Term vs Perm Life Insurance? What’s the difference?

Key takeaways

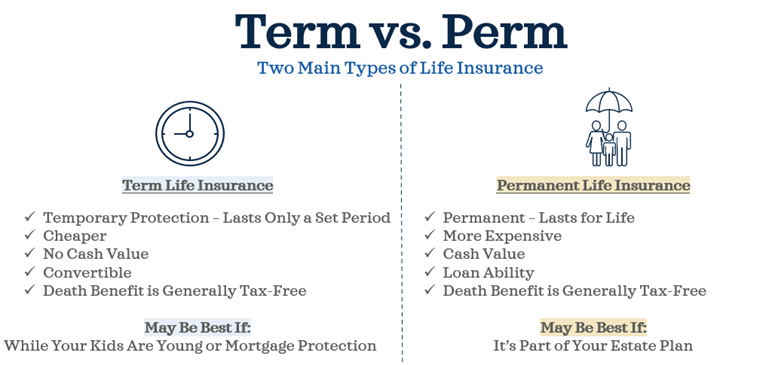

- Term life insurance provides temporary coverage at the most affordable prices

- Permanent insurance could grow in value and offer various other benefits

- The right kind and amount of coverage depends on your needs and life stage

Two Main Types of Life Insurance

- Term Life Insurance – coverage for the duration you want

- Accommodates for temporary circumstances1

- Provides coverage that ranges from one year to 30 years

- Can be converted to permanent insurance, depending on the policy

- Provides a death benefit with no cash value2

- Offers affordable, cost-effective premiums3

- Permanent Life Insurance – designed for your long-term needs

A permanent insurance policy can offer you protection for life⁴ (as long as it does not lapse⁵, ⁶) and access to the tax-deferred cash value of the policy to help cover future income needs.- Fixed Premiums

- Guaranteed death benefit

- Guaranteed cash value growth at a fixed interest rate

- Low risk tolerance

Permanent life insurance generally comes in two varieties: whole life (most common) and universal life. Both policies having a savings element. But while whole life savings grow at a guaranteed rate, universal life savings generally reflect market performance7.

Making the choice

The right kind and amount of coverage depends on your needs and stage in life. Term may be best while your kids are young or need mortgage protection. Permanent may be best if you want to make it part of your estate plan. Also, I’d recommend speaking with an insurance broker (shameless plug – I’d be happy to help) instead of directly through an insurance company. Reason being that a broker will compare prices over several insurance companies. If you have more questions or need guidance, call me at 954-945-3330 and schedule an appointment today!

1 At the end of the term, the insurance policy will not have any cash value or living benefits.

2 Riders and additional features may be available at an additional cost.

3 Premium amount is relative to other types of life insurance and is dependent on underwriting.

4 Some insurance companies may assign an age cap.

5 Required premium payments must be made on a timely basis.

6 Policy performance is dependent upon the investment or actual interest rates.

7 Premiums may be lower during periods of high interest; in addition, you may be able to skip premium payments if your cash value is enough to cover your minimum expenses.

These policies have exclusions and/or limitations. The cost and availability of life insurance depend on factors such as age, health and the type and amount of insurance purchased. As with most financial decisions, there are expenses associated with the purchase of life insurance. Policies commonly have mortality and expense charges. In addition, if a policy is surrendered prematurely, there may be surrender charges and income tax implications. Guarantees are based on the claims paying ability of the insurance company.