The stages of wealth management

Nowadays, investors have more to think about than just their portfolios. When managing wealth, one must also consider issues such as risk management, borrowing needs, estate planning and charitable giving.

Life is about stages, and so is wealth management. As investors move through different stages of life, they face a series of financial challenges that must be addressed. Some of these challenges arise earlier and continue throughout life, while others such as estate planning, come later in life. We view wealth management as a cycle with four main stages:

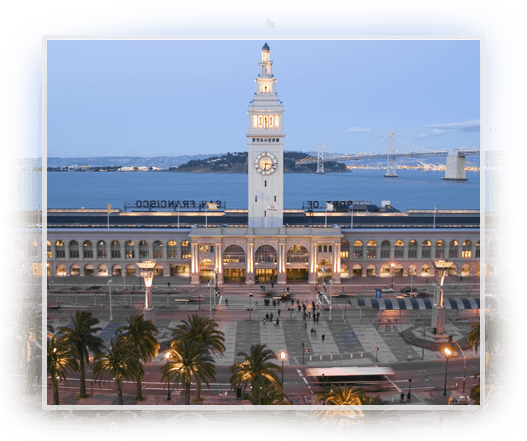

During this phase, investors are primarily focused on acquiring the assets they will need to meet their long-term financial goals.

As investors move into their peak earnings years, their financial focus may gradually shift from asset growth to risk management – preserving their portfolios from unexpected adversity to market volatility.

At some point, most individuals will need to draw upon their accumulated resources to fund specific needs, such as college tuition costs or retirement expenses.

Finally, many affluent individuals hope to leave a sizable legacy behind for their loved ones or their community.

By serving as your financial advisors for the long term, we can help you anticipate, prepare for and address the financial issues you face throughout your life.