It's been a year

It has been an interesting year in the financial world, there have been many twists and turns. The following is a quick review of the major financial related happenings in 2023:

Stocks

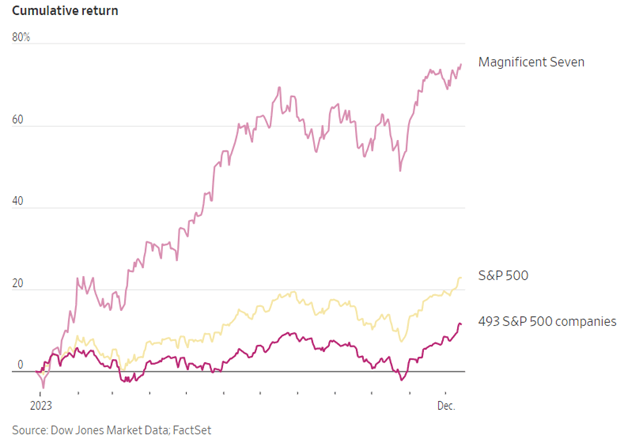

Most stocks spent 2023 meandering from slightly positive to slightly negative returns for the year until October, where they had a strong rally to finish the year. The exception was the “Magnificent Seven” (Apple, Google, Amazon, Meta, Microsoft, Nvidia and Tesla) which as a group are up about 75% this year. These companies’ performance was widely attributed to them being beneficiaries of the artificial intelligence mania. The chart below shows how big the difference in the returns of the Magnificent Seven has been versus the rest of the market. The other approximately 493 stocks that comprise the S&P 500 are up about 12% this year- and all that gain happened in the last two months. What does that teach us again? That a handful of stocks and days drive the market. And knowing which days and stocks will be the drivers of market performance in the future is unknowable.

Interest rates

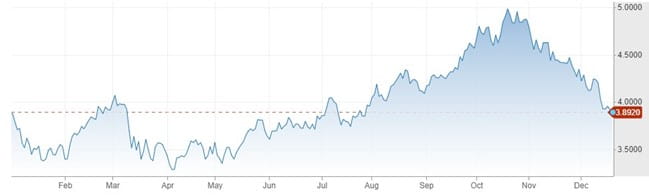

Interest rates went up sharply, especially in the bond market from June to the end of October, then came diving down in the last month or so. As the chart below shows, the ten- year U.S. Treasury bond yield started 2023 at 3.6%, rose to 5% in the middle of October, then dropped quickly to its current yield of 3.9%.

Chart: The Federal Reserve

So it has been and up and down year for both stocks and bonds, with big moves in both directions in very short time frames. Which again illustrates how impossible it is to try and time movements in the markets.

Wisdom

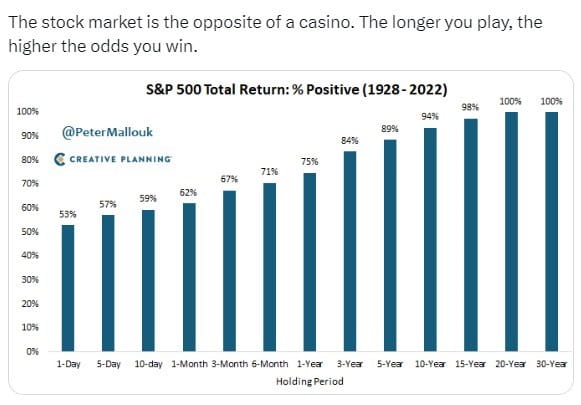

Sadly, Warren Buffet’s long time partner Charlie Munger passed away recently at the age of 99. One of his comments in his last interview a month before he died was about the value of not interrupting the compounding of returns. Investors do this by trying to get in and out of the market at various points as well as trying to determine when to invest. One comparison that I thought was of value was the chart below- comparing how unlike at a casino, your odds get better and better the longer you are in the market.

Chart: Creative Planning

While we don’t know what returns will be next year, for almost 100 years the chart above illustrates the longer you stay invested in a diversified portfolio, your chances of success increase substantially.

Also, most importantly please know it is an honor that you have entrusted us to help you. Our most valuable asset is your trust in us. And thank you very much for that.

We wish you and your family Merry Christmas, Happy New Year and Happy Holidays!

Thanks,

Beach

Disclosure: Any opinions are those of Beach Foster and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained here does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There are special risks associated with investing with bonds such as interest rate risk, market risk, call risk, prepayment risk, credit risk, reinvestment risk, and unique tax consequences. To learn more about these risks and the suitability of these bonds for you, please contact our office. If you no longer wish to receive this email, please reply “unsubscribe”.