Santa Claus Is Coming to Town

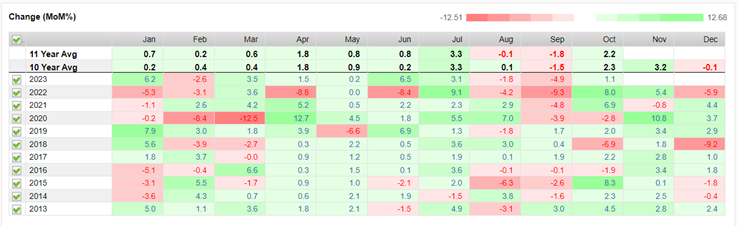

Last month we discussed the traditionally poor market months of August and September. These two months are among the worst for generating returns. Looking past the end of summer blues, its time to turn on the holiday music and prepare for joyful returns. When looking at the last 10 years, the “Santa Claus Rally” (the name given to the seasonal stock rally prior to the holidays), traditionally lifts investors profits into year end.

The stock market historically tends to perform well during the fourth quarter for several reasons. First, investors often exhibit increased optimism and confidence as they approach the end of the year. This is partially due to the holiday season, which tends to boost consumer spending and economic activity, translating into higher corporate profits. Additionally, many investors and fund managers engage in what's known as "window dressing" at the end of the year, where they purchase winning stocks to show on their year-end reports. This practice can drive up demand for specific stocks, contributing to a positive Q4 performance.

Furthermore, Q4 often brings about a season of earnings reports, with many companies releasing their annual or quarterly results. Positive earnings reports can stimulate market optimism and attract new investors, leading to higher stock prices. Additionally, the anticipation of strong holiday sales can influence retail-related stocks, contributing to the overall market's positive performance. This seasonal boost in consumer activity, corporate earnings, and investor sentiment can collectively fuel the stock market's historically positive performance during Q4.

Average Monthly Returns for the S&P 500 (MoM Change %)

Source: FactSet

Lastly, the fourth quarter is often associated with tax considerations and year-end investment decisions. Investors may engage in tax-loss harvesting or portfolio rebalancing to optimize their financial positions. These activities can lead to increased trading volumes, which can have a positive impact on stock prices.

While some years the rally does not hold true, we find the final months of the year are a great time to meet with your financial advisor and discuss how market conditions are impacting your financial plan.

- Brett Miller, CFA, CFP® - Financial Advisor

- Scott Miller – Senior VP, Investments

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary.The foregoing information has been obtained from sources considered to be reliable, but we do not guarantee that it is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Any opinions are those of Brett Miller and Scott Miller and not necessarily those of Raymond James.

There is no guarantee that these statements, opinions, or forecasts provided herein will prove to be correct. Past performance may not be indicative of future results. Keep in mind that there is no assurance that any strategy will ultimately be successful or profitable nor protect against a loss. Raymond James and its advisors do not offer tax advice. You should discuss any tax matters with the appropriate professional.