The Market Is Not Overvalued

“The market is overvalued” is once again a headline in financial media.

Many times, we hear broad statements categorizing the “Market”. These statements often refer to the S&P 500. Examining the index, the design of the S&P 500 can lead people to make inaccurate conclusions about the market. We’ll explain why.

The S&P 500 is a capitalization-weighted index. Our friends at Investopedia.com define a cap-weighted index: also known as a market value-weighted index, it is a type of stock market index in which individual components of the index are included in amounts that correspond to their total market value. With the capitalization-weighted method, the companies with a higher market cap will receive a higher weighting in the index. Proportionally, the companies with a small market cap will have less of an impact on the performance and metrics of the overall index.

For example, in today’s market, Apple, Microsoft, Amazon, Nvidia, Google, Tesla, and Meta Platforms make up nearly 28% of the index! Leaving the other 490+ companies to represent the remaining 72%. These 7 companies have an outsized influence on the S&P 500 compared to their peers and this includes the valuation.

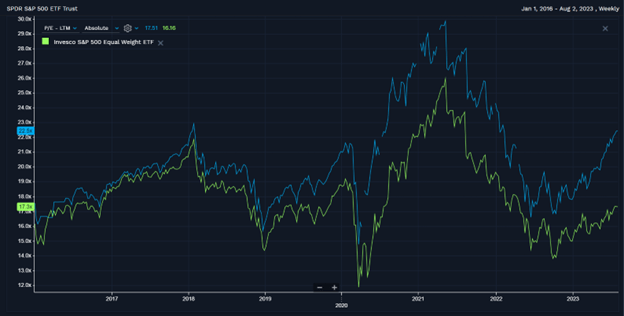

We believe a better representation of the market, is the S&P 500 Equal Weight Index. Instead of favoring the larger companies, this index gives all companies the same weighting. The index allows an equal representation of each company – a clearer view of “the market” in our opinion.

That leads us into the topic of present market valuations. Current claims point to an overvalued market when looking at the index’s Price to Earnings Ratio (P/E). P/E tells an investor how much they must pay for each dollar of earnings a corporation makes. It is used as a measuring stick for an overvalued or undervalued company, or when aggregated, a market.

Our chart below plots the P/E of the S&P 500 (symbol: SPY) vs. the equal weight S&P 500 (symbol: RSP) on August 1st, 2023. The combined P/E of the S&P 500 companies is now well above 20-year averages and sits at 22.5x using the capitalization method. We agree that it looks overvalued. Diving deeper, the equal weight S&P 500’s P/E is 17.3x, a much more reasonable metric by historical standard.

What does this tell us? Simply put, the outsized influence of the largest tech companies is giving the S&P 500 a higher Price to Earnings. Accounting for over roughly 15% of the index, Apple and Microsoft have P/E ratios north of 33 – almost double that of average stock in the S&P 500. That leads us to the conclusion on the market. Big tech is expensive, but the rest of the market is reasonably valued.

Stretched valuations on stocks can make future gains harder to come by, so current market conditions are ideal for stock pickers. Reasonable valuations outside of Big Tech signal opportunity in the market still exists. Also, the benefits of diversified portfolios begin to shine. We believe there is still a case for owning the Apple’s and Microsoft’s of the world, but implementing a value-oriented investment discipline is essential to long-term success regardless of your risk tolerance.

Reach out to your advisor to better understand how these factors affect your investment plan.

- Brett Miller, CFA, CFP® - Financial Advisor

- Scott Miller – Senior VP, Investments

Any opinions are those of Brett Miller and Scott Miller and not necessarily those of Raymond James. This information is intended to be educational and is not tailored to the investment needs of any specific investor. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete, it is not a statement of all available data necessary for making an investment decision, and it does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected. Past performance is not indicative of future results.

Every investor's situation is unique, and you should consider your investment goals, risk tolerance and time horizon before making any investment. Prior to making an investment decision, please consult with your financial advisor about your individual situation. You should discuss any tax or legal matters with the appropriate professional. Charts are for illustration purposes only and not a recommendation.

Keep in mind that individuals cannot invest directly in any index, and index performance does not include transaction costs or other fees, which will affect actual investment performance. Individual investor's results will vary. Past performance does not guarantee future results.