the markets so very much want.

Have a great week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.