The Week in Review 10/24/22

"If I've made myself clear, I've misspoken." - Alan Greenspan

Finally a really positive week!

The stock market had a strong week that saw the S&P 500, Dow, and Nasdaq register gains of 4.7%, 4.9%, and 5.2%, respectively. Price action in the Treasury market enhanced the advance in the equity markets.

Things got off to a good start after Morgan Stanley Strategist Mike Wilson, who has been right this year with his bear market call, said the S&P 500 could get to 4,150 in a technical rally if a recession or earnings capitulation can be avoided. There was also a BofA fund manager survey that showed cash holdings at their highest level since April 2001 (6.3%), acting as a contrarian buying signal. Worthy of note is Mike Wilson has been Bearish for years.

The stock market rally ran into resistance midweek while market participants digested a slew of new Fedspeak.

First, Minneapolis Fed President Kashkari (2023 FOMC voter) said that he could argue for the fed funds rate to go above 4.75% if he doesn't see any improvement in underlying or core inflation.

Then, Philadelphia Fed President Harker (2023 FOMC voter) said he expects the fed funds rate to be well above 4.00% by end of the year. These comments coincided with the 10-yr note yield hitting its highest level since 2008 (4.23%) and the stock market shifting into retreat mode.

On Friday, San Francisco Fed President Daly (not an FOMC voter) said she thinks stepping down on the pace of rate increases will help preserve market structure. Saint Louis Fed President Bullard (FOMC voter) said he hopes to get a deflationary process going in 2023, adding that the job market remains strong, according to Bloomberg. These comments coincided with the 10-yr note yield pulling back to 4.21% and equities shifting back into rally mode. To be specific, the 10-yr note yield still rose 20 basis points this week.

In addition, The Wall Street Journal published an article by Nick Timiraos that indicated the Fed will raise rates by another 75 basis points at the November meeting, but will then possibly consider a smaller increase at the December meeting. Mr. Timiraos is thought by some to be the Fed's preferred source for leaking insight on what they are thinking about monetary policy in order to gauge the market's reaction to their thinking. Another form of Fedspeak?

Notably, the 2-yr note, which is more sensitive to changes in the fed funds rate, did not exhibit the same outsized reaction as the 10-yr note. The 2-yr note yield only rose one basis point this week to 4.51%.

Earnings were generally better than expected this week, which was a nice tailwind for stocks. Bank of America and Goldman Sachs were standouts for financials; AT&T and Verizon were standouts for communication services; United Airlines and Lockheed Martin were standouts for industrials; IBM and Lam Research were standouts for information technology.

But new age Darlings Snap and Tesla went against the grain and disappointed with their quarterly results.

For the S&P 500 sectors, energy was the top performer this week with a gain of 8.1%. Information technology came in second place with a gain of 6.5%. On the flip side, utilities (+2.0%) and consumer staples (+2.2%) showed the slimmest gains, but we will take 2% in a week..

In other news this week, Liz Truss resigned as the UK Prime Minister after roughly six weeks in office. Wow, a term of only 6 weeks?

Market Snapshot…

- Oil Prices – Prices rose in mixed trading, with West Texas Intermediate adding 54 cents to end the day at $85.05/barrel, while Brent crude settled up 1.21% to $93.50/barrel.

- Gold – Gold prices jumped as the dollar weakens on rate hike uncertainty. Spot gold was up 1.64% to $1,654.41 per ounce, while U.S. gold futures edged up 1.2% to $1,656.3 per ounce. Silver finished the week at $19.066.

- U.S. Dollar – The dollar index was 0.9% lower against its rivals at 111.86, down from a three-week high of 113.95. Euro/US$ exchange rate is now .987.

- U.S. Treasury Rates – The benchmark 10-year Treasury yield hit a fresh 14-year high at one point, then fell less than one basis point to 4.219%.

- Asian shares were mixed in overnight trading.

- European markets are trading in the green.• Domestic markets are trading slightly higher this morning.

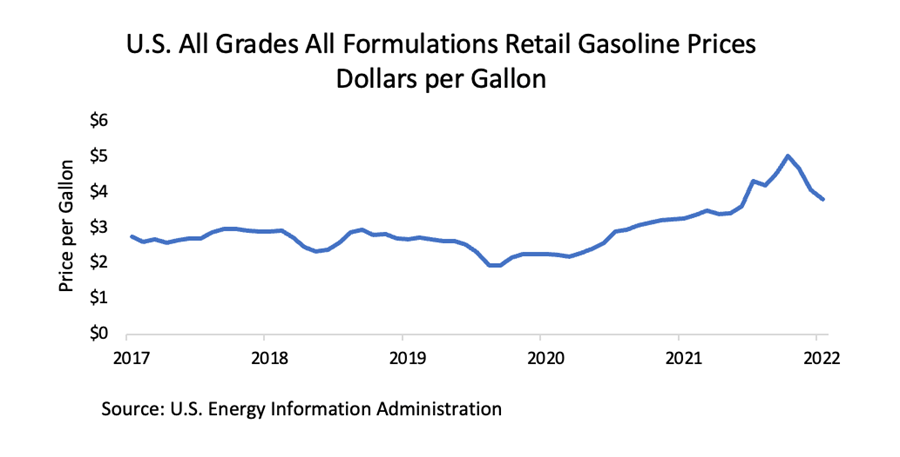

One of the biggest contributors to inflation is the price of gasoline… its recent decline should help the inflation numbers calm down.

President Biden’s recent release of 15M bbl. from the US Strategic Petroleum Reserve has suggested a floor now of $70 on crude oil… which beats $100 (or $120 just months ago) handsomely.

Perhaps the light at the end of this tunnel is not a train?

At the end of the day, it is all about earnings and they are, well OK… So far, we have heard from 20% of the S&P 500. Of those companies, 72% have reported positive EPS surprises and 70% have reported positive revenue surprises. Despite this, the earnings growth rate is only 1.5%, which is the lowest since 2020 (Source: Factset).

Not impressive, but not a recession… yet.

This week, we'll have plenty of news to watch. On top of the plethora of earnings reports, we'll receive new housing data, September’s PCE report, and the highly anticipated Q3 GDP report.

After two consecutive quarters of negative real growth, many hope for a positive report to assuage recessionary fears. The widely held belief is that two consecutive quarters of negative real growth indicates a recession is coming. While a highly accurate indicator, the success rate is not 100%. However, a third consecutive quarter might be met with renewed pessimism.

Have a wonderful week!!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.