Choosing The Right Savings Plan A Tale of Two Couples

When it comes to saving for their children’s future, every family has unique goals and circumstances. Let’s explore the stories of two couples, the Johnsons, and the Smiths, and how they chose between a 529 plan and a UTMA account to best meet their needs.

THE JOHNSONS

PRIORITIZING EDUCATION WITH A 529 PLAN

Meet the Johnsons: Sarah and Mark Johnson are a young couple with two children, Emily and Jake. Both Sarah and Mark highly value education and want to ensure their children have the financial support they need to pursue higher education without the burden of student loans.

Their Goal: The Johnsons’ primary goal is to save for Emily and Jake’s college education. They want to take advantage of tax benefits and ensure that the funds are used specifically for educational purposes.

Their Choice: After researching their options, the Johnsons decide to open a 529 plan for each child. Here’s why:

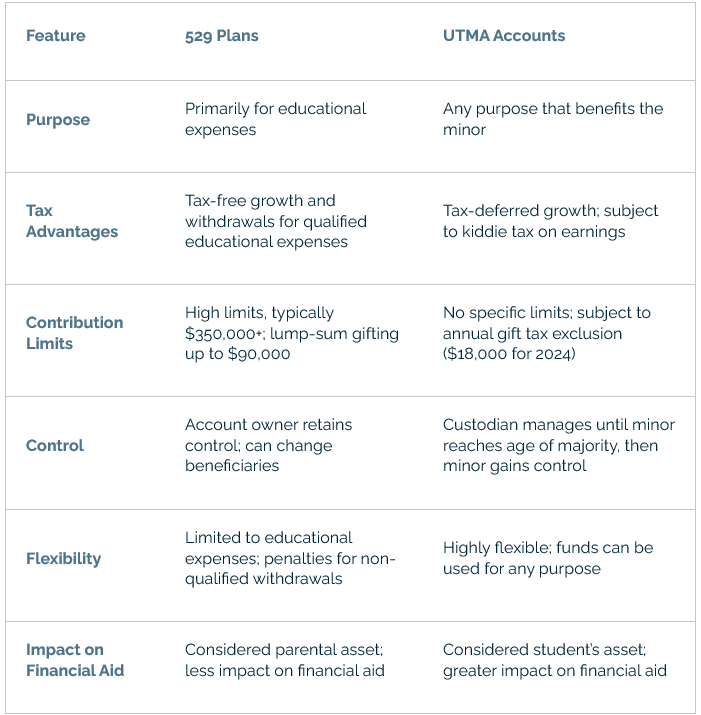

Tax Advantages: Contributions to the 529 plans grow tax-deferred, and withdrawals for qualified educational expenses are tax-free. This means they can maximize their savings without worrying about taxes eating into their funds.

High Contribution Limits: With lifetime contribution limits typically exceeding $350,000, the Johnsons can save a substantial amount for both Emily and Jake’s future education.

Flexibility: If Emily or Jake receives a scholarship or decides not to attend college, the Johnsons can change the beneficiary to another family member or even use the funds for their own educational needs.

Secure Act 2.0: Starting in 2024, they can roll over up to $35,000 from a 529 plan to a Roth IRA in the beneficiary’s name, providing additional flexibility for retirement savings. *see end of post for more information regarding Secure Act 2.0*

Control: Sarah and Mark retain control over the accounts, ensuring the funds are used as intended.

Outcome: By choosing 529 plans, the Johnsons feel confident that they are providing a solid financial foundation for their children’s educational futures. They appreciate the peace of mind that comes with knowing their savings are growing tax-free and will be available when needed.

THE SMITHS

EMBRACING FLEXIBILITY WITH A UTMA ACCOUNT

Meet the Smiths: Lisa and Tom Smith are a couple with one child, Alex. They value flexibility and want to ensure that Alex has financial support for a variety of future needs, not just education.

Their Goal: The Smiths want to save money for Alex’s future but are not sure if it will be used for college, starting a business, buying a car, or any other significant expense.

Their Choice: After considering their options, the Smiths decide to open a UTMA (Uniform Transfers to Minors Act) account for Alex. Here’s why:

Flexibility: Funds in a UTMA account can be used for any purpose that benefits Alex, not just educational expenses. This aligns with the Smiths’ desire for flexibility.

No Specific Contribution Limits: While contributions are subject to federal gift tax limits, there are no specific caps on how much they can save in the account.

Tax Treatment: Although earnings are subject to the “kiddie tax,” the Smiths are comfortable with this trade-off for the flexibility the account offers.

Control: Lisa and Tom will manage the account until Alex reaches the age of majority (21-25 in Virginia), at which point Alex will gain full control. They believe Alex will be financially mature enough to handle the responsibility by then.

Outcome: By choosing a UTMA account, the Smiths feel they are providing Alex with the financial flexibility to pursue various opportunities in the future. They appreciate the ability to use the funds for any purpose that benefits Alex, whether it’s starting a business or another significant life event such as a down payment on a house.

FINDING THE RIGHT FIT

Both the Johnsons and the Smiths made thoughtful decisions based on their unique goals and circumstances. The Johnsons prioritized educational savings with a 529 plan, taking advantage of tax benefits and high contribution limits. Meanwhile, the Smiths valued flexibility and chose a UTMA account to support a wide range of future needs for Alex.

When deciding between a 529 plan and a UTMA account, consider your specific goals, the level of control you want to maintain, and how you plan to use the funds. Each option has its own advantages and can be the right choice depending on your family’s needs.

COMPARISON: 529 PLANS VS. UTMA ACCOUNTS

SECURE ACT 2.0 529 TO ROTH

Effective January 1, 2024, assets in a 529 college savings account may be rolled over directly to a Roth IRA in the beneficiary’s name. The industry is still striving to clarify certain specifics, but we do know the general requirements.

General Requirements

- The 529 plan must be open for 15 or more years.

- Contributions and associated earnings must have been in the 529 plan account for at least five years to qualify for a rollover to a Roth IRA. Contributions and associated earnings made within the last five years are ineligible.

- A lifetime maximum of $35,000 per beneficiary can be rolled over from a 529 plan to a Roth IRA.

- The 529 to Roth IRA rollover is subject to the IRA annual contribution limit for the taxable year, applicable to the beneficiary for all individual retirement plans maintained for the benefit of the beneficiary. Thus, the total amount that can be rolled over from a 529 plan to a Roth IRA annually is the annual IRA contribution limit for the year, reduced by the total of any other IRA contributions made by the beneficiary in that year. The contribution limit for 2024 is $7,000 for a beneficiary under age 50 and $8,000 for a beneficiary age 50 or older.

- The beneficiary must have earned income sufficient to make the contribution into the Roth IRA.

Investors should consider, before investing, whether the investor's or the designated beneficiary's home state offers any tax or other benefits that are only available for investment in such state's 529 savings plan. Such benefits include financial aid, scholarship funds, and protection from creditors.

As with other investments, there are generally fees and expenses associated with participation in a 529 plan. There is also a risk that these plans may lose money or not perform well enough to cover education costs as anticipated. Most states offer their own 529 programs, which may provide advantages and benefits exclusively for their residents. The tax implications can vary significantly from state to state.

Any opinions are those of Austin Storck and not necessarily those of Raymond James. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Investing involves risk and you may incur a profit or loss regardless of strategy selected.