The Week in Review 10/17/22

"Just before you break through the sound barrier, the cockpit shakes the most." - Chuck Yeager

Good Morning,

It was quite a week for the capital markets. It was also a losing week for the S&P 500 despite a 2.6% gain on Thursday following the September CPI report.

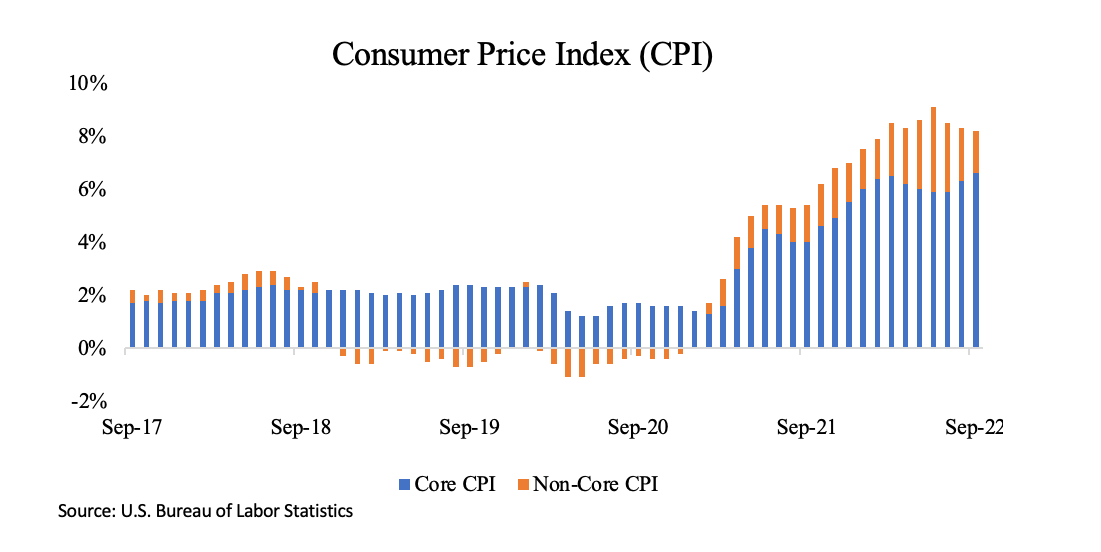

We might be inclined to think that the CPI report was good by the market’s reaction, but it was not. Total CPI was up 8.2% year-over-year, versus 8.3% in August, and core CPI, which excludes food and energy, was up 6.6% versus 6.3% in August. That was the highest level for core CPI since August 1982.

Worthy of mention is that the last 3 months we have seen a decline in CPI… albeit too slowly to tame the Fed.

The capital markets reacted accordingly (initially) in the wake of that disappointing report. Stock prices fell, Treasury yields shot higher, and the U.S. Dollar Index spiked. In the process, the S&P 500 fell to a new low for the year (3,491.58).

The move to that low, however, also included a 50% retracement of the pandemic rally.

That realization ignited a technically oriented rebound effort that was exacerbated by short-covering activity and computer-driven buy programs. It was a monster rebound, too. A rally in the UK gilt market, which followed reports that Prime Minister Truss might scale back her fiscal stimulus plan, added fuel to the rebound effort.

The Dow Jones Industrial Average swung 1,507 points from its intraday low to its intraday high on Thursday; the S&P 500 ended with a 2.6% gain after dropping 2.4%; and the Nasdaq Composite closed with a 2.2% gain after an early 3.2% decline.

But there was no follow through on Friday.

Although the S&P 500 would push as high as 3,712 on Friday, it quickly fell back as gilt yields rose sharply on festering worries about the state of the gilt market now that the Bank of England has withdrawn its emergency liquidity support, the 10-yr Treasury note yield topped 4.00%, and the recognition set in that Thursday's rally lacked fundamental credibility.

Some better-than-expected earnings results from JPMorgan Chase, Citigroup, Wells Fargo, andUnitedHealth provided a modicum of support but it was not enough to offset the broad-based selling pressure that picked up when the 10-yr note yield moved above 4.00%.

That move followed a preliminary University of Michigan Index of Consumer Sentiment report for October that showed a pickup in one-year and five-year inflation expectations. If nothing else, the inflation expectations data served as a reminder that the market got carried away with its post-CPI rally on Thursday.

It also stood out to market participants that the 10-yr UK gilt yield shot up to 4.38% (from 4.07% overnight) after Prime Minister Truss announced a scaled back fiscal stimulus plan and the firing of Finance Minister Kwarteng.

When the BoE announced its emergency gilt purchase operations on September 28, the 10-yr gilt yield stood at 4.32%, so the move above that level going into the weekend created some anxiety about what might unfold Monday in the gilt market when the BoE is back to the sidelines.

The selloff in the stock market on Friday was an orderly affair, which made it feel worse because there was very little interest from buyers. The same can be said for retail sales in September. There wasn't much added buying interest. Total retail sales were flat month-over-month while retail sales, excluding autos, were up just 0.1%. The retail sales numbers are not adjusted for inflation, so the lackluster numbers for September suggested consumers were pulling back on spending activity in the face of high inflation.

