Should I stay or should I go?

Understanding the Impact of Leaving the Workforce for Caregiving on Your Retirement Savings

While discussions around the wage gap and income inequality for women are prevalent, there's a less highlighted yet crucial aspect: the pressure on women to take time away from their careers to care for family members, be it children or elderly parents. This often-overlooked responsibility can significantly impact a woman's retirement nest egg, especially considering that two-thirds of caregivers surveyed in a 2020 CDC study were women.

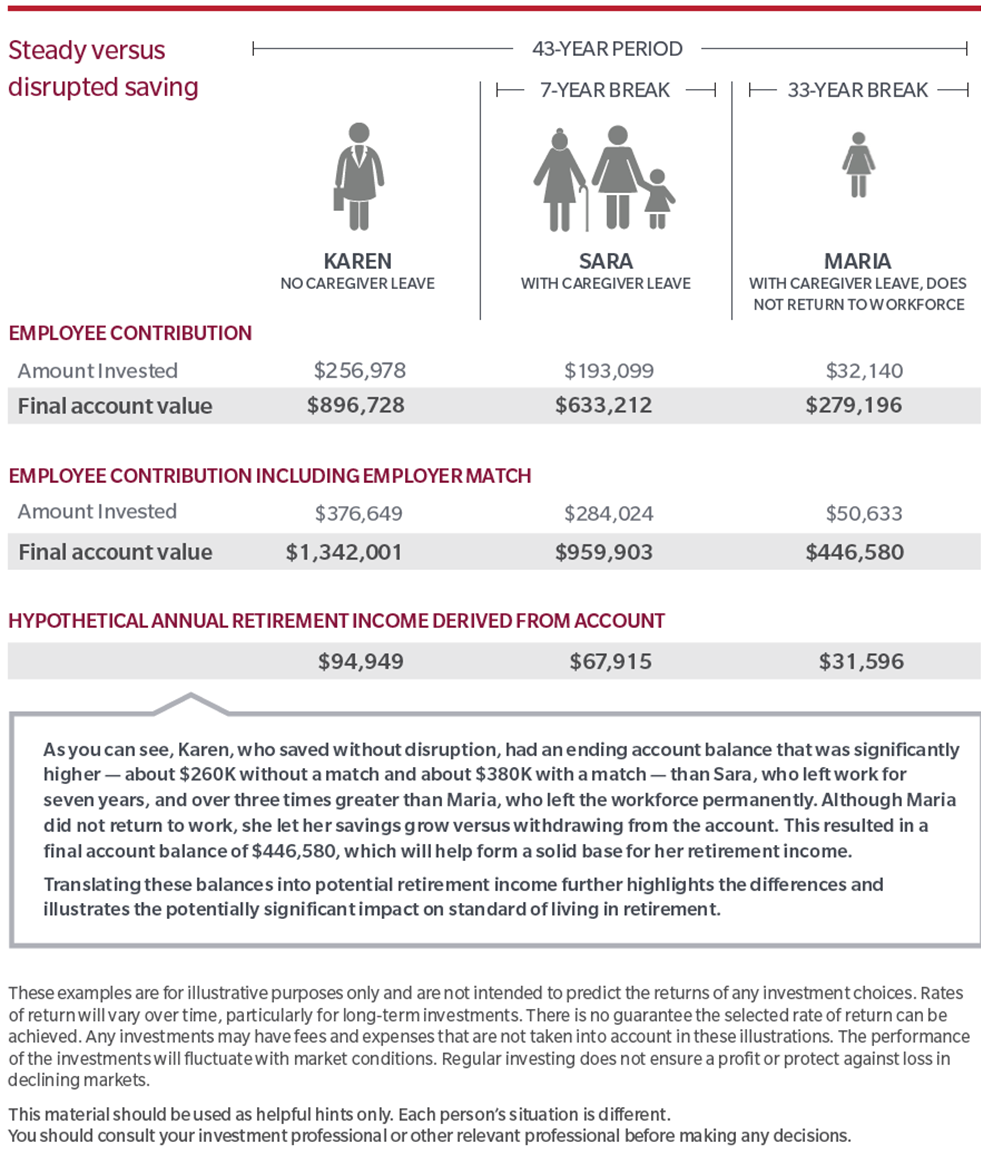

But what are the real implications for your savings? Let's explore by comparing the scenario of consistently saving in a hypothetical employer-sponsored defined contribution (DC) retirement plan against the alternative of taking a seven-year break or permanently leaving the workforce due to caregiving responsibilities.

