Placing Markets in Context

Placing markets in context can be a helpful exercise

There’s no question about it. The U.S. economy and financial markets have been healthy and resilient. GDP and earnings growth since the GFC (Great Financial Crisis) low in early 2009 have been impressive. The increase in valuation multiples (e.g., PE, price to book) have also been impressive.

Our economy and financial markets are the envy of the developed world, and we believe favorable conditions can continue. That said, historically high valuation metrics have only travelled so far on the upside. From elevated levels, downside surprises have harmed many investors. That’s because high valuations embody confidence that necessitate strong execution to be sustained. Shocks to the downside often translate into significant declines. That's a risk that likely lies ahead, but whether that is anytime soon is unknown.

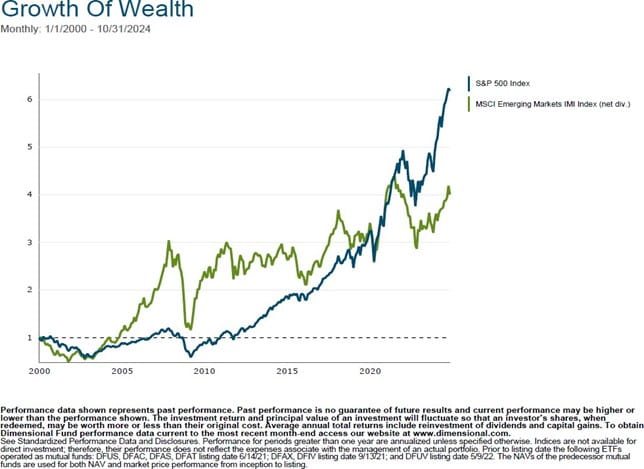

Please see the chart below. It shows the growth of the S&P and The MSCI Emerging Markets index from 1/01/2000 thru 10/31/2024.

Source: Dimensional

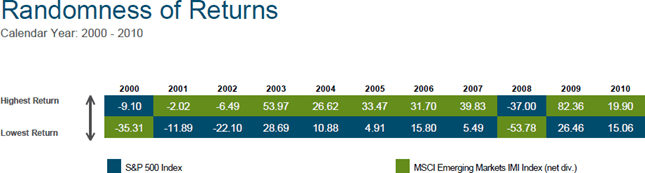

Here are a couple observations about the chart on the prior page. From year-end 1999, the emerging markets performed appreciably better than the S&P 500 for 15+ years. As the table below shows, the first years in the new Millenium were a period of EM dominance. The MSCI EM index outpaced the S&P 500 in 9 out of 11 years (e.g., 2000 – 2011). That said, from its low in March 2009, the S&P 500 has posted much larger gains.

Source: Dimensional

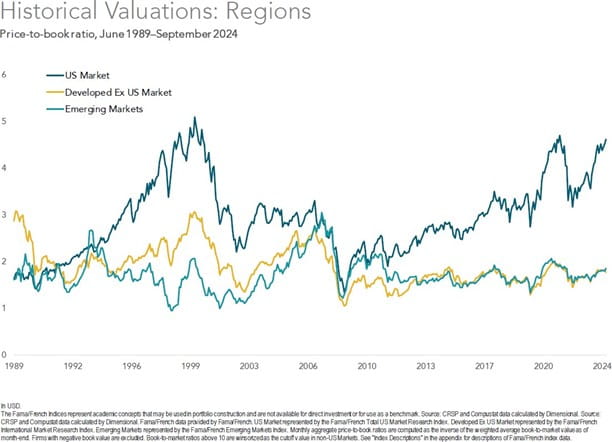

Increases in valuation metrics (e.g., price to earnings, price to book) translate into price gains that exceed the growth in earnings and/or book value per share. Declines in valuation partially or fully offset growth in fundamentals. Valuation changes have been more pronounced in the U.S. market since 1990 as shown in the table below –

Source: Dimensional

Valuation increases powered strong gains in the S&P 500 in the 1990s, while declines in valuation adversely affected returns in the 2000s. From the lows in 2009, valuation increases have once again powered strong gains in the S&P 500. As the table shows valuation increases in international equity markets have been more modest or down.

As the table below shows, valuation increases and decreases are also more pronounced in the U.S. large cap growth stocks relative to U.S. value stocks.

Source: Dimensional

In summary, U.S. stocks – especially U.S. large caps and U.S. large cap growth stocks have been extremely rewarding to own since the lows of their respective indexes since early 2009. When news is good, and markets are pleasing valuations tend to rise. In doing so, they magnify increases in earnings, sales and cash flow. The opposite occurs when valuation multiples contract. It is important to incorporate these considerations into one's purchase and sell decisions. A focus only on price change can lead investors astray. We don’t know when we will reach a major inflection point, but we believe investors are wise to anticipate and position for reversals. Throughout history many investors discover they are overly exposed to segments that have been extremely rewarding to own and that they have precious little ownership of market segments that lead the next phase of market leadership.

While we don’t know how long these favorable U.S. market conditions will last, our concern is that when the economy slows, that declines in valuation and price may once again catch investors by surprise. The good news is many other market segments are trading at or below their long-term valuation averages. If, and when, leadership changes occur, these lagging segments may once again provide ballast to portfolio values when they are sorely needed. We fully intend to remain diversified and to actively seek out out-of-favor segments that are available at reasonable valuations. While we can’t predict let alone pinpoint changes in leadership, history shows that it is prudent to prepare for them. Lastly, I have placed a few additional slides on index data furnished by our service partners at Vanguard and also FactSet in an endnote.i

Warmest regards for a happy Thanksgiving to you and all you care about from our merry group!

Warmest regards,

W. Richard Jones, CFA

Partner, Harmony Wealth Partners

i

Sources: Vanguard and FactSet

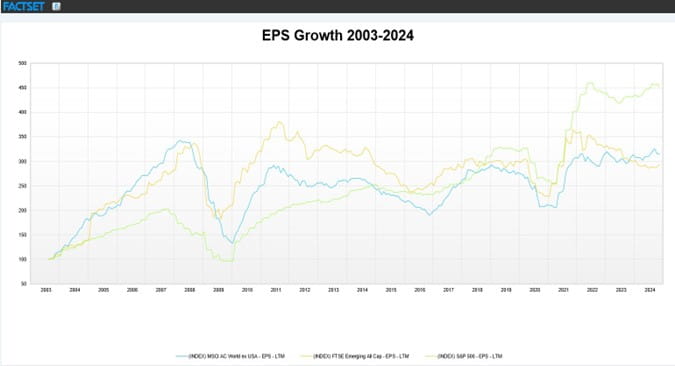

The S&P 500’s EPS growth has handily exceeded other international regions since 2009. That is not always the case.

Sources: Vanguard and FactSet

Valuation gains (PE ratio increases) have been healthy for the S&P 500 and muted for international markets. These factors translate into strong gains in the S&P 500 compared to international indexes especially since March 2009.

Sources: Vanguard and FactSet

Source: FactSet

The S&P 500 performed poorly from 1/31/99 thru early 2009 due to a significantly decline in its PE ratio and a decline in its EPS. Since then, the opposite has been true. Elevated valuation metrics tend to leave little room for disappointment. Many investors are surprised by sharp declines when markets have been pleasing to own for many years. The opposite is true for market segments that have been disappointing to own.