The Week in Review 10/31/22

“I am struck that so many of our leaders in the U.S. forget how strong our country can be.”

- Jamie Dimon

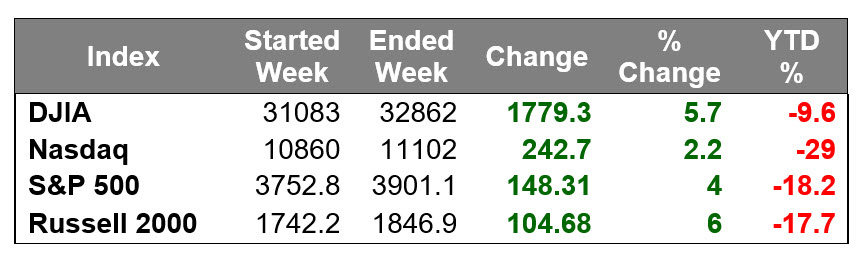

We had another outstanding week in the markets, in spite of some rather significant Tech earnings disappointments. Apple was a rare exception among the tech giants, trading up after reporting quarterly results. Meta Platforms, Alphabet, Microsoft, and Amazon all suffered heavy losses on the heels of their respective earnings reports.

A pack of blue chip companies provided a welcome distraction with good earnings news and guidance. Honeywell and Caterpillar were two of the biggest beneficiaries of this rotation out of the mega cap stocks.

Buying in names like Caterpillar and Honeywell led the S&P 500 industrials sector to close with the biggest weekly gain, up 6.7%. Other top performing sectors this week included utilities (+6.5%), financials (+6.2%), and real estate (+6.2%).

Meanwhile, the losses incurred by Meta Platforms and Alphabet drove the communication services sector to close down 2.9% on the week. It was the only sector to end the week with a loss. Another top laggard was the consumer discretionary sector (+0.7%). The remaining six sectors all closed with gains of at least 2.8%.

Small cap stocks were also a specific pocket of strength this week. The Russell 2000 gained 6.0%, which was more than the three major averages.

Other notable movers included Chinese stocks, and U.S. stocks with high exposure to the Chinese market, which sold off sharply in the first half of the week. This followed President Xi Jinping securing an unprecedented, third five-year term to serve as China's leader. That wasn't surprising, but it did come as a shock to many investors that he managed to surround himself only with loyalists who are apt to help him pursue tighter regulations and the continuation of China's zero-Covid policy.

JD.com and Pinduoduo were losing standouts for Chinese stocks while Las Vegas Sands and Starbucks also suffered heavy selling on concerns related to Xi's power grab. By the end of the week, however, these names recovered some of their losses.

There is a growing belief among market participants that the Fed will soften its approach after the November meeting. The policy move from the Bank of Canada this week further fueled this notion. The Bank of Canada raised its key policy rate by 50 basis points versus an expected 75 basis points. The European Central Bank, however, delivered a 75 basis point increase for its key policy rates, as expected.

Market participants digested a slew of economic data this week that both supported and undermined the notion that the Fed will soften its approach soon. Some of the data releases included:

- September Personal Income 0.4% (consensus 0.3%); Prior was revised to 0.4% from 0.3%; September Personal Spending 0.6% (consensus 0.4%); Prior was revised to 0.6% from 0.4%;

- September PCE Prices 0.3% (consensus 0.3%); Prior 0.3%; September PCE Prices - Core 0.5% (consensus 0.4%); Prior 0.5%

- The key takeaway from the report is that with continued income growth and a slightly hotter than expected Core PCE price growth, the Fed has an argument to maintain its aggressive rate hike course.

- Weekly Initial Claims 217K (consensus 220K); Prior was revised to 220K from 214K; Weekly Continuing Claims 1.438 mln; Prior was revised to 1.383 mln from 1.385 mln

- The key takeaway from the report is that the initial claims data suggest the labor market continues to hold up well, which of course is something that will continue to draw the Fed's attention.

- Q3 GDP-Adv. 2.6% (consensus 2.3%); Prior -0.6%; Q3 Chain Deflator-Adv. 4.1% (consensus 5.3%); Prior 9.0%

- The key takeaway from the report is that it ends a two-quarter streak of negative GDP prints. It also suggests the economy held up well in the third quarter as it started to acclimate to rising interest rates. Real final sales of domestic product, which excludes the change in private inventories, increased a solid 3.3%.

- October Consumer Confidence 102.5 (consensus 105.5); Prior was revised to 107.8 from 108.0

- The key takeaway from the report is that consumers' concerns about inflation picked up again in October on the back of rising gas and food prices.

Falling Treasury yields were a big support factor for the stock market. The 10-yr Treasury note yield dipped below 4.00%, but ultimately settled the week down 20 basis points at 4.01%. The 2-yr note yield fell nine basis points to 4.42%.

The soap opera in the UK goes on… Rishi Sunak was elected UK Prime Minister.

We hope everyone has a safe and Happy Halloween!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.