« Back

Economic Monitor – Weekly Commentary

by Eugenio Alemán

Court delivers good news on tariffs, but…

May 30, 2025

Chief Economist Eugenio J. Alemán discusses current economic conditions.

Since the start of the second Trump administration and its strategy of imposing tariffs, we have stated that we are not fans of tariffs as an economic policy instrument. We have also noted that many of the tariffs imposed are punitive. But even if we don’t like tariffs, the biggest issue today is probably not the tariffs themselves, but the uncertainty that these on-and-off, on-and-off tariff decisions create. This week’s Court of International Trade decision, plus the appellate court’s suspension of that decision, will add many more layers of uncertainty that will continue to make consumers and firms’ decision-making process more daunting. At the same time, the court’s decision will probably reduce the negotiating power that the administration thought it would have when dealing with other countries. The judicial process in the US is not easy, and Trump knows very well how to make the process a long one, so it is difficult to know how this chapter ends. However, as we have said many times since this process started, the longer the uncertainty remains, the higher the risks will be for economic activity going forward.

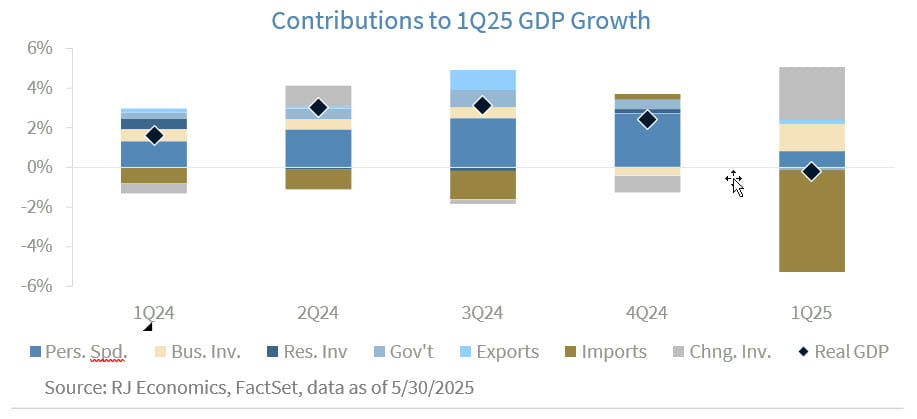

Q1 real GDP revision

Real GDP during the first quarter of the year was revised up slightly, from a decline of 0.3% to a decline of 0.2%, according to the Bureau of Economic Analysis. The revision was due to a relatively stronger investment profile, but fundamentally a larger contribution from an accumulation of inventories as well as a weaker than previously estimated contribution from personal consumption expenditures, i.e., consumer demand. At the same time, the drag from government expenditures and investment was lower than what was originally estimated.

The large positive contribution from the change in inventories, while positive during the first quarter of the year, could become a drag during the next several quarters as firms start to bring down those inventory levels, especially if consumer demand continues to expand and the uncertainty regarding tariff implementation continues for longer.

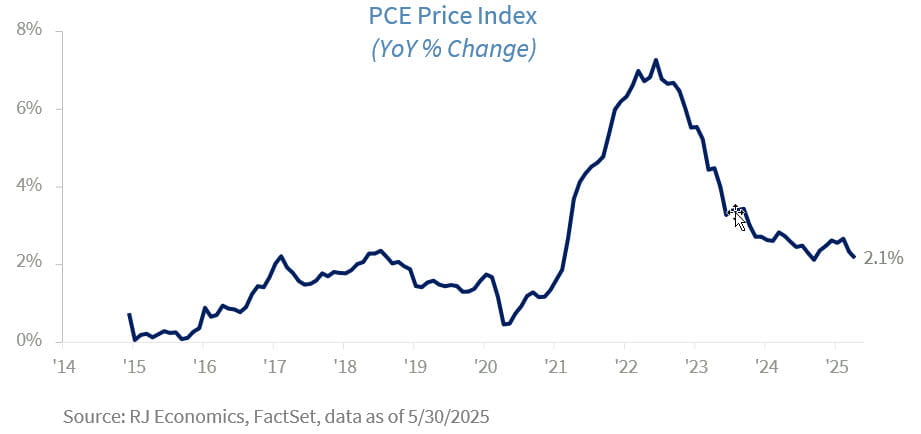

PCE inflation, personal consumption expenditures, and personal income

Today’s release of the personal income, personal consumption, and the PCE price index numbers for April, the first month of the second quarter of the year, was very encouraging, even though some of those encouraging numbers are going to be very short-lived. First, and from a consumer point of view, it is clear that those Americans who can prepare for what is coming are doing so. That is, Americans have been slowing down consumption even as incomes have been growing at a healthy clip. That has meant that the saving rate has surged to 4.9% of disposable personal income, up from a rate of just 3.5% at the end of 2024.

Of course, not all consumers are in a position to increase savings, but those who can are doing it in preparation for higher prices in the future. The second very encouraging development was that the Federal Reserve (Fed) came within a whisker of hitting the inflation target of 2.0% “over the long term” and although this is going to be short-lived for now, it is nonetheless a great achievement, considering that so many analysts have been arguing that the Fed would not be able to achieve the 2.0% target due to structural changes.

April’s 2.1% increase in the PCE price index reinforces the Fed’s credibility, not necessarily in keeping inflation perpetually low, but in demonstrating its ability to bring it back to the 2% target when needed. This will be especially important as upcoming tariff pressures are likely to push inflation higher in the coming quarters. That is, the Fed has all the tools necessary to bring inflation down to its 2.0% target. This should give investors and those worried about the US dollar, great comfort.

Economic and market conditions are subject to change.

Opinions are those of Investment Strategy and not necessarily those Raymond James and are subject to change without notice the information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. There is no assurance any of the trends mentioned will continue or forecasts will occur last performance may not be indicative of future results.

Consumer Price Index is a measure of inflation compiled by the U.S. Bureau of Labor Studies. Currencies investing are generally considered speculative because of the significant potential for investment loss. Their markets are likely to be volatile and there may be sharp price fluctuations even during periods when prices overall are rising.

The National Federation of Independent Business (NFIB) Small Business Optimism Index is a composite of ten seasonally adjusted components. It provides a indication of the health of small businesses in the U.S., which account of roughly 50% of the nation's private workforce.

The producer price index is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

Links are being provided for information purposes only. Raymond James is not affiliated with and does not endorse, authorize or sponsor any of the listed websites or their respective sponsors. Raymond James is not responsible for the content of any website or the collection or use of information regarding any website's users and/or members.