A When, Not an If

For many of us, caregiving is a role we’ll take on repeatedly over the course of our lives.

If you've decided to take time off work to care for loved ones (or even before!) I encourage you to prepare with these simple tips:

Before Taking Time Off:

- Understand who might depend on you. This could include older loved ones, children, spouses, extended family, pets, even friends. Your clients’ plans are only as solid as the least prepared person in their circle.

- Prepare key documents.Do you have current and complete powers of attorney, living wills, healthcare proxies, wills, etc.? Do the people named know they are?

- Get to know your family health history.What conditions are in your family tree? How long have older relatives lived? How well?

- Evaluate Workplace Caregiving Support: Do you have access to caregiving support services at work, including emergency/backup care, eldercare or paid caregiving concierge services?

While Taking Time Off:

- Keep Saving: Even if it's just a little, try to save money regularly, maybe through a spousal IRA. This helps your money grow over time.

- Use Retirement Benefits: If you have a retirement plan from a previous job or your spouse's job, make sure to contribute as much as you can.

- Choose Wisely: When investing, pick options that have the potential to earn more, especially if you're younger. This gives you more time to recover if the market goes up and down.

- Stay Informed: Take the time to educate yourself about financial matters, even if you don't have a formal education. There are plenty of online resources and courses available for free or at low cost that can help you improve your financial literacy and make more informed decisions.

Keep Reading:

On Caregiving:

Becoming a Caregiver – what to keep in mind when you become a primary caregiver.

Caregiving in the US – in partnership with AARP and National Alliance for Caregiving, this resource surveys the American caregiver.

A Place for Mom – find and compare senior living options at no cost to you.

Returning to work:

Relaunch your career with a Returnship

If you do leave, what can you do with an old retirement plan?

💡Want personalized advice? Request a complimentary 30-minute conversation with a trusted advisor here in the Triangle.

Charlotte Galamb is a financial advisor at Raymond James in Raleigh, North Carolina, helping people navigate life transitions and secure their financial futures. For more information, visit her website or email charlotte.galamb@raymondjames.com.

While familiar with tax provisions, we, as Financial Advisors of RJA, do not give advice on tax or legal matters. Discuss such matters with appropriate professionals. The information provided may not be complete or accurate and does not constitute a recommendation. Opinions expressed are those of Charlotte Galamb of Raymond James Raleigh Branch and Cary Financial Advisor and not necessarily those of Raymond James or Raymond James Financial Service.

Key assumptions

Starting age = 22 | Starting salary = $40,000 | Annual pay increase = 2% | Employee contribution = 3% escalating by 1% per year up to 10% | Employer contribution = 3% match on first 3% deferral, plus 50% of next 3% deferral (maximum match of 4.5%) | Fixed rate of return of 6% per year | Age at break for Sara and Maria = 32 | Length of break = 7 years for Sara, 33 years for Maria | Salary upon return = same as when left the workforce | The hypothetical example assumes that when Sara returns to the workforce she contributes to her DC account at the same rate she was contributing when she left (10%) | Age at retirement = 65 | Assumed life expectancy = 20 years from age 65 | Hypothetical annual income represents a level 20-year annuity calculated using a discount rate of 4%.

Sources: Census Bureau, 2019; Merrill Lynch 2019; MFS Advisor Edge Should I Stay or Should I Go?, October, 2023, Distributed by MFS FUND DISTRIBUTORS, INC., MEMBER SIPC, BOSTON, MA.