Separating Stock Owners from Renters

One of the things the stock market does regularly is find out who are the real long-term owners of the world’s best companies. It does that by having regular downdrafts. People who “rent” stocks usually get out after they have seen their brokerage statements shrink by a certain amount. Long-term investors (owners) either ignore these periods or use them to increase their ownership of these companies.

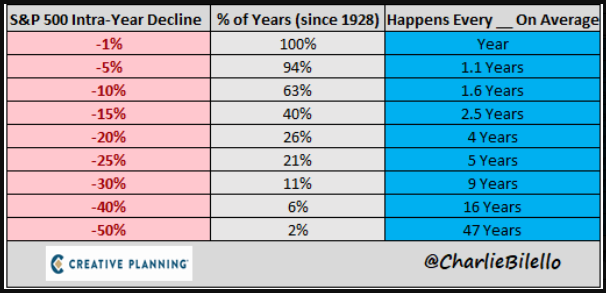

The chart below is a helpful reminder of how often these “shake-outs” occur. We just experienced a drop of a little over 10% from the high for the S&P 500. As the chart demonstrates, this level of drawdown on average occurs every 1.6 years- in other words regularly.

How this chart is most helpful is to teach investors to expect these periods. Something that has happened every 18 months should be expected to happen again. If investors expect that periodically they will open their statements to values that were lower than previous statements, sometimes a good bit less, then they can focus on the long-term benefits of stock ownership.

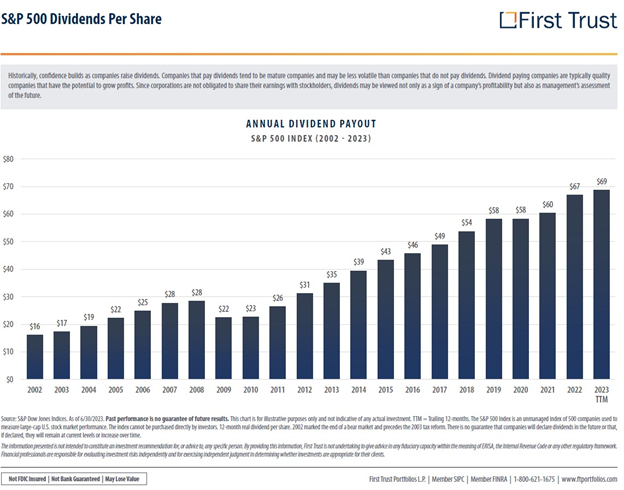

The next chart shows the long-term benefits of stock ownership. This chart answers the question as to why we investors willingly subject ourselves to getting our nose bloodied from time to time.

We do it because with a great deal of consistency and much less volatility we get an increase in our income from the stock market. This chart shows the income per share of the S&P 500 since 2012.

Looking just at the increase in dividends since 2015, we see a 60% increase in dividends. But you had to endure a 20% pullback at the end of 2018, a 35% drop during Covid in 2020, 25% drop in 2022 and the recent 10 % drop since this summer.

This is why we invest in an asset that regularly gives us heartburn when it comes to it’s price, but has historically been very good at giving us consistent pay raises.

We never know when a decline will end. But we do know that every time there has been a decline, regardless of the magnitude, the market has eventually gone on to make a new high. And the only people that are certain to benefit from the new higher levels of profits and income are those who stayed put when the market was testing them.

There are always a lot of things to worry about when investing, and sometimes it seems like the list is longer than usual. When talking with clients, it feels that way now. But realize that many other investors have the same concerns and much of that concern is likely already reflected in lower prices of financial assets.

It is certainly more fun to see our investment statements go up regularly, but unfortunately that is not how markets work. Markets make you “earn” that return by not reacting to our emotions and staying disciplined.

As always you will hear from us, but please do not hesitate to call us in the interim with any questions, thoughts or concerns.

Thank you for your trust and confidence in us.

Beach

Disclosure: Disclosure: Any opinions are those of Beach Foster and not necessarily those of Raymond James. Expressions of opinion are as of this date and are subject to change without notice. The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. The information contained here does not purport to be a complete description of the securities, markets, or developments referred to in this material. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. Past performance may not be indicative of future results. Future investment performance cannot be guaranteed, investment yields will fluctuate with market conditions. Investing involves risk and you may incur a profit or loss regardless of strategy selected, including diversification and asset allocation. Raymond James and its advisors do not offer tax or legal advice. You should discuss any tax or legal matters with the appropriate professional. Bond prices and yields are subject to change based upon market conditions and availability. If bonds are sold prior to maturity, you may receive more or less than your initial investment. Holding bonds to term allows redemption at par value. There is an inverse relationship between interest rate movements and bond prices. Generally, when interest rates rise, bond prices fall and when interest rates fall, bond prices generally rise. There are special risks associated with investing with bonds such as interest rate risk, market risk, call risk, prepayment risk, credit risk, reinvestment risk, and unique tax consequences. To learn more about these risks and the suitability of these bonds for you, please contact our office. If you no longer wish to receive this email, please reply “unsubscribe”.