We haven't spent much time talking about the early portion of the week, but that's because it was a truly back-end loaded week in terms of news drivers. The one exception perhaps was JPMorgan Chase CEO Jamie Dimon's observation on Monday that he thinks the economy will be in a recession in six to nine months and that the market could easily fall another 20% if there is something like a hard landing. Thank you Jamie… he has been pessimistic on the economy for some time.

Separately, the IMF cut its 2022 global growth forecast to 2.7% from 2.9%, reports indicated new restrictions were being implemented in Chinese cities because of rising Covid cases, and President Biden indicated that there will be consequences for Saudi Arabia following the agreement to cut oil production. Russia, meanwhile, stepped up its missile attacks on Ukraine cities.

Thursday's trade notwithstanding, it was not a good week for a variety of reasons.

The hardest-hit sectors were consumer discretionary (-4.1%), information technology (-3.2%), utilities (-2.6%), and real estate (-2.4%). The Philadelphia Semiconductor Index, though, fared the worst of all, dropping 8.3%. Those sectors managing gains for the week included consumer staples (+1.5%), which got help from a good report out of PepsiCo (PEP), health care (+0.8%), and financials (+0.2%).

Another losing weak with the exception of the Dow Industrials…

|

Index |

Started Week |

Ended Week |

Change |

% Change |

YTD % |

|

DJIA |

29296.7 |

29634.83 |

338.13 |

1.2 |

-18.4 |

|

Nasdaq |

10652.4 |

10321.39 |

-331.01 |

-3.1 |

-34 |

|

S&P 500 |

3639.66 |

3583.07 |

-56.59 |

-1.6 |

-24.8 |

|

Russell 2000 |

1702.15 |

1682.4 |

-19.75 |

-1.2 |

-25.1 |

The U.S. Dollar Index increased 0.5% for the week to 113.30.

Market Snapshot…

- Oil Prices –West Texas Intermediate settled down 3.93% to end the day at $85.61/barrel, while Brent crude also slumped, falling 3.11% to $91.63/barrel.

- Gold – Gold prices fell more than 1% Friday and were headed for their worst week since mid-August. Spot gold had fallen 1.3% to $1,643.90 per ounce, while U.S. gold futures slipped 1.6% lower to $1,649.50 per ounce. Silver finished the week at $18.071.

- U.S. Dollar – The dollar index was up 0.6% against its rivals. Euro/US$ exchange rate is now .983.

- U.S. Treasury Rates – The benchmark 10-year Treasury yield topped 4% to trade at 4.025%.

- Asian shares were mixed in overnight trading.

- European markets are trading in the green.

- Domestic markets are also trading higher this morning.

Looking ahead…

Odds for a 75 bps. hike now stand at 96%. While it is always possible that Chairman Powell or other FOMC members could surprise us or release commentary in the next couple days or weeks to change our minds, we would be seriously surprised at any other course of action. Another oversized hike would bring the streak to four in a row, indicating this is the most aggressive the Fed has been since 1980.

Should the Fed change its minds and pivot, we could see a sustained rally, but for now, we expect markets to continue to be quite volatile.

Have a wonderful week!

The opinions expressed herein are those of Michael Hilger and not necessarily those of Raymond James & Associates, Inc., and are subject to change without notice. The information contained in this report does not purport to be a complete description of the securities, markets, or developments referred to in this material. There is no assurance any of the trends mentioned will continue or forcasts will occur. The information has been obtained from sources considered to be reliable, but Raymond James does not guarantee that the foregoing material is accurate or complete. Investing involves risk and you may incur a profit or loss regardless of strategy selected.

The information contained herein is general in nature and does not constitute legal or tax advice. Inclusion of these indexes is for illustrative purposes only. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results. The Dow Jones Industrial Average (INDU) is the most widely used indicator of the overall condition of the stock market, a price-weighted average of 30 actively traded blue chip stocks, primarily industrials. The Dow Jones Transportation Average (DJTA, also called the "Dow Jones Transports") is a U.S. stock market index from the Dow Jones Indices of the transportation sector, and is the most widely recognized gauge of the American transportation sector. Standard & Poor's 500 (SPX) is a basket of 500 stocks that are considered to be widely held. The S&P 500 index is weighted by market value, and its performance is thought to be representative of the stock market as a whole. The NASDAQ Composite Index (COMP.Q) is an index that indicates price movements of securities in the over-the-counter market. It includes all domestic common stocks in the NASDAQ System (approximately 5,000 stocks) and is weighted according to the market value of each listed issue. The Russell 2000 index is an unmanaged index of small cap securities which generally involve greater risks.

Investing in oil involves special risks, including the potential adverse effects of state and federal regulation and may not be suitable for all investors.

International investing involves special risks, including currency fluctuations, differing financial accounting standards, and possible political and economic volatility.

The companies engaged in the communications and technology industries are subject to fierce competition and their products and services may be subject to rapid obsolescence.

Gold is subject to the special risks associated with investing in precious metals, including but not limited to: price may be subject to wide fluctuation; the market is relatively limited; the sources are concentrated in countries that have the potential for instability; and the market is unregulated.

The information contained within this commercial email has been obtained from sources considered reliable, but we do not guarantee the foregoing material is accurate or complete.

Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Prior to making an investment decision, please consult with your financial advisor about your individual situation.

Charts are reprinted with permission, further reproduction is strictly prohibited.