The September Slump Creates Buying Opportunities

The stock market often experiences a period of weakness in August and September, a phenomenon attributed to a confluence of factors. During these months, many traders and investors are on summer vacations, resulting in reduced trading volumes and a lack of market participation. This diminished activity can lead to heightened volatility as fewer participants are available to stabilize price movements. Additionally, the absence of substantial earnings reports during this time can leave investors with limited fundamental data to guide their decisions, making the market more sensitive to macroeconomic news and geopolitical developments.

The end of the summer season also coincides with the back-to-school period in many countries, diverting attention away from financial markets and contributing to decreased trading activity. These factors, combined with historical trends of geopolitical uncertainties and portfolio rebalancing by institutional investors, can collectively contribute to the observed weakness in the stock market during August and September.

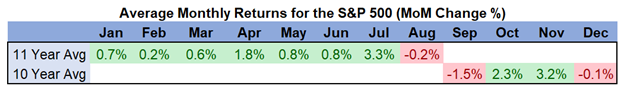

Our chart below shows the trailing returns for the S&P 500 for each month over the past decade of trading.

Source: FactSet

Historically speaking, the seasonal weakness of August and September is followed by some of the highest return months in October and November. The Santa Claus rally produces high powered returns for those investors who are patient.

When put into this context, we believe that the September slump creates not a selling opportunity, but a buying opportunity. Price dislocations from selling are bound to occur and with proper fundamental and technical analysis, investors can identify undervalued investments to add to their portfolios.

Speaking with your financial advisor to understand how these market trends effect your long-term financial plan is always best. But from where we sit, history tells us the time to put some cash to work is near!

Scott Miller, Senior VP – Investments

Brett Miller, CFA, CFP® - Financial Advisor

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Brett Miller and not necessarily those of Raymond James.