Cash

After a tumultuous but finally good year in 2023, what does 2024 hold?

That is the question on many investors’ minds as the new year gets underway. So far this year, it has been rather uneventful in the financial markets.

The stock market has been relatively flat and interest rates have crept up a little in the bond market. Money market funds (MMFs) are still offering attractive rates since the Federal Reserve (Fed) has not changed the rates they control.

There have been huge inflows of cash into MMFs in the last six months as these rates have moved from near zero for the last 15 years to the 5% range. One issue investors should weigh as they put funds in MMFs is while they are attractive now, the same entity that drove them up can also drive them down.

The Fed increased short term rates at a record pace the past 18 months. This was an effort to tamp down inflation which reached as high as 9% at its peak in mid-2022. But we need to remember that this is the same entity that kept rates at near zero for over a decade. While that is not expected now, should the economy slow down considerably, the Fed may feel it necessary to reduce rates again.

Below is a chart showing the history of how cash has done versus the stock market over various periods of time.

Chart source: Creative Planning

As you can see above, the longer the time period, the more often cash has underperformed the stock market.

We believe that funds that might be accessed soon should not be at risk, and MMFs are a great vehicle for that. But as you can see, if these are funds that do not need to be liquidated for a planned expenditure, a monthly stipend or just ready cash, then the longer it stays in cash the less beneficial it has been. After just 3 years, the stock market has done better than cash 78% of the time.

Speaking of cash, one of the most overlooked benefits that accrue to long term, diversified stock market investors is cash. More specifically growing cash flow.

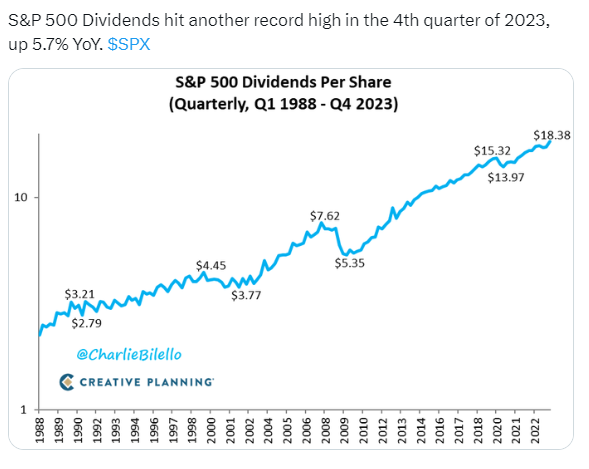

The chart below shows how much your income would have grown invested in the S&P 500 since 1988. This is why stocks are seen as an inflation hedge.

Chart source: Creative Planning

We will see what kind of year 2024 brings us. Last year at this time the consensus view of for 2023 from most Wall Street Experts was a recession that never happened. There are many reasons not to make predictions, and we thank Yogi Berra for his advice in that regard. As the wise Yogi said “It’s tough making predictions, especially about the future.”

Hopefully this newsletter helps to keep the focus on the benefits of a long-term strategy. We will experience the intermittent downward squiggles as shown in the graph above. But it has been a rewarding experience for investors who know these will occur from time to time but stick with a disciplined strategy.

Thank you as always for your trust and confidence in us. You will be hearing from us soon but please don’t hesitate to call us in the interim.

Thank You,

Beach

Any opinions are those of Beach Foster and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained here does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There are special risks associated with investing with bonds such as interest rate risk, market risk, call risk, prepayment risk, credit risk, reinvestment risk, and unique tax consequences. To learn more about these risks and the suitability of these bonds for you, please contact our office.